- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

The Future Of Oil Prices – Why The Market Still Might Not Have Hit Bottom

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

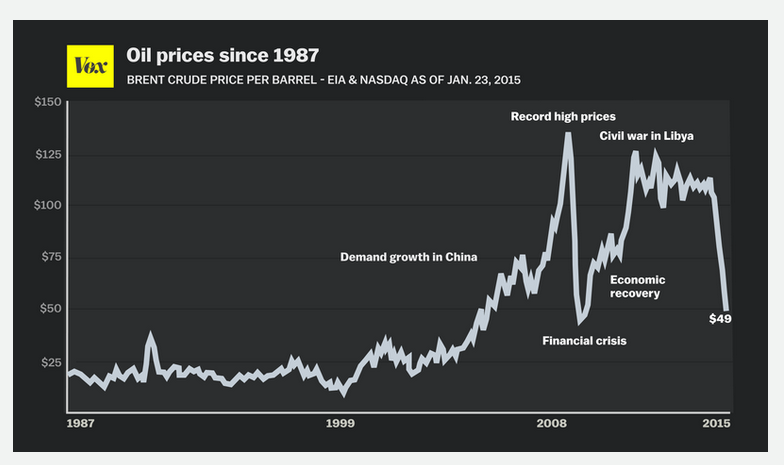

Over the past 6 months, the price of oil has completely collapsed. This drop came seemingly out of nowhere and caught investors, oil companies, and governments completely off guard. Recently, the price of oil has started creeping back up again making it seem that oil prices are on their way back to normal. However, there are factors which could easily cause the oil market to collapse again. Investors need to understand what’s going on in this market so they don’t get in trouble with this volatile commodity.

What caused the collapse in oil prices

Back in the summer, the price of crude oil was trading around $115 a barrel. In January, it was down to $49, a drop of over 57%.

This fall came from a near perfect storm of both supply and demand issues hurting the price of oil. First, demand for oil was stagnating. Both Europe and Asia are struggling economically so these countries are buying less oil than usual. While the American economy is recovering, oil demand hasn’t grown enough to offset losses around the World, especially since Americans have shifted to using less energy per capita.

On the supply side, America has ramped up production in new sources of energy from fracking and the tar sands. Altogether, this new production added about 4 million barrels of oil to World production, increasing total World production by about 5%. At first, this new production was mainly cancelled out by the civil war in Libya and unrest in the Middle East. However, production in both areas began stabilizing last year. Altogether, this extra production plus weak global demand started pushing down the price of oil.

The bottom really fell out of the market in November after a surprising decision from OPEC, a coalition of large oil producers mainly in the Middle East. Usually in the face of falling prices, OPEC nations cut production to prop up prices. This time around, OPEC decided they would keep producing as normal creating a massive supply glut. All these factors combined to oil’s stunning collapse.

Why oil prices could fall again

Since hitting a low in January, crude oil prices have crept back up to around $60 a barrel. Oil producers are slowing down production to get rid of the extra market supply by opening fewer rigs, spending less on exploration for new sites and delaying the opening of new wells as they wait for higher prices.

These steps will lower production in the short-term and has some analysts predicting that the market will recover throughout the year. However, these actions could also be setting the stage for another sudden collapse. First, even though producers are trying to slow down production, oil supplies keep growing because of all the wells that went up during the oil boom. Some producers are running out of storage space and may need to start selling earlier than they’d like.

Also, oil producers can only delay the opening of new wells for so long. Once prices hit a point where producers think they should jump in, a rush of new production could hit the market causing prices to collapse again. At the same time, OPEC continues to keep production high while Libyan production has grown from 325,000 barrels a day in January to 500,000 barrels a day today.

How this affects investors

The key takeaway for investors is that the oil market is too unpredictable to take a large position in. While some investors are taking a long position on oil futures, the losses from another sudden collapse would be disastrous. There’s just too much risk of a double dip in this market.

The good news is that Investors can feel confident that a sudden spike in the price of oil won’t derail the current economic recovery and stock bull market. There are enough headwinds in place against the price of oil that should prevent any surprise surge. If prices do go up, the increase should be gradual and more predictable than last year’s collapse.

Finally, expect market conditions to be tough for oil producers for at least another year or two. Until the World gets through the glut of oil supplies, it will be difficult for oil producers to get their prices and revenues up causing these stocks to struggle.

After years of soaring costs, low oil prices are certainly a surprise. Investors should expect that this market won’t be getting back to normal any time soon and should anticipate a long stretch of low oil prices.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum