- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

Venezuela Cancelling Its Gold Swap Agreement with Deutsche Bank Begs the Question Why

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

Last Updated on: 3rd November 2017, 11:34 am

You know that your country is in serious trouble when it has to come up with a creative way to trade its gold reserves for loans to pay back other loans which are coming due. This is the state in which today's Venezuela has found itself over the past year. The one-time richest country in all of South and Central America has so badly mismanaged its overabundance of wealth in natural resources that it finds itself in increasingly desperate straits. For a country that has not only enormous oil reserves but also a wealth of industrial metals, this is a sad place to be.

In 2016, Venezuela's struggling government led by Nicolas Maduro put his central bank to work negotiating an arrangement with German lending giant Deutsche Bank AG. The deal was that Deutsche would provide the country with gold swaps to boost the liquidity of their foreign reserves which are tied up in their physical gold holdings. A staggering 75 percent of their $16 billion in foreign reserves are kept in hard gold.

What this means in plain English is that the German bank would give them cash (dollars) secured by their gold so that they could use their precious foreign reserves to pay their several billion in major debt payments coming due in 2016-2017.

The country faced an overwhelming $9.5 billion in service on its debt costs for the time frame. In October and November alone, the government and its PDVSA state-owned oil corporation had to cover $3.5 billion in interest and principle repayments on debt, of which $2 billion was debt coming due.

In October of 2017, Venezuela Mysteriously Dumped the Gold Swap Arrangement

Maduro's government undoubtedly found these gold swaps useful over the last few years as his country went from bad to worse economically between slumping oil prices, corruption, waste, mismanagement, and discouragement of crucial foreign investment.

The plot thickened last month though, as Venezuela's government mysteriously let its $1.7 billion gold swap with Deutsche simply lapse. No one is entirely sure of the reason for this, and naturally neither the government nor Deutsche Bank has made themselves available for comment on the sensitive issue.

In fact it was only an opposition (to the government) legislator who leaked the story to the international financial media at all. Legislator Angel Alvarado became the proverbial whistle blower of the event (to Reuters) as he opined that letting the gold swap deal drop critically weakened the OPEC member government and central bank's crisis stricken balance sheet. He warned:

“Venezuela decided to allow this contract to lapse. We think the government could have negotiated better.”

The burning question behind it all is why did Venezuela simply walk away from the deal that provided them with the option (but not the obligation) to obtain hard currency for their gold reserves? It's not like they weren't using the facility after all. So far, the South American country had obtained $1.2 billion worth of cash in trade for as much as $1.7 billion of their gold in guarantees against the loan.

You also can't make the case that the country's foreign reserves have simply improved to the point that they don't need to trade gold for spendable currency. As the Legislator Alvarado astutely pointed out, their national reserves are stuck at 21 year long lows to this day.

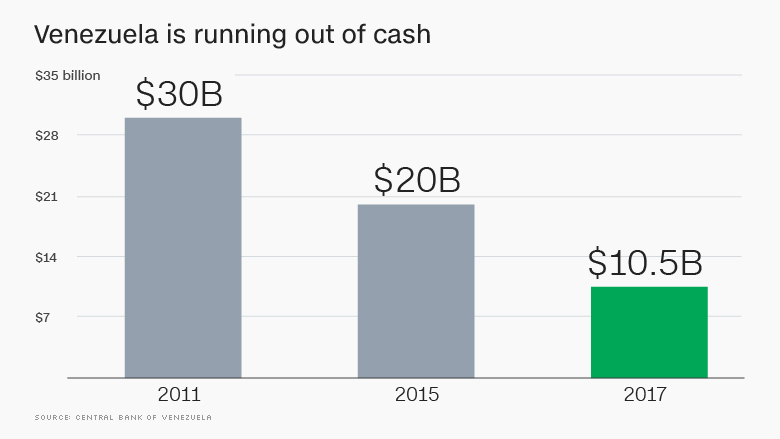

In fact, their long-cherished socialist national economic model has been crashing under the weight of $35 to $60 per barrel oil for several years now. This chart shows how fast they are burning through their reserves:

Obviously markets didn't like the revelation one bit. On the back of the announcement, both the bonds issued by PDVSA and the country of Venezuela proceeded to drop precipitously for all maturities. Some of them cratered by a sobering 2.5 percent in a single day.

This of course only makes the problem worse, as interest rates move inversely to prices. It means that their cost of borrowing would rise comparably, only aggravating an already increasingly hopeless national financial situation. Traders were claiming that the bonds' decline came from rising fears that coupon payments on the debt would be delayed.

All that we know for sure continues to come from the Legislator Alvarado. The Venezuelan Central Bank gets the $500 million more in cash that was left from their gold swap (in exchange for the $1.7 billion in gold they put up). This represented the remainder of the loan amount and the gold guarantee value. Alvarado stated that they had to come up with $1.2 billion by mid October if they wished to redeem their cherished gold holdings, which they were unable to do.

Meanwhile The Situation in Venezuela Continues to Deteriorate

The South American government finds itself increasingly in serious trouble as it is now caught in a downward spiraling vicious cycle. Inflation last year reached a mind-boggling 720 percent while GDP contracted by a sobering 10 percent, per the CIA World Factbook. Central reserves were dwindling and consumers faced widespread shortages of crucial food and medicines.

Because the government needed to borrow heavily to continue to pay for its critically needed imports such as medicine and food, its debt service payments have been eating away the dwindling government revenues which they need to pay for still more medicines and food.

It has led to severe shortages of critical goods in the country. Millions of Venezuelans are now struggling to come up with a basic daily ration of food. Hundreds of thousands have left the country for any neighboring nation that will take them.

The Venezuelan president who took over from the deceased Hugo Chavez claims that his government is the unfortunate victim of an American-led “economic war.” With this statement he refers to the few rounds of economic sanctions American President Trump's administration has leveled against him for his various human rights abuses and increasing crackdown on basic freedoms.

Besides the U.S. pressure, his so-called political adversaries are supposed to be behind the economic attack on their government and nation. According to Maduro, all of his serious economic problems are nothing more than a giant international conspiracy.

Objective reality as presented by international observers and economists paints a starker picture. Maduro has only accelerated the decline brought on by the inefficient socialist system that predecessor Hugo Chavez established. Over a decade of government policy has scared away international investors and discouraged domestic investment and businesses as the government seized control of key industries.

Their economic socialist model was simply unsustainable in the face of sub $50 per barrel of oil global energy prices. Whether or not they can catch up and dig themselves out of the proverbial hole they are in now with oil at $60 per barrel remains to be seen. Certainly the shock oil spike prices of $100 per barrel seen a few years ago in the hey-day of OPEC oil-producing countries looks unlikely to return any time in the near to medium term future.

A More Grim Possibility Is That the Venezuelan Central Bank Has Given Up

It may be that the Venezuelan Central Bank has decided to hold on to its gold reserves against darker days to come, even if this eventually means defaulting on the country's considerable interest and even principle payments due this year or next.

If the central bankers have privately sat down with President Maduro and told him that there is no point to continue selling their gold which they will need, then the devastating economic crisis in the long-time richest South American nation has reached a grim new low.

At least it would mean that the Central Bank recognizes the critical importance of gold in such end of the world types of scenarios. For now even the whistle blowing Venezuelan legislator Alvarado does not appear to have more answers on what the financial planners of the downward spiraling country are really thinking. Time will tell.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum