- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

How to Invest in Gold in 2024

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

Given today's uncertain economic landscape, generational inflation, geopolitical tensions, and stubbornly tight monetary policies, 2024 is a good year for investors to set up a meeting with their financial advisor, review their asset allocation, and ensure their portfolio isn't heavily weighted in stocks and paper currencies.

Gold versus FIAT Currencies

As the Fed continues its dollar printing policies, many investors are looking at gold as a way to diversify their investment and preserve their wealth in case the dollar hits rock bottom. It is important to remember that the median age of modern currencies is only 42 years old, while gold is a 4.7 billion years old asset and has been used by virtually almost civilization known to man.

Since the financial crisis of 2008, investment demand for gold has seen unprecedented growth. The coronavirus pandemic has exacerbated the Fed's QE policies which has led to an even greater demand for gold. By and large, monetary authorities have maxed out monetary and fiscal policy responses in pursuit of economic growth. The only policy left in most cases is the aggressive debasement of the national fiat currency. We have seen this currency debasement escalate worldwide since the beginning of the pandemic—central banks from the United States, Japan, Europe, China, Australia, and Switzerland are engaged in currency manipulation on a scale never seen before. Due to the zero-sum nature of currency wars, each country is in a fervent “race to the bottom”. What is playing out is Darwinism in reverse, the nation with the weakest currency wins.

On more detailed examination, it’s clear to see that these “beggar thy neighbor” currency policies are far from a zero-sum game. Like any conventional conflict, there is significant collateral damage – the damage to emerge from these policies is a severe drop in the purchasing power of fiat currencies. Debasement of the currency affects real people, real business, and a loss of confidence in the currency systems of these nations is likely to prove the next catalyst for a multi year rally in the world gold price. Throughout history, gold has been THE hedge against fiat currency debasement. No currency has acted as a better store of wealth and value than gold. Given this type of backdrop, it’s not difficult to see why investment demand for gold has been soaring.

Check out the following video to learn why one of the most successful portfolio managers in North America likes to keep at least 5% of his net worth in gold regardless of the price per ounce, with annual rebalancement…

Ways to Invest in Gold and Precious Metals in 2024

Regardless of the reason behind an investor’s decision to begin accumulating a position in gold, the next question that often arises is what are some of the best ways to purchase and hold gold as part of a broader investment portfolio? For the modern investor, there are a multitude of different investment options available, some traditional and some more innovative depending on your particular investment objectives. In the next few paragraphs, we examine some of the most popular and proven ways to invest in gold.

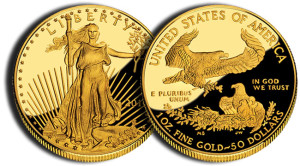

Physical Gold Bullion Coins and Bars

Purchasing physical gold, silver or any other precious metal in the form of bullion bars and coins is one of the safest and most conventional methods of investing in gold (See below to find out how to invest in physical gold bullion through your retirement account). Bullion buyers have a tremendous choice of products when it comes to purchasing gold coins and bullion and reputable online dealers compete fiercely to provide competitive prices to their customers. 1 oz gold coins have traditionally been a highly popular choice amongst investors, especially American Gold Eagles, Canadian Maple Leafs, Australian Kangaroos, and South African Krugerrands. It’s important to remember that when buying physical gold, you will always be paying a price higher than the prevailing spot price in the open market. This buyer's “premium” reflects the markup of retail gold versus wholesale gold prices. Make sure you request our free gold IRA investment kit to learn how to shop for bullion and avoid unnecessary premiums and fees.

Purchasing physical gold, silver or any other precious metal in the form of bullion bars and coins is one of the safest and most conventional methods of investing in gold (See below to find out how to invest in physical gold bullion through your retirement account). Bullion buyers have a tremendous choice of products when it comes to purchasing gold coins and bullion and reputable online dealers compete fiercely to provide competitive prices to their customers. 1 oz gold coins have traditionally been a highly popular choice amongst investors, especially American Gold Eagles, Canadian Maple Leafs, Australian Kangaroos, and South African Krugerrands. It’s important to remember that when buying physical gold, you will always be paying a price higher than the prevailing spot price in the open market. This buyer's “premium” reflects the markup of retail gold versus wholesale gold prices. Make sure you request our free gold IRA investment kit to learn how to shop for bullion and avoid unnecessary premiums and fees.

- Pros of investing in physical bullion: out of reach from the government, real safety in case of systemic collapse, lower premium over spot, highest purity levels, bullion coins hard to counterfeit due to serial numbers, most bullion coins are recognized by their issuing governments as currency and can be used as legal tender.

- Cons of investing in physical bullion: storage costs, not as easy to trade as “paper gold”.

Investing in Gold ETFs (Exchange Traded Funds) and Mutual Funds

Since their initial launch, precious metal ETFs have attracted a substantial amount of capital from the gold investment community. ETFs are popular as they feel and trade like conventional stocks, and the tight bid-ask spreads make it popular for speculative investors with shorter time horizons. Since its debut in 2004, GLD remains the most popular gold backed ETF on the market, and trades an average of $670m worth of shares everyday! While ETFs are convenient from a trading perspective, some elements of the gold community view these vehicles with caution – ETFs represent an unallocated claim on gold as opposed to direct legal ownership. For most investors, such semantics are usually overlooked, but if there were to be a severe systemic crisis within the financial system, it is unclear just how robust ETF systems would be if there were to be a scramble for the underlying physical commodity.

Since their initial launch, precious metal ETFs have attracted a substantial amount of capital from the gold investment community. ETFs are popular as they feel and trade like conventional stocks, and the tight bid-ask spreads make it popular for speculative investors with shorter time horizons. Since its debut in 2004, GLD remains the most popular gold backed ETF on the market, and trades an average of $670m worth of shares everyday! While ETFs are convenient from a trading perspective, some elements of the gold community view these vehicles with caution – ETFs represent an unallocated claim on gold as opposed to direct legal ownership. For most investors, such semantics are usually overlooked, but if there were to be a severe systemic crisis within the financial system, it is unclear just how robust ETF systems would be if there were to be a scramble for the underlying physical commodity.

- Pros of investing in Gold ETFs: can be easily traded, no need to worry about storage since you are not investing in “physical gold”.

- Cons of investing in Gold ETFs: no protection in case of systemic collapse, no ownership of physical metals, ETFs are not always backed by real gold.

Investing in Gold Mining Stocks

Buying direct equity stakes in exchange listed gold miners has always been a popular method for investors wishing to gain exposure to gold. Purchasing stock within these companies gives investors the opportunity to benefit from the gold mining operations of these companies and any future reserve upgrades arising through exploration activities. Equity investments have the potential for capital appreciation as well as dividend payments for the investor. Investors with a comprehensive brokerage account can buy gold related companies just about anywhere in the world. Investors should be aware that this form of investment carries higher risk than simply buying physical gold. Mining companies will not necessarily track the gold price closely – that is to say if the gold price starts to rally strongly, there is no guarantee that the price of gold mining stocks will follow suit. Mining operations are a notoriously volatile enterprise, with various regulatory structures and ever changing input costs.

Buying direct equity stakes in exchange listed gold miners has always been a popular method for investors wishing to gain exposure to gold. Purchasing stock within these companies gives investors the opportunity to benefit from the gold mining operations of these companies and any future reserve upgrades arising through exploration activities. Equity investments have the potential for capital appreciation as well as dividend payments for the investor. Investors with a comprehensive brokerage account can buy gold related companies just about anywhere in the world. Investors should be aware that this form of investment carries higher risk than simply buying physical gold. Mining companies will not necessarily track the gold price closely – that is to say if the gold price starts to rally strongly, there is no guarantee that the price of gold mining stocks will follow suit. Mining operations are a notoriously volatile enterprise, with various regulatory structures and ever changing input costs.

- Pros of investing in Gold Mining Stocks: can be easily traded, no need to worry about storage since you are not investing in “physical gold”.

- Cons of investing in Gold Mining Stocks: Yale study revealed that gold mining stocks correlate more strongly with the stock market than gold. (57% with the stock market and 40% with gold. See detailed study here), stocks provide no protection in case of systemic collapse, no ownership of physical metals.

Gold Futures and Options

Another popular choice for investors with a shorter time horizon are purchasing gold futures and options, essentially a series of derivatives on the underlying price of gold. These contracts are also used by larger institutional investors as a means of hedging their exposure to price movements in the underlying gold price. In the United States, the COMEX is home to the most actively traded gold futures and options contracts, with an estimated 200,000 contracts changing hands every day. This represents over 20m ounces of gold – a truly staggering amount of metal (if it's really there!). Investors in futures and options hope to benefit by rising or falling gold prices depending on the type of contract they enter into.

Another popular choice for investors with a shorter time horizon are purchasing gold futures and options, essentially a series of derivatives on the underlying price of gold. These contracts are also used by larger institutional investors as a means of hedging their exposure to price movements in the underlying gold price. In the United States, the COMEX is home to the most actively traded gold futures and options contracts, with an estimated 200,000 contracts changing hands every day. This represents over 20m ounces of gold – a truly staggering amount of metal (if it's really there!). Investors in futures and options hope to benefit by rising or falling gold prices depending on the type of contract they enter into.

One of the main attractions of the futures and options market is it allows investors to leverage their capital through the derivative market’s margin system. By investing a down payment known officially as “initial margin”, investors are able to gain much greater exposure than they would through the cash market. The futures and options market is a source of much contention within the gold community. The process of “naked shorting”, that is, selling metal which an investor does not own,is often cited as causing price distortions within the gold price, placing artificial selling pressure within the market. Given the fragmented nature of the world gold market. These days, most futures and options are traded through online broker platforms who handle all the relevant exchange connectivity and margin requirements on behalf of investors.

There are many options available to investors wishing to buy gold as a one off investment – we have discussed several in this guide including buying physical gold, investing in mining stocks, purchasing ETFs or gold futures and options, but many investors are interested in investing in gold over longer periods of time, and often seek ways on how to incorporate gold within their retirement plans – there are several ways to achieve this with an Individual Retirement Account (IRA). Remember, you should always consult with a professional tax consultant or investment advisor for advice on how to structure your pension investments. This guide is for information purposes only.

- Pros of investing in Gold Futures and options: can be easily traded, no need to worry about storage since you are not investing in “physical gold”.

- Cons of investing in Gold Futures and options: unclear whether these are backed by real physical metals, no real protection in case of systemic collapse, no ownership of physical metals.

Gold IRA's (Self-Directed Gold Bullion Individual Retirement Accounts)

For investors interested in incorporating gold within a long term investment or retirement strategy, an Individual Retirement Account (IRA) provides the most suitable structure. In fact, many experts believe that investing in metals through an IRA is one of the best, safest and tax-efficient ways to hold gold.

For investors interested in incorporating gold within a long term investment or retirement strategy, an Individual Retirement Account (IRA) provides the most suitable structure. In fact, many experts believe that investing in metals through an IRA is one of the best, safest and tax-efficient ways to hold gold.

Already have a retirement vehicle that does not allow physical gold bullion investments? No problem, the IRS allows you to open a 2nd separate self-directed IRA in which you can invest in alternative investments such as physical precious metals. Also, new IRS regulations now allow even more types of gold and silver bullion coins and bars to be held within an IRA as long as certain purity conditions are fulfilled. Some of the more popular coins allowed are the American Gold Eagle and Canadian Gold Maple Leaf. IRA’s also allow investors to accumulate ETFs and individual stock of mining companies directly.

Setting up an IRA is relatively straightforward and can even be rolled over from existing retirement plans. The current law allows for both transfers from IRAs as well as rollovers from qualified retirement plans, such as 401(k), 401(a), 403(b), and 457. IRA’s have various tax implications so be sure to seek professional advice when deciding how to proceed with your investment. Overall, gold backed IRAs can be a highly efficient solution for long term investors seeking a broader exposure to gold and precious metals. Historically, gold has been a solid investment over longer time horizons, and with the current turbulence and uncertainty in financial markets, owning gold as part of a diversified retirement portfolio looks increasingly attractive.

- Pros of investing in physical bullion: tax-free investment, good long term position in gold, out of reach from the government if stored in offshore vault (ensure you choose a gold IRA company that does offer this service), real safety in case of systemic collapse, lower premium over spot, highest purity levels, bullion coins hard to counterfeit due to serial numbers, most bullion coins are recognized by their issuing governments as currency and can be used as legal tender.

- Cons of investing in physical bullion: storage costs, not as easy to trade as “paper gold”.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

[…] Investing in Gold […]