June 2022 Newsletter: This One Alternative Asset Saw Strong Growth in May; A Looming Investment Opportunity Ahead of the Fed’s June 15th Meeting?

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

Last Updated on: 13th June 2022, 03:11 pm

Another month, another bloodbath in the alternative assets market. While the S&P 500 Index held relatively steady with a (-0.04%) return over the 30-day period ending June 6th, U.S. equities saw considerable volatility and the SPX saw periods of erratic dips to the $3,900 mark, all the way down from a high of $4,176.

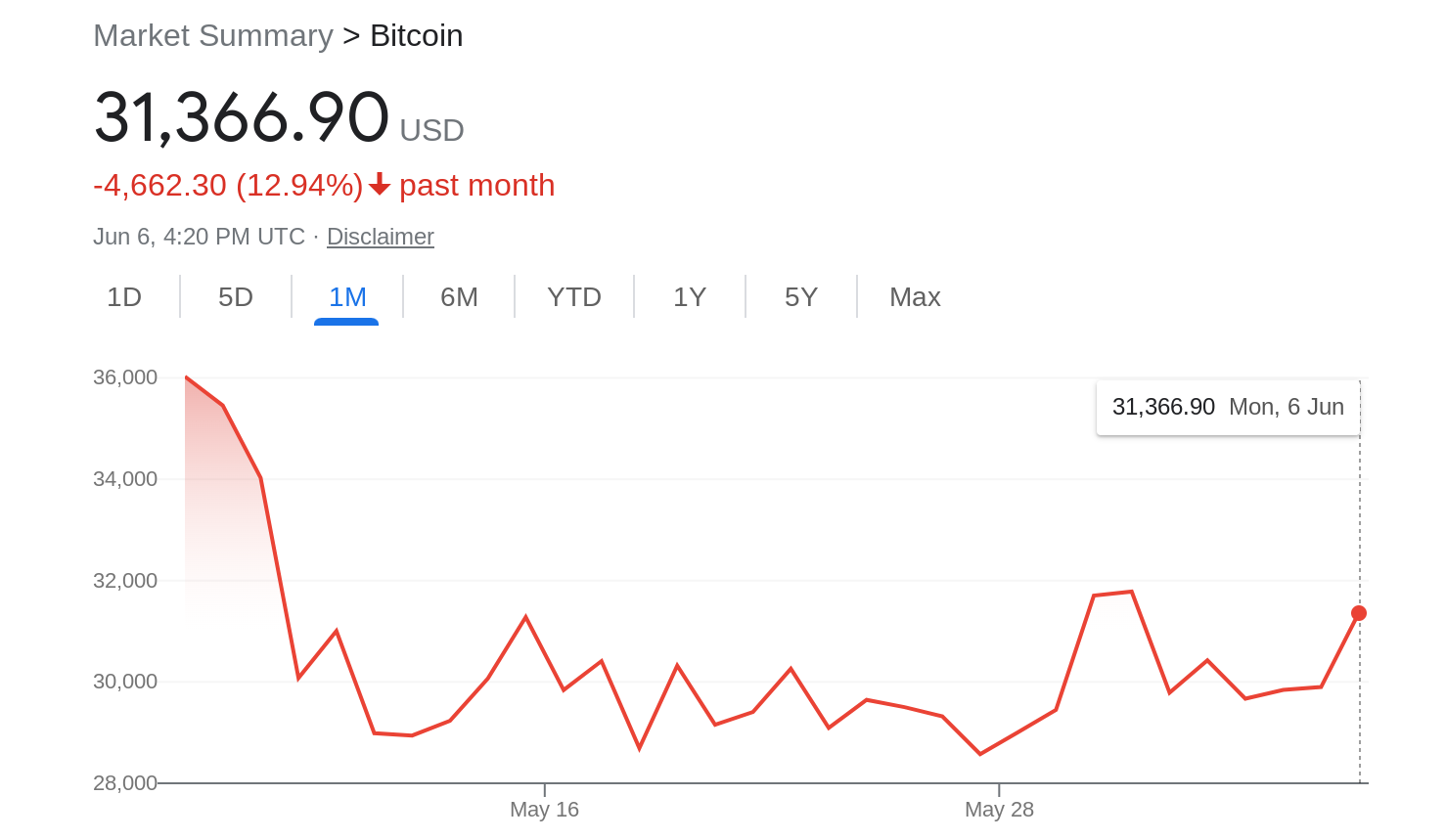

Investors seeking shelter from the up-again, down-again nature of the stock market certainly haven't had much luck with long positions in cryptocurrency. The leading blockchain projects fared poorly in May, with Bitcoin down (-13.94%) on the month and Ethereum buried (-29.9%) over the same time period.

Source: Google Finance

As a Fortune magazine writer pointed out last month, there's no straightforward answer behind the crypto market's correction in May. While geopolitical conflict, interest rate hikes, and a highly inflationary macroeconomic environment all play a role, the price decline of the leading cryptocurrencies is a bit of an anomaly.

The traditional investment thesis sees Bitcoin and Ethereum as a safe haven during times of inflationary runaway and rising interest rates—however, it would appear that the conventional wisdom has been contradicted as of late. It remains to be seen whether the major coins have seen the worst of this season's correction, or whether their decline is part of a larger sell-off precipitated by whales and larger institutional players, like J.P. Morgan, who have long considered Bitcoin to be overvalued.

There is, however, some positive news out of the alternatives market. As expected, precious metals have held their value and have proven resilient, even when other conventional hedges, such as cryptocurrencies, have fallen to the bears.

Let's take a look at how gold, silver, and the platinum-group metals have performed over the 30-day period ending on June 6th:

Evidently, the platinum-group metals are split down the middle with platinum bullion standing alone as the sole winner this month, while palladium steered in the opposite direction. By contrast, gold and silver saw slight-to-moderate losses.

Putting It All Together

Experts suggest that the reason behind gold's negative price action is, largely, a strong dollar supported by a rising federal interest rate environment. In mid-May, Federal Reserve Chairman Jerome Powell hiked interest rates by 50 basis points and indicated that more rate increases loom on the horizon.

The central bankers tasked with devising our monetary policy form the Federal Open Market Committee (FOMC). Their next meeting is scheduled for June 14 and 15th. It is highly likely that the FOMC will announce further rate hikes in order to cool down inflation and rein in soaring asset prices.

For some, this is a bearish sign. For others, however, this is a buy signal. Savvy investors may want to consider getting in on gold after the FOMC's upcoming interest rate announcement. Should Mr. Powell augment the federal funds rate by another 25 or 50 basis points, we can conclude with a high degree of confidence that gold prices will slide to discount levels.

Will you miss the dip, or cash in when the opportunity arises? To prepare yourself for the upcoming gold price opportunity, consider opening a gold IRA today or speaking with a customer satisfaction specialist to enhance your current gold or silver position.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $3,941.03

Gold: $3,941.03

Silver: $47.27

Silver: $47.27

Platinum: $1,541.61

Platinum: $1,541.61

Palladium: $1,405.67

Palladium: $1,405.67

Bitcoin: $101,602.68

Bitcoin: $101,602.68

Ethereum: $3,294.43

Ethereum: $3,294.43