Equity Trust Review: Is This Self-Directed IRA Company Worth Trusting With Your Savings?

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

- Phone : (855) 233-4382

- URL :

- Global Rating

- Spectacular

User Rating

- 2 Reviews

With over $12 billion in assets under management, over 130,000 customers, and over 10,000 financial advisor partnerships, it is not hard to see why Equity Institutional/Sterling Trust is the number one-rated IRA account administrator. The company specializes in managed futures, hedge funds, real estate, and other kinds of investments. One of their greatest but less obvious strengths is their partnership with Augusta Precious Metals, the number one rated gold IRA administrator. Overall, Equity Trust is the best pick for self-directed investors in need of a reputable and hassle-free IRA custodian.

Pros:

- Their partnership with Augusta Precious Metals ties them to the best gold IRA administrator in the business

- They offer numerous choices of brokers, bullion dealers, investment firms, and financial advisors from which clients can select for their precious metals IRAs

- The annual renewal and storage fees remain the same regardless of how high the account value becomes

- Ten thousand different financial professionals partner with them

- Low account minimums (~$5,000)

- Trustworthy firm with an A+ rating from the Better Business Bureau

Cons:

- Their $150 annual precious metals storage fee is not the cheapest in the industry

- Custodian to custodian transfer fees of $50 to $100 per transaction

Equity Institutional is ranked #2 on our list of the top 10 IRA custodians of 2024. In the following review, we'll cover this custodian's history, management, reputation, products/services, and fees.

Equity Institutional (http://www.equityinstitutional.com/), a division of Equity Trust Company (hereafter used interchangeably), is an industry-leading provider of IRA custodial services to financial advisors, brokers, and sponsors. The company has more than $12 billion in assets under custodial management, with more than 130,000 clients, and partnerships with more than 10,000 financial professionals. In addition to self-directed precious metals IRAs, Equity Institutional also specializes in hedge funds, managed futures, real estate, and other types of investments. They became qualified to serve as a non-bank IRA in 1983, and in 2009 they acquired the assets and business of Sterling Trust Company.

In our books, Equity Trust is the pinnacle in self-directed IRA custodianship. Since they partner with many of the top-ranked gold IRA firms, such as Augusta Precious Metals, they already have the endorsement of major institutional capital. Plus, their longevity speaks volumes. Although they charge fees on par with their competitors (and, in some rare cases, even above their competitors'), you simply cannot put a price on peace of mind, especially when the security of your retirement savings are at stake.

Table of Contents

About Equity Trust's Management

Equity Institutional was founded in 1974 by Richard Desich, an expert in self-directed IRAs with more than 35 years of industry experience. Richard is also the Founder of Retirement Education Group. Equity Trust Company was co-founded by one of Richard's sons, Richard A. Desich. More information about Equity Institutional's management can be found on their Leadership page.

At the time of writing, in January 2024, Equity Trust's corporate leadership composition consists of:

- George Sullivan (Chief Executive Officer)

- Amy Hall (Chief People and Human Resources Officer)

- Andrea Obregon (Senior Recruiter)

- Matt Gardner (Chief Financial Officer)

- Frank Flanagan (Chief Information Officer)

- Mark Furmanek (Chief Operating Officer)

- Elizabeth Curtis (General Counsel)

- Casey Roberts (Chief Business Development Officer)

For the most up-to-date information about Equity Trust's team, you can view the firm's LinkedIn page here. If you ask us, the fact that Equity is so transparent about its management team says a lot about its trustworthiness. Whereas other firms shy away from putting a public face to their company, Equity Trust is open about who is behind the company, and they aren't afraid to make public the people who run the company.

As of late, Equity Trust has caught the eye of much of the investing world and financial media. In fact, even Business Insider has endorsed Equity Trust, calling their services “unbeatable” for their low fees and diverse range of product offerings for IRA investors.

Equity Institutional's Prices and Products

Equity Institutional specializes in alternative investments within various types of IRAs, including traditional IRAs, Roth IRAs, and Flex IRAs. They also assist clients in conducting low-cost 401(k) rollovers and provide qualified and non-qualified custodial accounts to individuals and businesses. In addition to its custodial services, Equity Institutional also provides institutional services to registered investment advisors, banks, mutual fund companies, and other investment firms. Altogether Equity Institutional charges a flat-rate annual fee of $225, which includes the annual renewal fee and the precious metal storage fee.

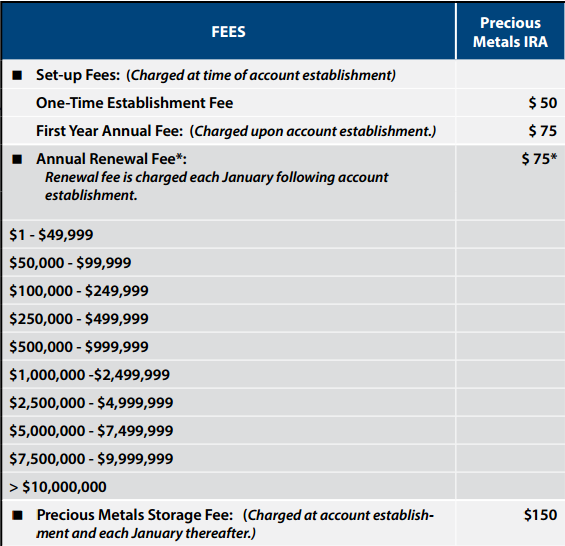

Here's a more detailed view of Equity Institutional's fee schedule for a precious metals IRA:

As you can see, the annual renewal and storage fees stay the same regardless of the account value. This is in contrast to many other custodians that charge a sliding scale fee, which increases with the fair market value of the account. However, we should note that all custodians have some fees other than the storage and renewal/admin fees. These may include late fees, wire transfer fees, transaction fees, termination fees and more. Click here to see Equity Institutional's full fee schedule.

At the time of writing, Equity offers the following annual fee schedule for their accounts, which slides according to the account's balance:

| Portfolio Value | Standard Fee |

| $1-14,999 | $225.00 |

| $15,000-24,999 | $320.00 |

| $25,000-49,999 | $350.00 |

| $50,000-99,999 | $425.00 |

| $100,000-199,999 | $500.00 |

| $200,000-299,999 | $700.00 |

| $300,000-399,999 | $750.00 |

| $400,000-499,999 | $1,075.00 |

| $500,000-599,999 | $1,750.00 |

| $600,000-699,999 | $1,850.00 |

| $700,000-799,999 | $1,950.00 |

| $800,000-899,999 | $2,000.00 |

| $900,000-999,999 | $2,050.00 |

| $1,000,000-1,999,999 | $2,150.00 |

| Over $2,000,000 | $2,250.00 |

| Account Set-up Fee: Online Application Paper Application | $50.00 $75.00 |

While the above fee schedule is accurate, we should note that it is possible to have the all of the first year's fees waived entirely if you set up an account with Equity Institutional through the gold IRA firm Augusta Precious Metals. In fact, Augusta even offers to waive all storage and admin fees for the first three years if the value of the account is high enough. Once the fees are applied, you'll still only pay a $150 flat-rate fee for annual storage and a yearly $75 account renewal fee.

Contact Details

- Address: 1 Equity Way, Westlake, OH 44145

- Phone: 855-355-ALTS (2587)

- Fax: 440-243-9702

- Email: EIServices@EquityInstitutional.com

- Website: www.equityinstitutional.com

Consider the Competition Before Investing

Many financial advisors recommend allocating between 5%- 40% of your total retirement portfolio towards precious metals investments. In the event of another recession, that seemingly small portion of your portfolio could become the most crucial as inflation devalues the dollar and the price of gold continues to rise. A self-directed IRA gives you the freedom to invest some of your retirement savings in a variety of alternative instruments, including precious metals.

However, not all self-directed IRAs are the same, so setting up an account and purchasing IRA-eligible bullion for it is not always as straightforward as it might seems. To avoid the hassle and expense of paying unnecessary fees and enduring a complicated setup and administration process, we suggest you thoroughly compare the top precious metals companies and IRA custodians before making a buying decision. Fortunately, we've made it easy for anyone to conduct their own research from our top 70 gold IRA companies of 2022 and top 10 IRA custodians of 2022 lists.

Contact Us if You Own or Represent Equity Institutional

If you're an owner, representative, or associate of Equity Institutional and you've noticed any information within this review that is inaccurate, outdated, or misleading, please doe contact us with revision or removal requests. We will gladly honor any requests that are in line with our goal of providing the most accurate and up-to-date company reviews on an ongoing basis.

Why Equity Institutional is a Top-Ranked IRA Custodian in 2024

We considered a total of nearly 40 IRA custodians and administrators when narrowing down this year's top 10 IRA custodians list. Our comparison table makes it easy for anyone to independently research and examine various aspects of each custodian in order to come to an informed investment decision. We based our custodian rankings on a number of key attributes and features, including:

- annual storage/admin fees

- setup charges and other hidden fees

- preferred depository

- overall reputation and industry presence

We also awarded Equity Institutional with the top spot due to their partnership with Augusta Precious Metals, one of this year's top-ranked precious metals IRA companies.

To learn more about the benefits of opening a self-directed IRA with Equity Institutional through Augusta Precious Metals, see the full Augusta Precious Metals review. As the world's most trusted gold IRA firm, Augusta and Equity Trust (their preferred custodian) can handle the entire setup and funding process from end-to-end with little effort (or fees) required on your part.

- Phone : (855) 233-4382

- URL :

- Global Rating

- Spectacular

User Rating

- 2 Reviews

With over $12 billion in assets under management, over 130,000 customers, and over 10,000 financial advisor partnerships, it is not hard to see why Equity Institutional/Sterling Trust is the number one-rated IRA account administrator. The company specializes in managed futures, hedge funds, real estate, and other kinds of investments. One of their greatest but less obvious strengths is their partnership with Augusta Precious Metals, the number one rated gold IRA administrator. Overall, Equity Trust is the best pick for self-directed investors in need of a reputable and hassle-free IRA custodian.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $2,747.39

Gold: $2,747.39

Silver: $32.70

Silver: $32.70

Platinum: $997.31

Platinum: $997.31

Palladium: $1,121.05

Palladium: $1,121.05

Bitcoin: $70,699.13

Bitcoin: $70,699.13

Ethereum: $2,540.60

Ethereum: $2,540.60