- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

U.S. Fights Back Against Chinese Investment in Asia

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

Last Updated on: 23rd September 2018, 09:21 pm

This past week saw the United States stand up for itself in Central and East Asia. America fought back against the Chinese One Belt, One Road Initiative with a program of its own designed to counter the rising economic global influence of the only other major economic and military superpower China. There is a real danger in this strategy, which spilled over into a series of not so veiled threats from China by the end of the week. Armed conflict with China (and their partners in crime the Russians) is becoming an increasingly conceivable possibility.

This is a very real reason to look into buying gold in monthly installments. Historically proven safe haven gold makes sense in an IRA precisely because the geopolitical competition between the United States and China has now clearly changed from being amicable to anything but friendly on economic, diplomatic, and now even military levels. The showdown of our age between the U.S. and China for global dominance means that you need to look into the Top five offshore storage locations for your gold IRA now while you still can.

What Is America's New Clear Alternative to Chinese Economic Influence in the World?

American lawmakers and U.S. President Donald Trump have long been worried that China was so successfully buying friends and influence around Asia, Europe, Africa and the Indian Ocean that there would not be any nations left with loyalty to the United States. Finally Washington D.C. decided to do something about it. The U.S. Congress is now debating the bill that will allow the country to establish the new $60 billion fund to invest throughout Asia.

Such an organization already exists within the U.S. government. It is called the U.S. IDFC International Development Finance Corporation. The idea is to offer a clear alternative to China's Belt and Road infrastructure economic program. This economic piece of the Indo-Pacific strategy for the United States threatens to bring the U.S. into outright confrontation with China (and not only economic and diplomatic conflict).

IDFC will bring together all disparate American agencies that separately run their own kingdoms in spending private and public money on still-developing nations. Congress had begun pushing the bill through in the BUILD Act, which stands for Better Utilization of Investments Leading to Development Act. The expected Senate approval is all that is holding it back from becoming reality.

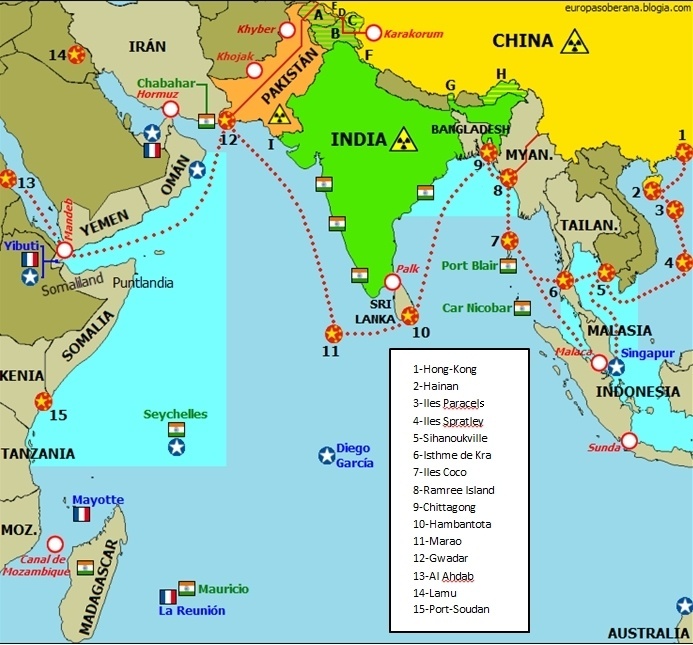

Congress' efforts are not the first American endeavors to do something as a counterweight to China's increasingly powerful economic punch around Asia (and Africa). The White House in July revealed its $113 million Indo-Pacific area infrastructure spending plans. This is only a first response to the One Belt, One Road Initiative, as China has committed vastly greater resources to their economic imperialism than a mere $113 million. Looking at this map of Chinese rising military base expansion, it is clear that they are getting some serious payback for their investments:

It explains why Congress came forward with a plan to put $60 billion to work amid rising fears that China is stealing the hearts and minds of the peoples and governments of the Indo-Asian region.

A Clash of Civilizations and Empires: How Does the Belt and Road Compare to the IDFC Fund?

The proponents of the beefed up U.S. IDFC Fund argue that this can outclass China's investment even if the amount involved is still much smaller than what China brings to the table in the One Belt, One Road projects. The Special Assistant to the President for International Trade, Investment, and Development Clete Willems at the National Security Council shared:

“The U.S. is increasingly concerned about China's effort in the region, the types of investments they are making, what it's doing to different economies and what it's doing for China's strategic interests. We want to find a way to provide a clear choice and a clear alternative and that's really what this is all about.”

The secret weapon which the IDFC possesses is its capability to form alliances and pursue joint ventures with other Western-friendly developmental finance outfits throughout the globe, as the Chairman of the House Foreign Affairs Subcommittee for Asia and the Pacific Ted Yoho explained.

Thanks to the ability of the IDFC to pursue overseas investments now, the fund looks like it may pose a serious challenge to China's imperialistic economic ambitions around Asia especially. IDFC will hire local nationals for workers and build on money from the private sector contributions in order to increase local area economic growth. It is a shrewd move.

The most serious criticism of the Chinese One Belt, One Road has been that they only deploy Chinese national workers and they chain up the recipients with loans that a great number of the nations partnering with them simply can not service over the longer term. Those poor countries that are unable to repay their loans will fall into the clutches of Beijing and have no choice but to sell off their important assets of the state to China.

This has already happened with Sri Lanka. It played into the Chinese interests when they were able to take over the maritime Hambantota port of Sri Lanka in what is now called debt trap diplomacy.

China Stumbling Is An Opportunity for the U.S., but Growing Rivalry Poses Risks of Spiraling Out of Control

Belt and Road has suffered from a disconnect between its massive financial size and the actual results happening in locales throughout Asia, the Indian Ocean, and Africa. The Center for Strategic and International Studies explained this in a simple one-liner from their September-issued report:

“Beijing's control problem could be Washington's opportunity.”

It remains to be seen though if $60 billion from Washington can effectively compete with China's one trillion dollar One Belt, One Road Initiative. With the American development fund boasting only six percent of the Chinese financial resources in play it makes the U.S. look like a veritable David versus Goliath in this arena.

Are the U.S. and China Headed to Armed Conflict in the Region and World Over This?

What should be a bigger concern for those watching the drama unfold today is: how will this titanic economic rivalry of our age play out in other areas of strategic competition like military and hard power issues? The U.S. has enraged the Chinese by imposing sanctions on some segments of China's armed forces as a punishment for purchasing Western-sanctioned Russian arms.

The Chinese pursued what the U.S. has labelled “significant transactions” with Rosoboronexport the Russian arms dealer. These included Russia's high technology S-400 surface to air missiles and Su-35 fighter warplanes. Thanks to these new sanctions from this past week, the EDD and Li Shangfu have had all U.S.-based assets frozen and are now locked out of any business dealings with American corporations or individuals.

The Chinese response has been swift and ominous. Spokesperson Geng Shuang of the Chinese Foreign Ministry warned in his press conference:

“The U.S. actions have seriously violated the basic principles of international relations and seriously damaged the relations between the two countries and the two militaries. We strongly urge the U.S. to immediately correct their mistake and withdraw their so-called sanctions, otherwise the U.S. will have to bear the consequences.”

What makes this battleground with the Chinese more dangerous still is that the Russians have now been given a common enemy with the Chinese against America. Sergei Ryabkov the Deputy Foreign Minister of Russia could not miss the opportunity to weigh in on the issue of American and Chinese deteriorating relations with:

“It would be good for them to remember there is such a concept as global stability which they are thoughtlessly undermining by whipping up tensions in the Russian-American ties. Playing with fire is silly, it can become dangerous.”

Those two threats from the Chinese about America “suffering the consequences” and from Russia on “playing with fire becoming dangerous” should serve as a wake up call for anyone with investment and retirement portfolios to protect. The U.S. and world markets are now walking a fine line between diplomatic and potentially open hostilities with such major geopolitical powers as China and Russia. This is why you need to investigate the top five gold coins for investors along with the top five silver coins for investors while you still have time.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum