Interest Rate Hike: What Next for Economy & Financial Markets?

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

Last Updated on: 28th July 2022, 07:33 pm

The interest rate hike the Federal Reserve implemented on July 27, 2022, was well expected by the financial markets, investors, and analysts alike. What was of concern, was how far the interest rate hike would go. And how it may impact a looming economic recession.

Some economists and analysts had made calls for a 100-basis point hike, while the majority of pundits were expecting a 75-basis point hike. From the way the markets reacted after the announcement, there was clearly caution running up to the event. We’ll look more closely at that, and we’ll discuss what the higher interest rate cycle may mean for the economy and the financial markets.

Interest Rate Hike: Market Reaction

Let’s have a close look at the reactions of the main financial markets and what they may mean for the near future.

Stocks

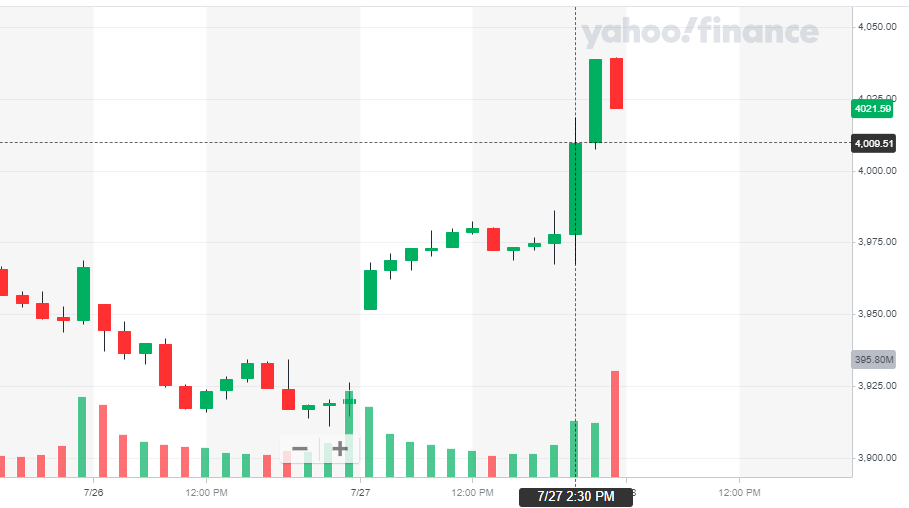

The S&P 500 had a positive reaction to the news the Fed had hiked interest rates by 75 points. After the announcement, we saw how the broad stock market index advanced from 3997 to 4041 for a 1.10 % increase in just one hour. Stock investors were relieved that it looked like the Fed will take a slower approach to hike interest rates.

Source: YahooFinance

Source: YahooFinance

Now, we know very well how the stock market has been dreading the monetary tightening policy the Fed has no choice but to implement. Profit margins will be squeezed as companies with low cash levels will pay more to borrow money. New-project profit margins will also be hurt, and companies with high debt-to-equity ratios will also suffer as they pay more to service their debt.

Going forward the momentum stocks can gain will depend greatly on the speed at which the Federal Reserve raises interest rates. Various economists and analysts have warned that the monetary tightening enacted by the Fed may cause severe economic contraction.

That stock market reflects economic activity on a forward-looking basis. So, how quickly the Fed raises interest rates to stem inflation will also determine the next move for the broad stock market. However, a lot will also depend on how GDP growth progresses along with the interest rate hikes.

Fixed Income

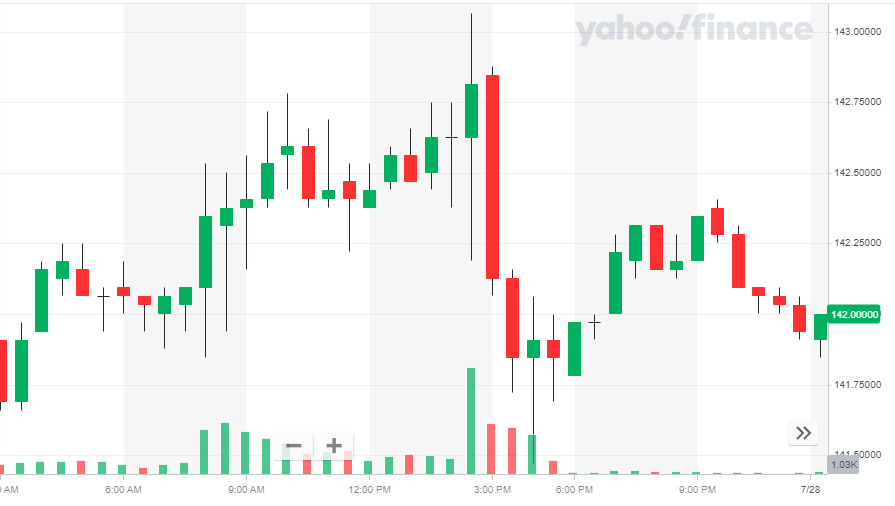

The bond market was also rattled by the interest rate hike, even though they were certainly expecting one. Looking at the chart below for the US Treasury Bond future we can see the market started the sell-off at 03:00 pm.

That’s a full hour after the announcement. While the candle for 02:30 pm showed a very high level of volatility as the market whipped up and down depending on the comments heard at the Federal Reserve’s press conference.

The open at 02:30 pm was 142-20/32 it then rallied to 143-2/32 to then tanked down to 141-6/32 before closing at 142-26/32. That’s a considerable amount of volatility, however, bond investors felt that overall, the press conference indicated that more hikes are on the way. Therefore, the market continued to decline, closing the day at 141-27/32.

Source: YahooFinance

How the bond market reacts depends greatly on how fast it sees the monetary tightening cycle. Bond prices will adjust downwards to compensate for a higher yield as interest rates continue to rise. However, long-term US treasuries and bonds have many years of life that far exceed the expected duration of the tightening cycle.

So, bond prices should bottom once the market feels that the Fed is close to ending its policy of hiking interest rates. In my opinion, bond prices are set for further declines independently of how the stock market performs. At least until there is some indication by the Federal Reserve that the tightening cycle is about to end.

Gold

Gold is known to be a great hedge against inflation, despite rising interest rates. Of course, higher interest rates leads to higher bond yields and this factor can make an asset that has no income streams less attractive.

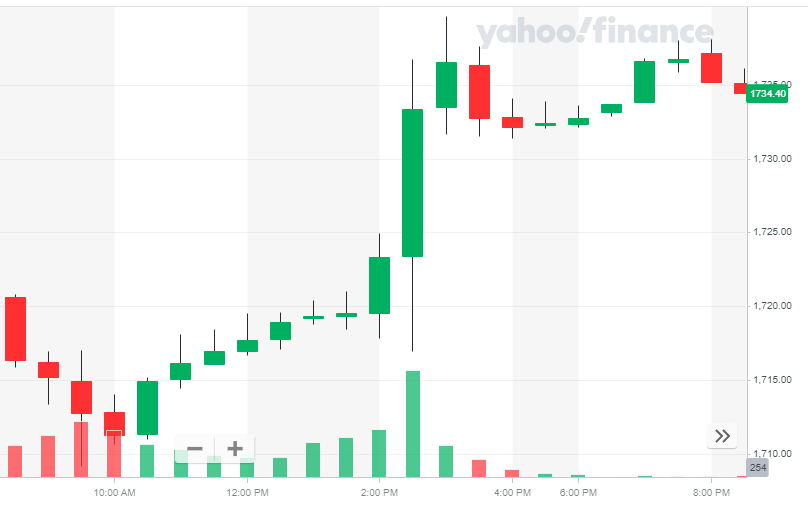

However, inflation reduces the value of the dollar, and gold holders want to receive more dollars to compensate for the diminished value. Looking at the chart below for the COMEX gold future, we see how the price of gold jumped after the interest rate hike announcement at 02:00 pm.

Source: YahooFinance

Source: YahooFinance

The price of gold went from its open at 02:00 pm of $1,719.50 to close at $1,723.30 half an hour later. That’s 02:30 pm when the Fed’s press conference started, which created some volatility with the price dropping to $1,716.90 before closing at $1,733.30 by 03:30 pm. Another 30 minutes and the price of gold advanced to the day’s high at $1,739.60.

For the future prospects of the world's best-known shiny metal, we can have a look at past performance. Although past performance is no guarantee for the future, we do know history has a tendency of repeating itself. And so do the financial markets.

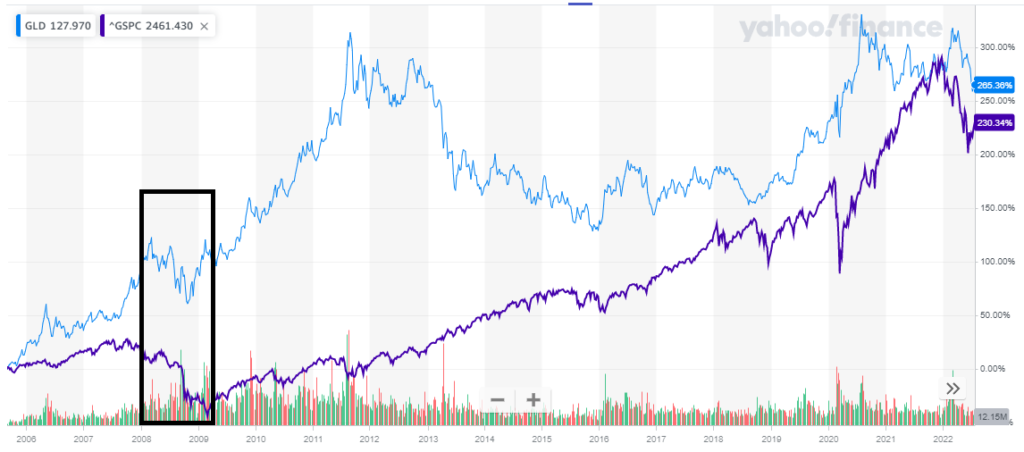

Let’s compare the price of gold to the S&P 500 using the SPDR Gold ETF as a proxy for gold price. From the chart below we can see how gold has outperformed the broad stock market since the inception of the fund.

Source: YahooFinance

Source: YahooFinance

More importantly, gold has performed considerably better than stocks in the global financial crisis that roiled stock markets around the world in 2008. Even though over the past 2 years gold has not made significant price advances, it has still produced growth of 266.40% compared to 230.34% for stocks over the past 17 years.

Bitcoin

Bitcoin had been falling the days previous to the Federal Reserve meeting, although during the hours preceding the announcement the price action was flat. From the chart below we can see how after the interest rate hike announcement Bitcoin reacted immediately. Price rallied from the open at 02:00 pm of $21,646 to the most recent high at $23,357 by 10:00 pm.

Source: YahooFinance

Bitcoin investors were cautious about the possibility the FED may have hiked 100 basis points instead of 75. Once the news was out bulls took command of the market and created a new rally.

Cryptocurrencies are a relatively new asset class, and we have fewer data to make comparisons that may give future guidance. However, investors have considered Bitcoin as a reliable hedge against inflation and stock market routs.

However, more recently cryptocurrencies and Bitcoin being the gold standard, have shown high correlations with the price of the broad stock market. As we have seen above, the price performance of bitcoin was very similar to that of stocks.

GDP Growth Data

With GDP just released on July 28, 2022, the stock market reacted positively for the first hour. In fact, the S6P 500 broke out of its sideways range and rallied from 4012 to 4040 in just over an hour. Investors may have felt that move was justified by the higher-than-expected GDP price index.

Source: TradingView

Source: TradingView

Despite negative GDP Growth data, the bears were not able to take control of market sentiment. The GDP growth rate for Q2 (preliminary) was much lower than expected. The consensus before the release had been marked up to 0.5% growth. Whereas the data released showed a negative growth of -0.9%.

The S&P 500 continued to rally, reaching 4051.21 or 0.85% on the day. Bitcoin followed suit and also ended the day up at $23,775 at the time of writing. While gold managed a rally immediately after the release of the GDP data rising to the high of the day at $1,756.36. The bull sentiment in precious metal faded after that, and the price fell by the close at $1,754.80 for the day.

The bond market took relief from lower-than-expected GDP growth and bond prices rallied immediately after the data release. Bondholders are hoping that the Fed will have to loosen its monetary tightening policy at least for the short term.

As per the Treasury bond futures we mentioned above, the price jumped from 141-24/32 on the release of the data and rallied to 143-27/32 in just over 1 hour 30 minutes. Bond prices then retracted lower to 143-18/32, to close the day up 0.86%.

Wrapping Up

The latest round of Federal Reserve action is creating a fair amount of volatility in the financial markets. As we have seen depending on which asset class we look at, the Fed’s actions can have varying consequences.

We generally believe that higher interest rates can initially negatively affect the stock and bond market. However, if the action taken is already priced into the market or is considered inferior to expectations, we see that the stock and bond markets may still have positive performances.

That said, we believe as do many economists and analysts, that inflation is set to drag on for some time. Due mainly to supply chain constraints and geopolitical woes. So, the Federal Reserve will be in a tough position when it comes to stopping rampant inflation and saving jobs.

Role of The Federal Reserve

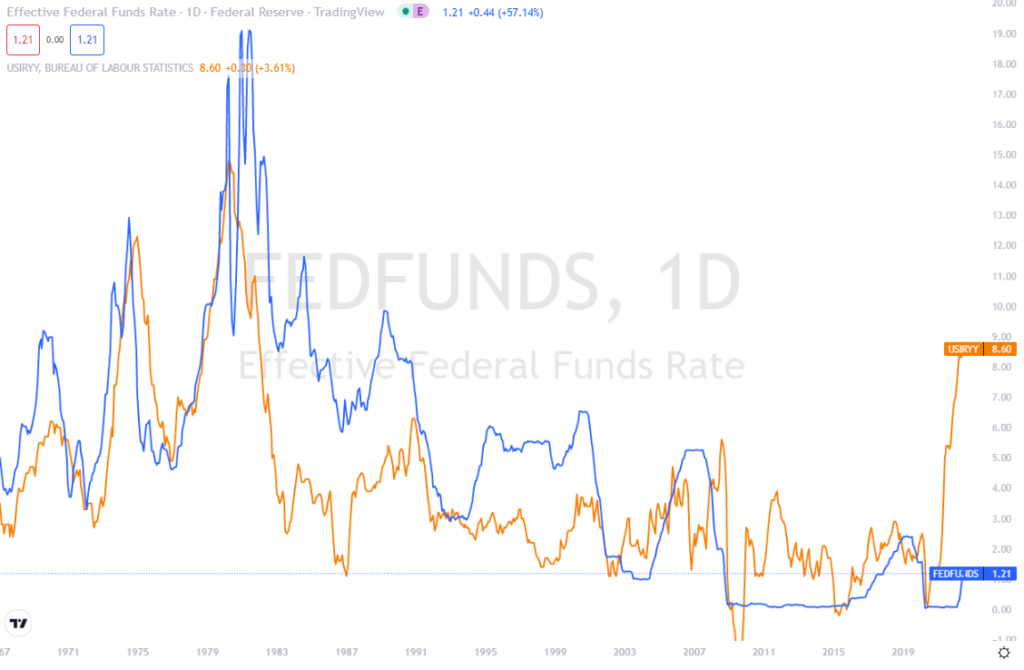

Eventually, the Fed will have no choice but to hike up interest rates to squeeze demand and halt high inflation. The chart below shows the Fed Fund rate (Blue) compared to the inflation rate (Orange). As we can see Fed Funds usually hover close to or over the inflation rate.

Source: TradingView

Source: TradingView

Since the 2008 crisis, there has been some disconnect in the correlation between the two numbers. The Fed was maintaining a loose monetary policy in light of the recession, and inflation remained below or around 2%.

Things have changed dramatically since then, and here at GoldIRAGuide, we believe the Federal Reserve still has a lot to do to tame runaway inflation. Given the uncharacteristically high gap between the official interest rate and inflation, we see the Fed as having no choice but to take more action.

The question is, will it be too late? The longer the Federal Reserve waits the tougher it will be to avoid a hard landing. Various pundits have voiced their opinion that if the Federal Reserve times it correctly it can create a soft landing for the economy.

However, from what we saw from today’s interest rate hike, we feel the Federal Reserve could have acted more decisively. The market in general was already pricing in somewhat a 100-basis point hike. True that if that is what they had announced, and then given forward guidance at the conference stating more of the same was to come perhaps the markets (stocks and bonds) would have acted differently.

But we must ask, is the Fed's mandate saving the stock market, or is it to keep price stability and employment growth? So far, it looks like the former to us, although we may be wrong.

Bottom Line

We are not alone in thinking the stock markets read the Federal Reserve's chair Jerome Powell incorrectly. From the way the stock market reacted to today's interest rate hike, one gets the feeling the market is seeing rate hikes ending soon.

While from Jerome Powell’s comments it would seem clear that more interest rate hikes are on the horizon. Various pundits expressed the same view today, and the likelihood of a severe sell-off in the stock market seems higher. Due mainly to the fact that further interest rate hikes are not priced into the market.

In these times of uncertainty, it seems ever more necessary to add alternative assets. Ones that can withstand the negative effects of inflation and a shrinking economy. Gold has those characteristics. And you can take advantage of investing in a tax-enhanced environment through a self-directed IRA.

Many companies offer specialized services for investors requiring self-directed IRAs. We have selected some of the most reliable and professional on the market. You can read our reviews on the top gold IRA companies here.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $4,227.69

Gold: $4,227.69

Silver: $52.74

Silver: $52.74

Platinum: $1,672.43

Platinum: $1,672.43

Palladium: $1,571.48

Palladium: $1,571.48

Bitcoin: $111,066.15

Bitcoin: $111,066.15

Ethereum: $4,004.54

Ethereum: $4,004.54