- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

Yodlee Money Center

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

Last Updated on: 25th March 2023, 12:34 am

Yodlee Money Center

- Phone : 1 800 427 1913

- URL :

- Global Rating

- Good

User Rating

- 0 No reviews yet!

Review Summary :

Yodlee is extremely good at providing data and powering the slicker, more sophisticated services of its rivals, but unfortunately its Money Center seems to be unimportant to the company. While it is very good at producing and allowing you to customize exhaustive reports and charts, its interface is cumbersome and tired-looking at points.

Pros:

- Synchronization is extremely reliable.

- Summary page can be customized to show the data you desire.

- Account information sharing allows you to share part or all of your accounts within the Yodlee universe, allowing you to share financials as needed. This is unique to Yodlee.

Cons:

- Investing section is weak and investing reports leave much to be desired.

- User interface is cumbersome and outdated.

- Cost for using mobile apps is atypical in this industry.

Quick Facts about Yodlee Money Center

Reviewed By:David Crowder

Have you purchased products from Yodlee Money Center? Leave a review!

Yodlee has been around ten years now, making it the undisputed grandfather of the personal financial software and apps out there. This is its great advantage, since it has been first in the space, it secured some of the best turf in the industry. As an example, Yodlee is probably most famous for powering the numbers behind a lot of famous financial sites, more than one hundred of them to be precise. This greatest strength of Yodlee's is also its principal weakness, it focuses so heavily on its bread and butter business that it neglects updating its personal financial software platform. As a result, Yodlee looks old and outdated, unlike its competitors' slick, sophisticated, and cutting edged interfaces and appearances. This does not mean that the free service is not useful though.

Yodlee Intro and Background

No matter how much glossier and more appealing Yodlee's personal financial app competitors may become, Yodlee will always have the bragging rights of providing the power and data behind many of their pretty faces. This is true for a number of well-reviewed and successful companies in the personal financial app space, including Personal Capital, LearnVest, FutureAdvisor, and Fidelity's Full View. Each of these companies maintains their own website fronts to Yodlee's data and customizes its own individual features to analyze and deliver your financial info displays and reports. They are the beautiful front end to Yodlee's powerful but less attractive back end support.

We only think it fair to deliver that disclaimer on Yodlee before criticizing their tired and busy-looking interface. Remember that Yodlee is like the person who does not care how they look on the outside, so long as they are beautiful inside. They care about their impressive, leading, and proprietary data services, and not their consumer application service. That describes Yodlee and their coporate attitude in a nutshell.

Like with most of the personal financial command centers these days, you as a user simply input your bank, credit card, loan company, investment brokerage, and other company financial account information, and Yodlee uses that amazing computer power to download all of your accounts, loans, assets, debts, and other personal data into its central processors and your Yodlee account interface. While the startup and setup procedures are pretty close to their rivals', only Yodlee's are not as easy and intuitive as many of the others' are. They surely know data delivery, powering, and distribution though.

Yodlee Tools and Features

Yodlee is so exhaustive in providing data that it goes literally overboard and gives too much. They offer more features and tools than any rival, partly because they have enjoyed ten years of history developing them. Do not get us wrong, some of these tools are really good and useful. The better ones are:

- View Transactions – View an in depth listing of all transactions from a central command screen.

- Yodlee links – to most every institution under the sun, not just financial ones. Banks, investment companies and brokers, credit card providers, lenders, and somewhat random miscellaneous companies like real estate, email providers, rewards programs, and even online news outlets are all synchronized. Whatever you may say about the relevance of some of this data, it is still much more than the competition offers.

- Alerts – You can sign up for every alert imaginable with Yodlee. Some of the better ones are for overdraft protection or major withdrawals from your accounts.

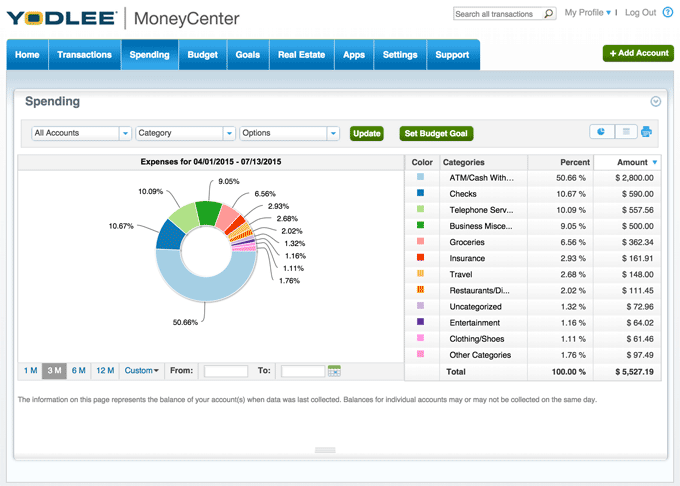

- Expenses Analysis– Provides a categorical breakdown of your spending patterns and habits.

- Goal Setting Feature – You can set financial goals, manage them, and track their progress.

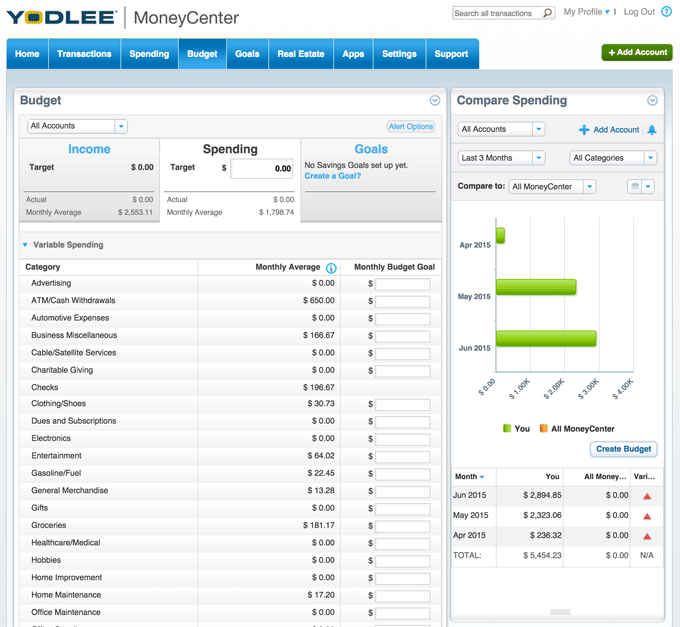

- Budgeting– With this budgeting, you can not only create budgets but have it send you another series of alerts if you exceed your own set limits.

- Graphical Calendar – shows when various pre-set financial events happen, like bills due or bills paid.

- Real Estate – This nifty feature allows you to easily keep up with the current value of your house using Zillow’s Zestimate.

- Online Bill Pay – trying to be all things to all people, Yodlee offers you a bank-like feature of paying all of your bills from their platform. Thanks to their security levels, you can rest assured you will not be hacked in your bill pay stored accounts area.

Yodlee Interface Screenshots

Yodlee Fees

Web browser-based services are free, as with many of the freemium modeled services. Yodlee has been around since the very beginning of the personal financial software and app revolution, so they may have even invented this model ten years ago. One strange thing is that Yodlee does provide mobile apps to use the service on your Android, iPad, or iPhone devices, but they charge for these extra access points. The apps are a $3.99 one-time charge. This is not much money nor a recurring charge. It is simply bizarre as compared to its rivals, all of which grant access to their mobile apps totally for free. This is especially unfortunate since their mobile apps are alright, but nothing to write home about, with a confusing and boring interface.

Yodlee Safety and Security

We feel that Yodlee is very concerned about your private data and accounts' information, safety, and security. Perhaps because they have been at this for so long now, they have had plenty of time to consider and improve their security protocols for their account stakeholders. In fact their security is tighter and better than most, if not all, of their competitors. Not only does Yodlee require you to set up a username and password, but they also make you set up an image to identify each time that you log on to the site, and give answers to several security questions.

Besides this, they employ a stiff suite of defensive measures to protect their network using intrusion detection software, firewalls, third party independent inspections and audits, and standard encryption SSL protection. To say the service is secure proves to be a gross understatement. These additional protocols may be a pain for you to go through every single time you log on, but consider how some small inconvenience that takes a minute of your time is worth avoiding theft and identity problems that will take you months, if not years, to clear up and from which to recover.

Yodlee Ratings & Complaints

Yodlee maintains a coveted Better Business Bureau rating of A+, their highest honor and seal of approval. In the past three years, they have only had to close out three complaints, and they have experienced zero during the previous 12 months. This is what you call fantastic customer service and satisfaction.

Final Words on Yodlee

Yodlee is criticised for maintaining an old interface and providing a dizzying amount of information to its clients, but there are two sides to every coin. On the other side of the argument, Yodlee out sparkles its competition with its wide and varied output. It is possible to view charts that compare your expenses and income, your spending categorized, and even your budgeted spending measured against true expenditures. They give you charts to analyze your amount of credit available and used. Perhaps most impressive, you might design reports that are customized and set up budget goals with this interface. For range and flexibility of personally tailored reports, none of the competition comes close.

Another advantage that Yodlee boasts is its efficient and effective synchronizing with banks and other financial organizations. If only it were not for their tired and cumbersome front end interface, they would completely dominate the space of personal financial software and apps. Yet for them, this consumer-driven model business is simply not important, since they make all of their money and earn their glory from providing powerful data on the back end service. This leaves Yodlee Money Center feeling like they could do much better with the appearance and usability, if only it mattered to them to do so. Besides this, consumers in this space mostly care about either budgeting or investment direction and performance monitoring. Yodlee is about average at budgeting, and since their exhaustive reporting only pays lip service to investing, it is not particularly strong in this department.

Yodlee Money Center

- Phone : 1 800 427 1913

- URL :

- Global Rating

- Good

User Rating

- 0 No reviews yet!

Review Summary :

Yodlee is extremely good at providing data and powering the slicker, more sophisticated services of its rivals, but unfortunately its Money Center seems to be unimportant to the company. While it is very good at producing and allowing you to customize exhaustive reports and charts, its interface is cumbersome and tired-looking at points.

Have you purchased products from Yodlee Money Center? Leave a review!

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum