- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

Society Generale Warns Italian Bonds are the New Greek Bonds

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

Last Updated on: 24th August 2018, 04:05 pm

This past week, you saw a dire warning from major French investment bank Societe Generale about Italian government bonds. Societe claimed that Greek bonds are actually less risky than their Italian counterparts. As if this was not bad enough, investor data revealed that they now see Italian company bonds as safer than Italian sovereign bonds.

It is a stark warning for why you need to have an IRA-approved gold IRA. Gold makes sense in an IRA because it has protected assets and value for the last five thousand years of recorded human history.

How Can Italian Corporate Bonds Be Safer than Italian Sovereigns?

The data on comparative yields show that investors will take on the risk of major Italian companies sooner than they will the Italian government. How is this possible? Italy is a G7 trillion dollar plus economy with famous and valuable global exports like Gucci, Ferrari and Lamborghini. It goes against all reasoning that a government would be less creditworthy than limited liability companies.

Italy has the taxation powers and full faith and credit in the sovereign government. They ought to get a better interest rate yield than corporations because of nonpayment risk. Consider that in those nations where they lack the sterling credit ratings (think Spain and France), the government sovereign bonds still trade for a lower interest rate than do their national companies. The Head of European Credit Strategy Martin Barnaby of Bank of America Merrill Lynch explained this as:

“In the credit market we've been struck by the extreme relative value gap that's opened up between Italian corporate credit and Italian sovereign debt during the last week. Italian credit spreads have held up incredibly well vis-a-vis [Italian government paper], amid the volatility.

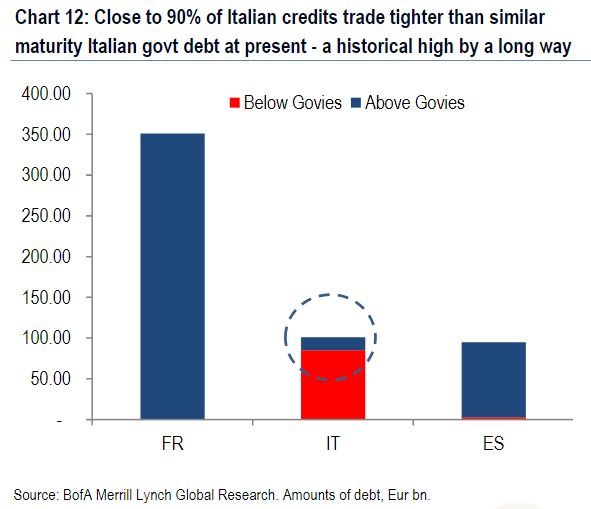

This chart above reveals one of many problems showing up in Italian public and banking finances.

How Can Greece Have Better Government Bond Prospects Than Italy?

It is shocking to think that Greece could have better government bonds and creditworthiness than Italy does. Yet according to Societe Generale's analysts, this is exactly the case. Societe says it is “very hard” to imagine a scenario in which Greece will default. This is why the Italian securities are in less prime position for investors than the Greek securities are. Risk aversion in Europe is focused like a laser beam on Italy.

Italy Has Played A Central Superpower and Financial Role Twice in History

It is no coincidence that Italy has carried the role of dominant world superpower on two different occasions. In the glory days of the Roman Empire, no one could oppose them. They dominated much of the entire world economically too. The second time Italy became a dominant global player was during the early centuries of the Renaissance. At that time, Venice, Florence, and Genoa became the economic superpowers of Europe. Sadly, on both occasions they ruined things for themselves.

It was the combination of too much runaway debt and frivolous spending, too many wars fought, excessive regulations, and finally too much debasing of the national currency. Regardless of how powerful your empire or nation may be, eventually such combined destructive forces will weaken the country to the point that it falls to its enemies. This always happens throughout ancient, Medieval, and modern history.

Italy's Past and Present Situations Are A Warning to America and Europe

No country in time has successfully run itself into intolerable debt levels, fought unlimited wars, spent like crazy, and ruined their currency's value without paying a terrible and ultimate price. It would be silly to assume that for once, this time will be different. This is exactly what is happening right now, today, all over the Western world. In Europe it is more pronounced. The whole continent is undergoing multiple existential challenges, all at once. Italy, Greece, and Spain are constantly dealing with their debt overhang and looming future banking crises.

And That Value in Greece is A Notable Exception to Many Failing Western Economic Models

Yvan Mamalet and Ciaran O' Hagan from Societe Generale penned a research note to the bank's clients about Greece and its long term economic prospects, with:

“There is long term value in Greece, especially when we get over the threats of risk aversion just now. GGB spreads should narrow relative to BTP's if the origin of the disturbance is in Italy.”

While Italy is teetering on the potential brink of fiscal and banking collapse, Greece is just finally exiting its third and final bailout package this very month. They will likely reveal Geek plans to return to credit markets next year in 2019. For the moment, investors can only participate in Greek bonds via syndication. This means that it is challenging at best to get out of the investments in a hurry if an unrelated shock should rock global markets. Turkey's sudden collapse in the value of the lira is one such example.

The data from the Bank of Greece revealed that the premiums on the national bonds versus the BTP's have become more narrow in the chaos that has plagued the Italian markets in the last several months. The current spread for five year bonds is at only one hundred basis points. This is the lowest point since the Global Financial Crisis.

But Are Italian Corporate Bonds Really Safer Than Italy's Government Debt?

The question remains regarding Italian government yields versus corporate bond yields in the country. Following the selloff in Italian sovereign debt this past week, fully 90 percent of the highest grade corporate bonds now garner a lower yield than the government's paper. Bank of America Merrill Lynch performed the analysis.

The present suffering for the Italian bondholders could be minor when measured against what would actually occur if the global credit ratings lower their opinion on the Italian sovereign debt. Societe Generale believes that the various investors will trample each other to get to the exits faster and harder as the government bond rating of Italy nears a junk level status This would create a vicious cycle where all conservatively minded investors eschewed the bonds from their investment holdings.

Italy has been put on warning notice. Moody's has held a negative view outlook on the country's sovereign debt now for over two years. It means that there could be a downgrade that materializes at practically any point in the coming months. A single downgrade from Baa2 to Baa3 would place the Italian government in the unenviable position of being only a single notch higher than junk. This would cause the present movements to be “very minor indeed” per Rates Strategist Keven Ferret for Societe Generale.

Gold Will Be Your Sword and Shield In Times of Geopolitical Crazy Around the Globe

What is bad for Europe is nearly always bad for the United States. A banking crisis that kicks off on the continent will make its way across the Atlantic with stunning speed. This is why you need gold to protect your retirement portfolio.

Now all you need to understand is the Top 5 Gold Coins for Investors. The time to start building up a precious metals position in these accounts is now, before Peak Gold makes the yellow metal non-affordable. You can buy gold in monthly installments to get started and even keep them in top offshore storage locations now.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum