- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

Major Russian Bank Bailout Demonstrates A Looming Systemic Banking Crisis is Imminent

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

Last Updated on: 4th September 2017, 01:04 pm

Last week, it emerged that it is not only the Italians, Spanish, and Portuguese in Europe whose banks are in obvious continuing trouble. The CBR Central Bank of Russia announced late on Tuesday that it now plans to rescue its seventh biggest bank by assets Otkritie. They revealed deep and abiding concerns surrounding the bank's loan portfolio. The suspicion is that where there's smoke, there's probably fire. Analysts are already wondering which other Russian bank will be the next to be proven insolvent.

This should be of grave concern for you with your investment and retirement portfolios. Banks are the life-blood and growth engines of any national economy. If the Russians are in trouble, then this will likely spread to other especially European and Asian banking systems in the near future. It is yet another threat to the global economy and worldwide financial systems.

Gold is your only historically proven best, last, and only line of defense. It protects against market crisis in times of financial trouble. This is why you need to look into IRA-Approved gold and the Top Five Gold Coins for Investors at your earliest convenience.

Russian Central Bank Reveals All Is Far From Well In the Russian Banking System

This was not just any ordinary bank rescue, per international news agencies. It represented one of the biggest all time bank rescues in the history of Russia and the now defunct forerunner to the county, the Soviet Union. It has already stirred up fears that another systemic crisis of the banking sector is looming just around the corner. Strategist Tim Ash of BlueBay Asset Management from London warned by email in a research note that:

“The problems at Bank Otkritie are, I think, raising more general concerns as to whether a larger and potentially systemic crisis is brewing in the Russian banking sector. It is notable in my view that the accelerated efforts by the CBR to clean up the Russian banking sector, with large number of bank closures already, has not seen noticeable stress across the broader banking sector.”

The truth is that the problems of this large Russian bank (and entire sector for that matter are not new). The Russian banking and finance authorities have been aware of the nation's banking system problems stemming from structural weakness for years now. They only put the central bank on the issue a few years ago back in 2014.

It was the substantial oil prices slump paired with the harsh international sanctions for annexing Crimea and destabilizing eastern Ukraine that combined to subject the Russian financial markets and banking system to vulnerability and extreme pressure.

The Too Big Too Fail Western Concept Comes to Russian Banking Models

Because a number of the shareholders of Otkritie Bank are well-connected with some of the major state entities, a range of analysts think that the bank is far too influential and large to be permitted to fail or go bankrupt. Of concern was the fact that the Russian Central Bank did not reveal the amount it is paying to clean up and wind down the bank in this bailout. It did state that it will take on at least a minimal stake amounting to 75 percent after contemplating the financial position of Otkritie Bank.

Previously the largest banking bailout in the history of Russia amounted to the 2011 Bank of Moscow rescue for $6.7 billion. This had been the fifth largest bank according to its assets in that day and age.

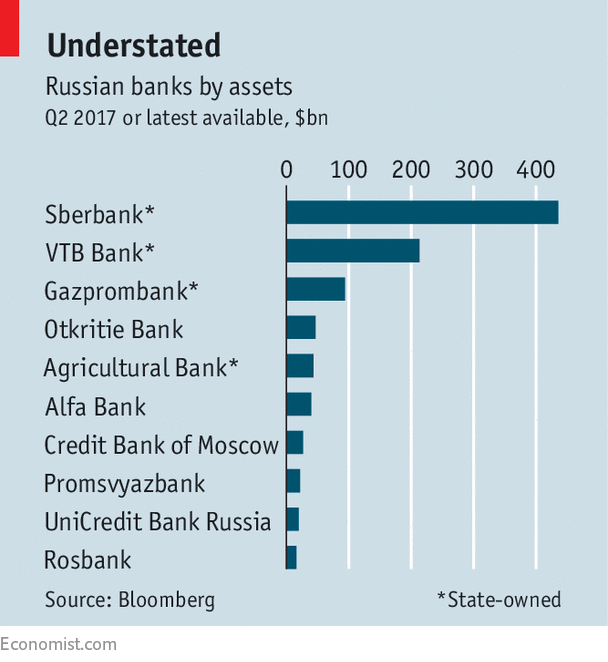

Meanwhile, the Otkritie Bank, which represented a piece of the larger and diversified Otkritie Group, was allowed to expand rapidly over the last few years. It gobbled up such rivals in the Russian banking world as Nomos, Lukoil's lucrative diamond business, and even insurers and non-pensions funds. This graph below shows how far Otkrtie Bank rose in the largest Russian bank rankings by assets:

Yet despite all of this seemingly positive financial and economic activity, the first deputy chairman of the central bank Dmitry Tulin revealed in a news briefing that at best the business practices in which Otkritie Bank engaged had proven to be questionable. The question has emerged as to whether or not other banking participants in Russia should be worried after news emerged on the in-progress Otkritie Bank bailout package.

CEO Gina Sanchez of Chantico Global revealed that this is a “very important” development in the Russian banking secotr that had not really been under the microscope previously. She shared her fears that:

“We are talking about a potential systemic bank failure.”

Newer Bank Players in the Sector Concerned

This bailout likely marks the end of the attempt of the newly upstart private lenders to help the state industries to sidestep international sanctions all the while competing with their former banking monopolies at the same time. This is because the central bank taking over Bank Otkritie means that their ambitious strategy of three years ago has failed.

The financial restrictions on such former monopolies as Sberbank PSJC that held around half of all Russian savings allowed for a rising batch of private lending outfits to step into the gap, helped in no small part by the cheaply provided state-offered financial backing.

It was actually a lower than expected credit rating from the bank's souring loan portfolio, coupled along with a rival's untimely failure, that kick started Otkritie Bank's untimely downfall. This caused an ultimate run on bank deposits which drained away $9.1 billion in critical customer deposits in the two months leading up to the central bank bailout announcement. Professor Anastasia Nesvetailova from the City University's Political Economy Research Center located in London stated in her email:

“It's no secret that many Russian private banks are ill-prepared to meet international standards of accounting, risk control, and even simple business strategy. Some of Otkritie's problems appear to be linked to the banks own strategy of acquiring a series of competitors, but they are merely a reflection fo the wider financial cutlure in the country.”

Yet these gambles had appeared to work out well for Otkritie Bank that managed to more than double its own assets all the while winning the envy and admiration of the Russian banking industry in the process. The bank's CEO Belyaev continued to aggressively pursue growth after this.

He obtained 127 billion Rubles funding from the Russian Central Bank in order to rescue the National Bank Trust, which proved to be the largest crisis victim at that point. Chief Operating Officer Tom Adshead of Macro Advisory in Moscow opined:

“Otkritie was a key player when things were going crazy in late 2014 and it was very cooperative post-crisis. But clearly it was a bit too aggressive.”

Potential Mess in Russian Banking System Argues for Obtaining Gold for Your Personal Financial Protection

This is only one of the many reasons that the price of gold has been shooting up lately. You should take careful note of the problems in the Russian banking sector, as they will likely spread both east and west. When the banking chips of sovereign nations are down, the lifeline to turn to with your own personal retirement portfolio is gold.

Gold will see your various portfolios through the financial crises regardless of which banks fail. This is because it is not a counter-party to any commercial banks in the world. It is all part of the reasons for why gold makes sense in an IRA. It also helps to explain why gold still glitters for many world leaders. Now is a good time to study your Gold IRA storage options.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum