- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

20 Year Anniversary of Euro Reminds Why World Is A Mess

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

Last Updated on: 2nd January 2019, 09:18 am

This past week witnessed the 20 year anniversary of the greatest currency sharing experiment in history— the Euro. The only way to appropriately describe this monetary foray so far is with a Dickens' classic line, “It was the best of times, it was the worst of times…” Twenty years later, the euro has barely survived the Global Financial Crisis, the European Sovereign Debt Crisis, and the loathing of the Greek and Italian electorates.

This is a poignant reminder of why you can not count on anything in your portfolio ultimately but gold and precious metals. When the global geopolitical and economic chips (stocks and bonds) are down, the one to turn to is IRA-approved gold. Reality will always be that gold makes sense in an IRA because no other single asset class in the history of mankind has offered anywhere near the stability and purchasing power protection of the yellow metal. It is time to review your Gold IRA pros and cons while an uneasy calm prevails in the increasingly volatile and troubled markets going into 2019.

On Paper the Euro Looks Strong, but Reality Paints a Bleaker Picture of Papering Over Cracks

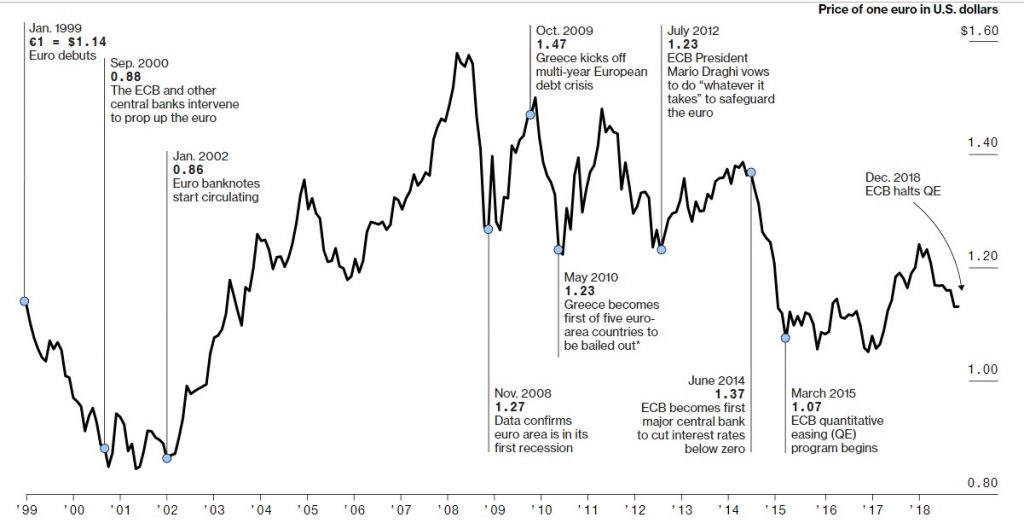

It is perhaps appropriately ironic that on the 20 year anniversary of the euro, the currency that has swung wildly from 1.14 to the dollar down to as low as .83 and as high as 1.60 in the last two decades is now back to where it began its frighteningly volatile journey at 1.1450. It has literally come full circle. A casual observer unaware of the single currency's troubled history might think it was a beacon of currency stability, but this is the exact opposite of the case. Imagine if the dollar had plunged 20 percent before rocketing up 100 percent then falling another 28 percent and all in only 20 years. Investors and consumers alike would be begging them to stop the ride so that they could get off.

Yet this is precisely where you find the euro today, and worryingly, a few nations' voters do want to get off the euro roller coaster ride desperately (think Italy and most Eastern European nations). While membership has expanded from the founding 11 states to 19 today and the value of the euro-dominated economy has increased to 11.2 trillion in euros (or about $12.8 trillion) for a 72 percent gain, this has still only been good enough to set the currency block up as the second largest on the planet behind the United States.

In all likelihood, the greatest days of the euro lie behind it. Divergences in the North and South countries, and Central versus East/West economies in the block have strained the single currency to the breaking point on more than one occasion and threaten to break it still. Europeans as a rule counted on an improvement in their economic well-being when they pooled their currencies and interest rate and fiscal budget setting powers.

In cases like Italy, they have seen anything but prosperity from their tenure in the currency block. In fact, only a small handful of the euro carrying members today are actually flourishing economically, and these mostly center around powerhouse Germany and its neighbors Austria and Belgium. For everyone else, it is the start of another tough year making the joint European economic policy work for their own vastly different set of economic circumstances and models.

The Euro Has Even Hurt Some Founding Members Significantly

Italy may remain the poster child for countries economically left behind by the euro, but it is not the only nation to struggle to cope with the loss of financial and fiscal policy powers in the last 20 years. Ireland, Portugal, and Greece vie for the unenviable slot of second worse off under the euro (behind Italy). None of these three nations in particular had the necessary space to tinker with their fiscal policy or choose deflation to escape from the ill effects of the Global Financial Crisis and subsequent European Sovereign Debt Crisis.

This chart below shows the wild ride the euro has taken its member states on, even as Greece teetered on the brink of total financial collapse over the past decade:

If Italy's case is any indicator of where things are heading in the future, then the volatile and challenging euro ride is far from over too.

Today Some of the Largest Euro Members Want Out of the Currency Union…

Three of the biggest and most important national economies in Europe are all struggling to make the euro and all that comes along with it work for their divergent economic situations. This includes Italy, France, and Spain. Each of these once-powerhouse economies has suffered significantly from the loss of ability to devalue its currency in response to economic turmoil caused by rising crises.

As they could not lower their own national wages, their once-admirable competitiveness simply crumbled away in the meanwhile. Unfortunately during the stronger periods of the euro, each of these three countries did not succeed in making the most of the currency union's offer to deepen their trading partnerships within the euro zone. Even today, Spain is the only one of these Big 3 to begin changing this shortcoming.

Mavea Cousin of Bloomberg Economics put it this way:

“Growth soared, but without sufficient structural reforms, their economies overheated and competitiveness deteriorated. The crisis then led to a brutal adjustment and threw into light the lack of fiscal capacity, at the country and at the euro-area level, to soften the impact of shocks.”

Euro Has Been Anything But A Beacon of Financial Stability

While some at the European Central Bank will try in vain to point out the stability that the euro provided countries which were previously fiscally irresponsible, this is an illusion at best. Since its inception of January 1st in 1999, the euro currency has swung often wildly from one extreme to the other and then back again. The turbulence makes even the old Italian Lira and French Franc look placid. Between the bailouts of national banks and debt-saddled members (think Ireland, Spain, Cyprus, and Portugal) and a lengthy and devastating European recession, the currency union nearly imploded on more than one occasion.

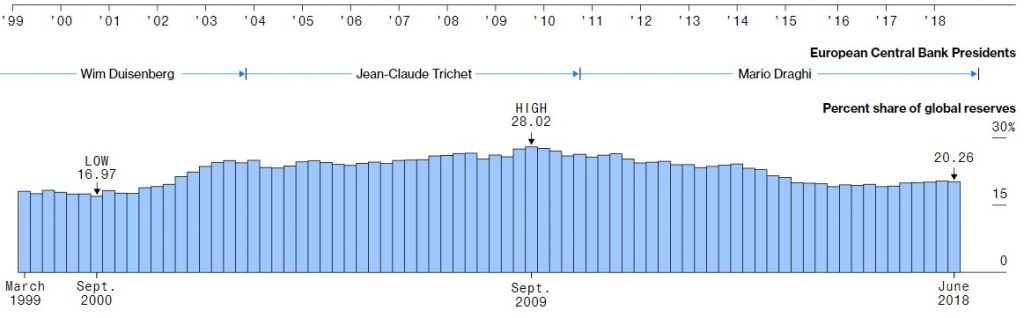

ECB hero and head Mario Draghi succeeded in holding the currency union together almost through sheer willpower alone by flooding the banking system and national governments with almost-free cash. Yet the reputation of the single currency has suffered appreciably from the need to wildly print away. Its percentage of global currency reserves has plunged from the 2009 one-time high of 28 percent to June of 2018's 20 percent, an almost 30 percent plunge, as this chart below shows:

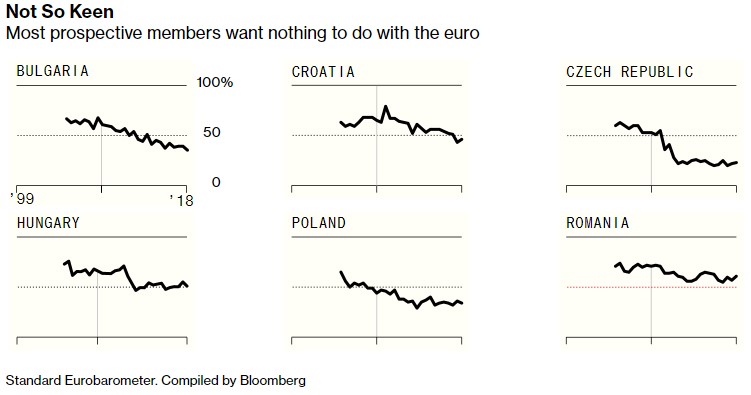

Let's be completely honest for a moment and admit that not all nations which are required by the Maastricht treaty to join the euro are chafing to do so. In fact the opposite is true today. None of the members who must join except for the Romanians are eager to do so. A mere 23 percent of Czechs and only 35 percent of Poles want to join at all. Hungarians and Bulgarians are also significantly below 50 percent of voters wanting to give away their financial and economic sovereignty, as these graphs below amply demonstrate:

With the Future Fate of the Euro and Largest Trading Block Uncertain, Gold Is Your Portfolio's Best Hope

The international solidarity of the euro has been seriously tested over the last especially five years, since the start of the Sovereign Debt Crisis and continuing through the Brexit vote (to leave the troubled European Union) to the troubling rise of the radical far-right parties in European national politics. Italy's public support for the single currency has plunged as the nation gleefully elected the first anti-establishment government among founding EU member states. The new government has proudly done nothing but oppose the Brussels regime since they took power in Rome, culminating in a long and bitter war with the European Commission over their submitted annual national budget.

Gold is the glue that holds investment and retirement portfolios together in geopolitically uncertain and economically unstable times like these. Today is the day for you to review the Top 5 gold coins for investors and seriously think about getting your own personal store of IRA-approved gold before things get any more dire in national and world markets. Start by looking at the Gold IRA rollover rules and regulations.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum