- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

U.S. Trade Deficit Touches Near Decade High

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

Last week you saw the trade deficit widen to an almost decade long high despite ongoing U.S. administration efforts to reduce it. Even with new trade tariffs going into effect, the U.S. is still importing far more than it exports. It means that the country is moving in the wrong direction in terms of its trade and balance of payments. These statistics have only emboldened the protectionist arguments in the United States.

This is another reminder of why you need the stability of IRA-approved metals to insure your investment and retirement accounts. Gold makes sense in an IRA because it hedges against market volatility and economic instability like you are witnessing now in the financial and equity markets. Now is a good time to consider acquiring some of the top five gold coins for investors.

What Happened to the U.S. Trade Deficit?

The data this past week revealed that the February U.S. trade deficit rose to an almost nine and a half year long high. This happened as U.S. imports and exports each made all time records. Ironically, the trade imbalance with China narrowed dramatically even as they have been the main scapegoat for the out of balance trade deficit the U.S. has run for decades.

Thursday the Commerce Department data revealed that the gap in trade increased to $57.6 billion. This was 1.6 percent higher than the prior month. Such a trade imbalance in the U.S. had not been seen from October of 2008. It was especially surprising given that January's shortfall had been revised down to $56.7 billion. The goods component of the trade deficit saw its highest level dating to July of 2008 while the usual surplus in services category showed its lowest point to December of 2012.

This represented the sixth consecutive month that the U.S. trade deficit has increased. It continues to strengthen the arguments by the administration that the various American trade relationships are unfair and one sided. This only encourages the voices calling for tariffs on imports into the country.

Economists Had Looked For A Better Result

The data surprised economists that Reuters had polled. They had looked for the February gap in trade to only widen to $56.8 billion from January's $56.6 billion. One of the prime culprits in the report was a series of commodity prices that increased.

Yet despite this, the China goods trade deficit declined by 18.6 percent to reach $29.3 billion. At the same time, the American trade deficit versus Mexico dramatically increased by 46.6 percent for the month.

U.S. and China Tariff Reprisals Continue Throughout the Week

The United States is presently engaged in enacting rounds of trade tariff barriers primarily with China over the issue of the worsening trade deficit. President Trump highlighted his position on the issue with the comment:

“We are not in a trade war with China, that war was lost many years ago by the foolish, or incompetent, people who represented the U.S. Now we have a trade deficit of $500 billion a year, with intellectual property theft of another $300 billion. We cannot let this continue!”

U.S. and global equities markets have been severely shaken by the ongoing trade battle with China that only worsened throughout the week. On Tuesday the U.S. administration imposed 25 percent specifically targeted tariffs on around 1,300 Chinese products in industrial technology, medical, and transport sectors. This included aerospace, machinery, and robotics goods.

Besides addressing the trade imbalance, the administration was seeking to create a shift in the practices of China concerning intellectual property. By Wednesday China responded forcefully with a comparable round of duties on $50 billion in significant U.S. imports to their country. The U.S. products impacted include soybeans, automobiles, beef, airplanes, and chemicals.

These were the latest round of tariffs imposed by the U.S. in an effort to create a fair and level playing field in its international trade. The first round had seen duties erected on washing machines and solar panels, as well as 25 percent steel and 10 percent aluminum tariffs. Economist have argued that this will raise prices to businesses and consumers, yet so far this is not the case. The President remarked in a Twitter message on Friday that:

“Despite the aluminum tariffs, aluminum prices are down four percent. People are surprised, I'm not! Lots of money coming into U.S. coffers and jobs, jobs, jobs!”

By Thursday the trade dispute with China only intensified. Trump instructed the U.S. Trade Representative to contemplate more tariffs on another $100 billion worth of Chinese products. This was in response to the Chinese retaliating to his $50 billion of products' import duties on their exports to the U.S. Stock markets were tumbling on the news.

Spokesman Gao Feng of the Chinese Ministry of Commerce warned that China will “retaliate immediately, intensively, and without any hesitation” against a new tariff list for another $100 billion in Chinese imports. He claimed that they have already drafted their retaliatory targets in anticipation of such a move.

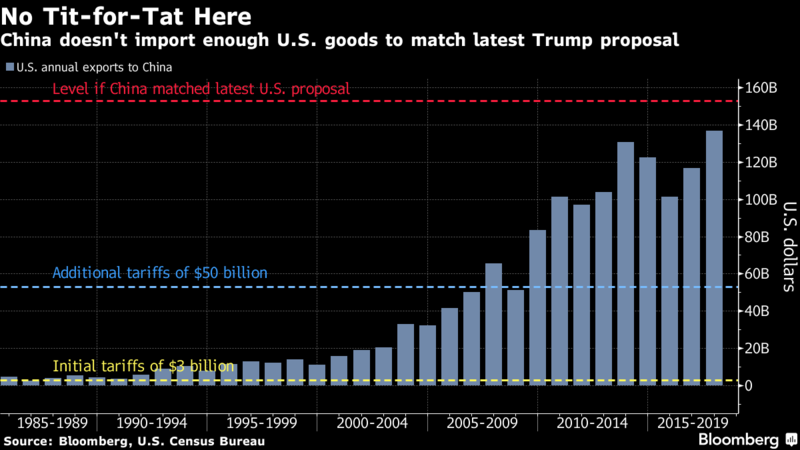

The problem that the Chinese are encountering is that they do not have a large enough dollar value in American imports to go after this time, as the chart below shows. In order to match it, they would have to focus on students studying in the United States, on package tourism, and possibly on American firms doing business in their country.

What the actions and reactions are certainly doing is destabilizing global equities markets as European Central Bank Executive Board Member Benoit Coeure pointed out, with:

“By fueling uncertainty among market participants, fears of a ‘trade war' have added to the volatility already witnessed earlier this year in equity markets. None of this supports growth and employment.”

As these tit for tat tariffs continue, high level American and Chinese trade officials are working together to come to an agreement to head off the economic conflict. Administration officials continue to downplay worries about an ongoing trade war. To this effect Thursday, Chief Economic Adviser Larry Kudlow insisted that the country can still work out an arrangement with China.

The White House Trade Adviser Peter Navarro argued that it is all part of the president's strategy to address the trade imbalance. He stated:

“The message he's sending to China is this: He has a great relationship with the president of China. This is business. And this is the kind of business where we have to stand firm against China's unfair trade practices.”

Yet as the trade data for February showed, the trade imbalance with China is only a part of the lopsided U.S. trade flows.

Larger Trade Deficit Means More U.S. Debt

One thing that is getting lost in the trade actions and heated responses is the consequence of the widening U.S. trade deficit. The deficit is covered and paid for by floating additional U.S. debt. With the total balance of the federal debt already in excess of $21 trillion, this is a dangerous issue that does need to be addressed in some constructive way.

Common sense tells you that the country can not indefinitely issue debt (which is growing faster than its economy) to pay for the trade imbalance. It is a good idea to protect your retirement assets from these complex economic problems with gold. Now it is easier than ever to acquire these historically proven precious metals as you can buy gold in monthly installments.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum