- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

Time’s Up for the Equity Market?

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

Last Updated on: 21st March 2016, 04:09 pm

Back on December 14, I argued that various fundamental, technical and macro developments indicated that the stock market was set for a fall. Call it luck rather than skill, but the S&P 500 index slid roughly 200 points over the following two months, hitting a closing low for 2016 on February 11.

Since then, share prices have rebounded sharply, powered largely by short-covering associated with lopsidedly negative sentiment and positioning. While I didn't call the low, I did raise concerns in the latter part of February about whether the “crowd” had gotten too bearish. In that and a subsequent article, I suggested that those who were considering betting against stocks should wait for better levels to sell.

Now that the S&P 500 has returned to where it was in mid-December, the obvious questions are: does the earlier call still make sense and, if so, is it time to pull the trigger?

Still pointing to the downside

In regard of the first question, it still seems that, longer-term at least, the major risk is to the downside. Among other things, there is no real evidence of any substantive recovery in economic activity. In fact, as I argued in “Not Yet Time to Pull the Trigger,” various data, including the sharp drop-off in global trade; the continuing decline in corporate bottom lines; pessimism among CEOs, small businesses and individuals; and other developments have heightened the odds of an imminent recession.

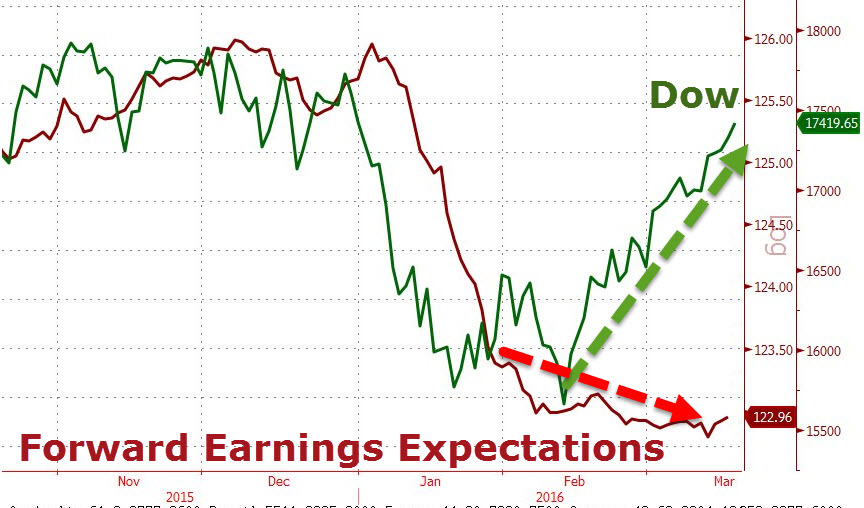

Historically, economic downturns have not been an especially good time to be long equities. However, there are also other factors, including a worsening earnings outlook, that bode poorly for the continuation of the now long-in-the-tooth bull market. As the following chart shows, analyst expectations have been trending downward since this year began, and have not kept pace with the recent rally in share prices.

One development that has in recent years played a vital role in keeping the market's upside momentum going has been ongoing purchases by companies of their own shares. In fact, citing a note from HSBC, Business Insider recently reported that “buybacks have been the source of most of the demand for stocks since 2009.” Over the past two years, the researchers maintain, “companies in the S&P 500 have bought back nearly $500 billion of their own stock and a total of $2.1 trillion since 2010.”

Biggest buyer leaving the scene?

However, this long-time positive appears set to fade away, undermined by the Federal's Reserve's shift to a tighter monetary policy stance and deteriorating credit market conditions. Because many companies have been supporting such purchase through debt issuance, they will find it harder to “finance and execute buybacks at the rate seen in the last few years,” according to Barclays equity strategist Jonathan Glionna. It would, Business Insider notes, “end the reign of buybacks as the biggest buyer in the market.”

Given these and other negatives, including still-unsettled high-yield bond markets and increasing geopolitical instability in the Middle East and elsewhere, it's hard to make the case that the next big move is up rather than down. But what about the timing? Are the technical indicators and other factors that previously confirmed a countertrend rally was on the cards telling a different tale?

In some respects, at least, the answer is yes. While there is little sign of the exuberance that has in the past marked major market tops, small investors, in particular, seem much less concerned about the downside risk than the were six weeks ago–just before share prices began their ascent. According to the latest American Association of Individual Investors survey, bullish sentiment has rebounded from 19.2% to 37.4%, in line with its long-term average.

Flowing the other way

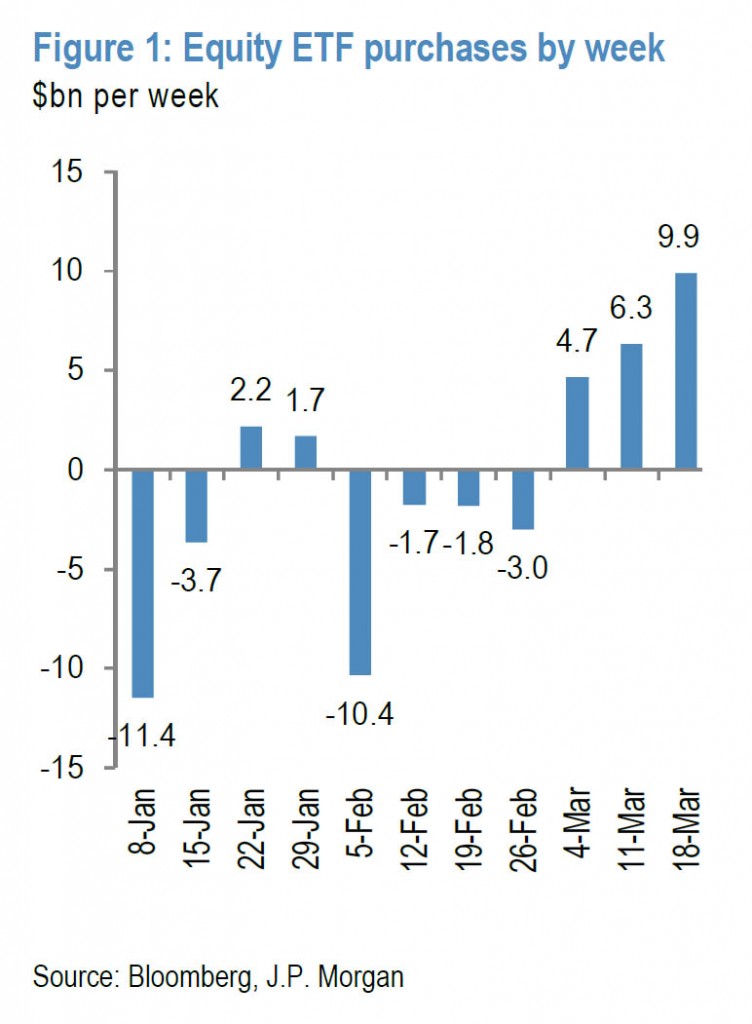

The selling in equity exchange-traded funds that accompanied and contributed to the selloff that ended in mid-February has also dried up. As the following chart illustrates, equity ETF purchases have risen for three straight weeks; the cumulative inflows over that span have offset nearly three-quarters of what left those funds when the broad market was under pressure.

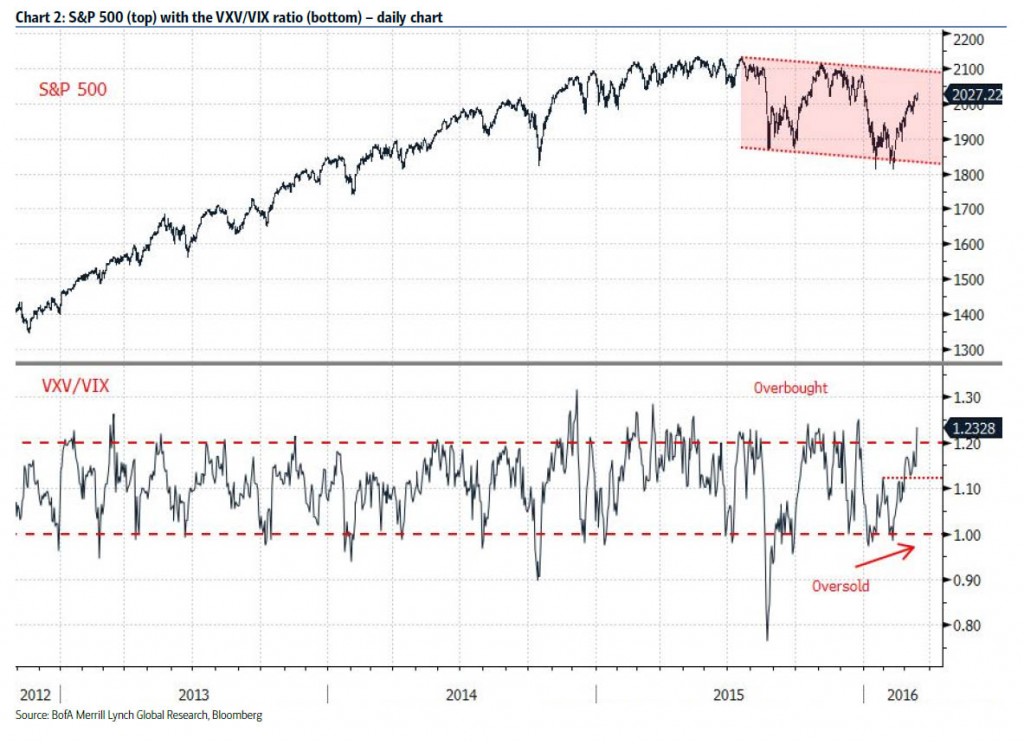

Certain indicators are also signaling that investors as a group are less fearful than they were. Zero Hedge recently highlighted commentary and two charts from Bank of America Merrill Lynch's (BAML) chief market technician, Stephen Suttmeier, suggesting that the technical picture has swung from oversold to overbought, and that sentiment is now relatively complacent.

Also a short-term negative

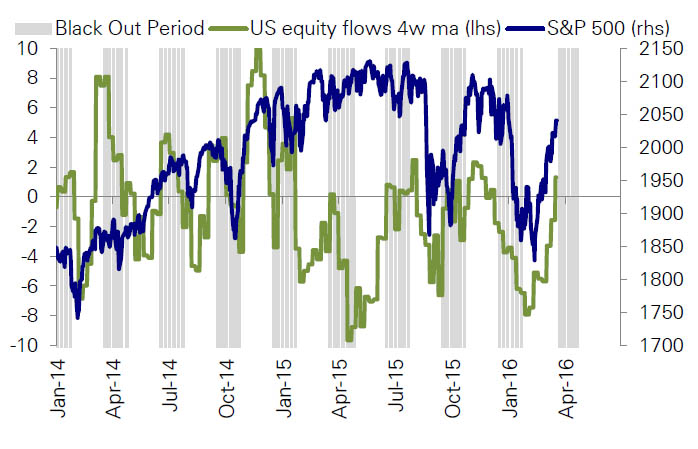

Finally, while the issue of diminishing buybacks represents, as noted above, a longer-term threat to share prices, the impact of such activity–or rather, the lack of it–could be strongly felt over the coming six weeks. That is because companies typically refrain for regulatory reasons from acquiring their own shares during the earnings reporting season. According to Zero Hedge, U.S. equity flows have seen substantial and sharp declines during past “black out” periods.

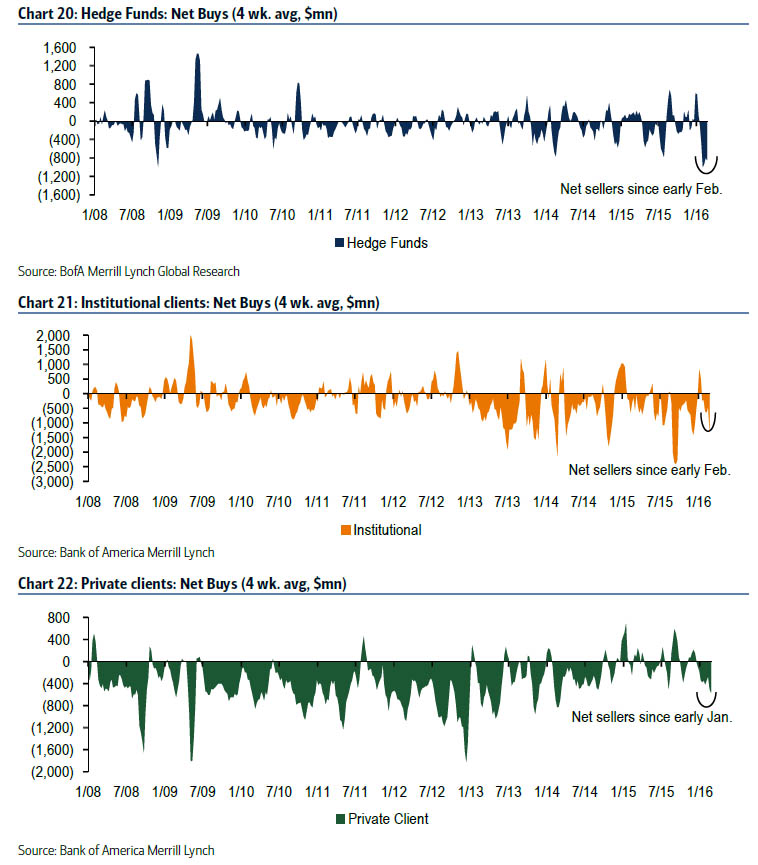

Under the circumstances, share prices will likely experience a heightened impact from the trading of other players, notably institutional investors, hedge funds and private clients, who have, according to BAML, been net sellers of equities for seven consecutive weeks. In fact, the latest week's net sales by this group of $3.7 billion of equities were the largest since September, casting doubt on the market's ability to keep powering ahead in the absence of the main buyers.

In sum, it seems that the impact from factors that contributed to the recent upswing in stock prices is set to diminish, while negative fundamentals, including the prospect of numerous earnings disappointments, are likely to reassert themselves. With that in mind, it looks like the second-chance opportunity that bears have been waiting for has just arrived.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum