- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

“Scoxit” Threat Returns As PM May Agrees to Another Scottish Referendum

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

Last Updated on: 10th November 2021, 01:23 am

Even as British Prime Minister Theresa May continues to wrestle with the challenges involved in invoking Article 50 to begin the two year Brexit divorce proceedings from the European Union, she is facing other mounting problems. This past week saw the Scottish independence referendum threat revived, sometimes referred to as “Scoxit.”

Meanwhile, in the U.S., President Donald Trump's administration turned its attention to a set of detailed blueprints for deporting millions of illegal immigrants in a series of moves that could see potentially most or even all of the 11 million illegals returned to their countries via Mexico.

In Europe, banking problems continued. The Royal Bank of Scotland Group announced earnings which showed its ninth consecutive annual loss. Even more job cuts are in the offing as the bank attempts to reinvent itself from former global banking titan to mere domestic British market lender. Credit Suisse also warned of developing revenue threats from Brexit. IRA approved gold is the best way to protect your retirement accounts from the various geopolitical and financial threats in the world today.

“Scoxit” Back On the Radar Again in the Not So United Kingdom

Just when you thought the question of Scottish independence had been “settled for this generation” to quote previous British Prime Minister David Cameron, the much-feared “Scoxit” threats are back. The regional Scottish nationalist government drafted up another bill for now a third vote on Scottish independence from the United Kingdom. Early polls are already suggesting it has a better chance for success than the last one held in September of 2014, which saw Scots vote 55 percent to 45 percent for remaining a part of the United Kingdom.

Most alarming about this announcement for the European and international community was the revelation this past week that the team of Prime Minister Theresa May is already working towards another Scottish national poll as they anticipate Scotland calling for the latest referendum during March. Unidentified British governmental sources claimed that May will agree to such another Scottish referendum vote for separation with one caveat. The Scottish poll must not take place until after the United Kingdom withdraws from the European Union.

What increases the chances of the Scots opting for a breakup of the more than 300 year old powerful union of England, Scotland, Wales, and Northern Ireland is the fact that over 62 percent of the Scottish regional vote went for remaining in the EU even as England voted overwhelmingly (outside of the capital London) to Brexit. At the same time, Scotland's economy has taken a series of major blows since the last poll in 2014.

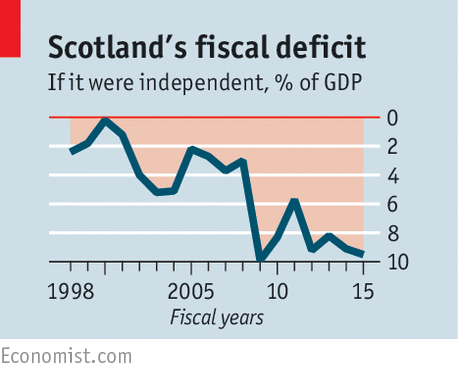

When the U.K. held the last referendum on Scottish independence, Scotland's growth equated with that of the remainder of Great Britain. It has since declined precipitously. Out of the last five quarters, it did not grow in two of them. This has caused Scotland's fiscal deficit (if it were independent) to crater, as this chart shows:

The main causes of the economic stagnation in Scotland come down to their dual reliance on energy production and banking. This nation of only five million counts on revenues from Brent North Sea crude to support its government spending needs. Back in 2014, the price for a single barrel of the Brent crude came in at $110. Based on these lofty prices, the nationalist government was able to project that Scotland once independent would realize hefty tax revenues from their share of $12.5 billion for 2015-2016.

The later crash of oil prices to $55 per barrel means that the government only saw a measly one percent of the rosy forecast. Besides this, the North Sea oil has entered terminal decline, which will only aggravate the problem. The first North Sea Oil rig has recently been closed.

Banking and finance was the other mainstay of the Scottish regional economy, and this also has taken a battering in the past few years. Thanks to the restructuring of banks including and especially RBS Group, Scotland has watched in dismay as 10 percent of all the financial jobs in the country disappeared. Adding insult to injury, London picked up some of these. The average pay in the British banking industry also declined by five percent last year. Between finance and energy exports, this amounted to as much as one-third of the GDP of Scotland previously.

These economic repercussions reverberate far beyond simply Scotland and the world's sixth largest economy by GDP the U.K. The EU common market is still impacted even though Brexit will go ahead as planned. London remains hands-down the financial center for the continent. A weakened, divided Great Britain would also have potentially negative military and diplomatic consequences for the defensive arrangements of Europe against a resurgent Russia and China because of a decline in the active British participation in both NATO and the United Nations.

Trump Administration Continues Plans for Sweeping Illegal Immigrant Deportations

President Donald Trump's administration has aggressively pursued a number of his “America First” campaign promises in its first month in office. Nowhere have the impacts of these policies been more dramatically felt than in his decision to rigorously enforce the existing immigration laws of the United States. This past week on Tuesday, his administration revealed their blueprint for a widespread expansion of the crackdown on the illegal immigrants living in the country.

The memos made it clear that the administration will quickly deport huge numbers of immigrants without giving them court hearings. They will also be targeting any migrant who has been charged with a crime or who is potentially considered to be dangerous, and not only convicts as under the lax immigration enforcement of the Obama administration.

Secretary John Kelly, head of the Homeland Security Department, wrote in the two memos which outlined the plan in detail:

The U.S. “no longer will exempt classes or categories of removable aliens from potential enforcement.” The immigration officers are instructed to deport those people without proper documentation who have practiced any form of either fraud or “willful misrepresentation in connection with any official matter before a governmental agency” or those who have “abused” any programs of government benefits besides only the criminals.

Secretary Kelly also announced the department is to hire on another 15,000 additional immigration agents and border control personnel. He ordered them to start building a wall on the border with Mexico in order to carry out the President's executive orders which Trump signed on January 25th.

The goal of the plan is to carry out the President's campaign promise to end the old Obama “catch and release” policy where caught illegal immigrants were released while they waited for multiple year deportation proceedings. The utilization of detention centers will be massively stepped up in order to temporarily hold the illegals which the immigration authorities catch.

The memos have continued to fan the flames of tension between Mexico and the United States. Secretary of State Rex Tillerson held meetings with his counterparts in Mexico this past week which were described as frosty at best. Mexico has recently warned its citizens who live in the U.S. to take necessary precautions regarding the new immigration policy of the administration. One Mexican Senator Zoe Robledo shared her concern with how these deportations will affect Mexico in her statement:

“This is an enormous mistake that Mexico shouldn't accept. If we suddenly have massive deportations into Mexico, we'd have a lot of pressure not only from our own population, but would be in charge of deporting others as well.”

Mexico has reason to be concerned about the possibility of this type of mass deportations. The Department of Homeland Security is contemplating utilizing a seldom-employed law in order to return any immigrants who came illegally through Mexico to the U.S. back to Mexico. This would be the case regardless of whether or not they are Mexican citizens.

RBS Bank Suffers Ninth Consecutive Annual Loss as Credit Suisse Warns About Hard Brexit

The largest taxpayer-owned bank in Great Britain is the Royal Bank of Scotland Group. After suffering their ninth devastating consecutive yearly loss in financial results reported this past week, they revealed plans to slash costs at the one-time global banking titan by another $2.5 billion through the coming four years.

The bank's loss expanded from last year's 1.98 billion British pounds to an eye-watering 6.96 billion pounds for 2016 according to the statement the Edinburg bank released this past Friday. The bank is still hoping for its first profits in fully ten years within fiscal year 2018. Meanwhile, it has lost over 58 billion pounds sterling over the course of the last nine years. This has only been aggravated recently by the mortgage-backed securities fraud investigation for which RBS has now put aside 3.8 billion pounds over recent weeks.

Looking at the bank now, it is hard to imagine that it once boasted over 2 trillion British pounds in balance sheet assets less than a decade ago. They have slashed their once-global staff from 170,000 workers to less than 80,000 now. Additional staff cuts have been promised by bank chief McEwan in tandem with the 2 billion pounds of cost cutting measures. They have already sold off valuable assets such as their large American consumer banking operation Citizens Financial Group Inc. McEwan warned:

“There will be job losses that we have to go through.” RBS will cut operational expenses through removing “people, property, lower technology costs in some areas. It will be across the board.”

Meanwhile Credit Suisse Group announced additional problems they see cropping up from the soon to be triggered, s0-called Hard Brexit. The CFO David Mathers announced that another 1,500 jobs will be cut in London this same year. Besides this, Credit Suisse Group will have to create other means of servicing its clients at their British subsidiaries once Britain withdraws from the European Union, per Mathers.

This is because their loss of access to the European markets would put up to $750 million in revenues from their U.K subsidiary at risk, representing 10 to 15 percent of the two units' total income. Mathers explained:

“In the event of a ‘hard Brexit,' with no passporting and no negotiated equivalent regime,' this would be “at risk. We are looking at options with the EU-27 nations to protect the service we offer to our clients in these countries.”

It is all part of the mounting evidence that you need gold which outperforms traditional asset classes during market crisis periods. Now more than ever, gold makes sense in an IRA.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum