- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

The New Tech Bubble – 3 Reasons Why It’s 2000 All Over Again

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

During the 90s, it felt like the internet and the United States had unlimited potential. New tech startups were revolutionizing how the World did business and seemingly had nowhere to go but up. This pushed the market, especially the Nasdaq, to record highs and everyone believed the party would keep going forever. We all remember how that ended:

Now, nearly 20 years later, history seems to be repeating itself. The stock market is also hitting new records with a lot of help from the tech sector. Analysts say this time it’s different because growth is coming from companies with actual value like Google and Facebook, instead of miserable failures like Pets.com. Still, there are a few eerie similarities to 2000 which should have investors worried.

Reason 1 – Tech Stocks Are Massively Overvalued Compared To Revenues

Tech stocks are generally growth stocks. This means investors buy these companies because of their future potential rather than because of their current earnings. These stocks have a high price to earnings ratio because investors expect that future earnings will grow quickly enough to justify an even higher price. For a growth investment strategy to work, companies need to be able to gain market share.

When you look at the size of today’s tech giants, it’s difficult to see how they can have any more room to expand. Facebook is a classic example. The company is already massive and has a market cap of $235 billion, near its all-time high. It’s getting harder and harder for the company to keep growing. Last quarter was Facebook’s weakest quarter of earnings in two years. At the same time, its expenses are soaring: R&D, sales, and marketing spending are all up about 100% yoy.

Still, money keeps pouring into the company, especially from venture capital, and they’re under pressure to keep expanding quickly. As a result, Facebook is making more speculative investments like the $19 billion purchase of Whatsapp, a company that only had $20 million of annual sales. Facebook is hoping to see huge gains from these investments but really it has no idea about what kind of long-run return it will see since it keeps moving into untested markets. If the company stumbles, its flow of venture capital financing could dry up and force a sharp correction. Facebook is the most obvious example but most tech companies are in the same rocky position.

Reason 2 – Tech Insiders Are Worried About A Bubble

Though they’d never admit it publicly, even tech insiders are worried about the state of their industry. Evan Spiegel, the founder and CEO of Snapchat, had his frank thoughts revealed in a recent email leak. Spiegel expressed that the industry was facing lower user engagement and a pullback of advertising spending. Still, tech stocks are growing because money from venture capital keeps coming in. VC firms feel like they are justified making this investment based on the growth potential of tech stocks.

Spiegel believes this is a recipe for disaster, especially with rising expenses and not enough information on the long-run value of advertising spending for new users. There’s no clear or immediate value in these companies but investors keep buying with the hopes of future price increases. If this momentum slows down because tech companies run into problems, Spiegel sees a possible 20% correction or worse in the tech sector. No CEO could ever be this frank in a public statement which is why this email leak is so significant.

Reason 3 – The Market Is Unaffordable For Regular Investors

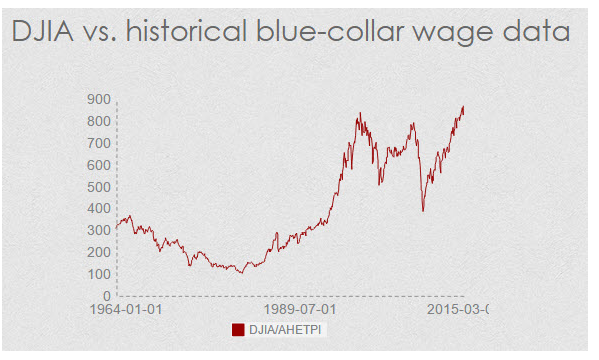

Beyond the tech industry’s struggles, the stock market as a whole looks like it’s in bubble territory. One effective way to gauge the value of the market is to compare stock prices to average wages in the economy. This shows whether stocks are growing because of a strong economy or because of a bubble. By this metric, we’re in bad shape. The Dow Jones is the most expensive compared to average blue collar workers than it’s even been, even during the previous tech bubble.

Most Americans can’t afford to invest which means market gains are being driven by Wall Street investors, company stock buybacks, and loose Fed monetary policy. This isn’t sustainable. Any problems will immediately end this momentum buying and cause the market to collapse. Right now it looks like an overvalued and underperforming tech sector could be the problem that pushes us over the edge.

Years after the last tech bubble burst, the problems seem so obvious. Still, nearly no one expected the crash until it was too late. Don’t make that same mistake again. Investors should start moving out of the stock market, especially tech stocks, in anticipation of another crash. The tech industry sees it coming. Hopefully investors do too before it’s too late.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum