- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

Recession Returns to First G7 Nation Since Sovereign Debt Crisis

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

Last Updated on: 4th February 2019, 01:50 pm

Economists have long debated which would be the first leading economy to fall into recession when the wild experiment with sub-zero interest rates and quantitative easing finally ended. As of this past week we officially know. Italy is the first G7 nation to fall back into recession since the end of the Sovereign Debt Crisis of 2012.

This does not at all mean that it will be the only leading economy affected though. Super economic engine Germany may be close behind it, and economists have said that the United States is not immune to the dangers and damage of the global economic slowdown and bear market in

stocks either. This is the time to circle the wagons and diversify a portion of your investment and retirement accounts into IRA-approved gold.

In the world we live in today, it is not hard to see why Gold makes sense in an IRA. You should start contemplating the Gold IRA rollover versus transfer rules and stipulations now before the economic malaise spreads any farther.

Italy Entered recession in the Final Quarter 2018

The year 2018 finished with an economic whimper in Italy. After a period of fiscal tensions with the European Union, escalating borrowing costs, and rising political turmoil, the Italian economy finally felt the brunt of the perfect storm in Rome.

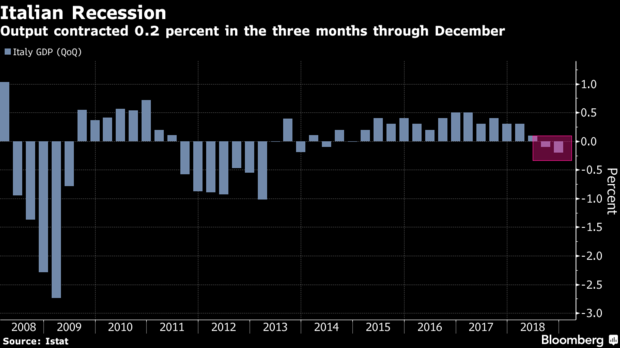

National output decreased by .2 percent for the final three months including December. This succeeded a .1 percent drop for the third quarter, according to the press release from Italian statistics organization Istat. This chart below from Istat reveals the plunge into recession territory in Italy:

The bad news had been anticipated, but it does pile still more pressure on the fragile Italian coalition still in its first year of government. Before last week's news, the squabbling two main parties in Rome already looked on the verge of unwinding.

Italian Premier Giuseppe Conte had forewarned the Italian people that he anticipated a fourth quarter decline in GDP. Yet even as Italy slumped into negative territory, other statistics revealed that the entire euro zone economy expanded by an anemic only .2 percent for the final three months of 2018. This was a slowdown from the first half of the year across the zone.

Investors Nervously Watch Italian Markets

So far, the markets' reactions to the new Italian recession

have been more or less muted. Thankfully the critical bell weather spread between German government bunds and Italian 10 year bond yields remained at 240 basis points. As anticipated, the Italian FTSE MIB stock market index declined for the day, by around .4 percent.

Regional investors had been carefully noting the economic impacts of months of tough negotiations between Rome and the European Union. At the heart of the matter was the Italian budget that did not meet earlier government's austerity levels and commitments. This had forced up Italian bond yields in the last few months of 2018.

It is anyone's guess how long or short this Italian recession will last. Anyway you look at it, the news is not positive for the government's fiscal spending program expansion set for this year in 2019.

Portfolio Manager James Athey of Aberdeen Standard Investments based in London warned on Italy:

“The growth forecasts on which the budget was based have already been blown out of the water and euro zone growth continues to weaken. Italy is going to have to face up to some real problems.”

The fourth quarter numbers came in worse than expected too. The median forecasts of economists had been for a .1 percent decline in GDP. Istat claimed that the disappointment resulted from a “market worsening” in industry. Services sectors also witnessed stagnation for the quarter. In the quarter a year prior, the Italian economy had grown by .1 percent in 2017.

Up till now, the present day coalition government leaders have taken turns squarely blaming the last government for the economic mess in the country. This government only assumed office back on June 1st. Deputy Premier Luigi Di Maio took to Facebook to insist that the prior governments led by the Democratic Party had “lied to us, never brought us out of the crisis.”

The previous two administrations' finance minister Pier Carlo Padoan refused to take the abuse without comment. He responded to the verbal attacks, saying that such unhelpful comments from Di Maio were both “disgraceful and ignorant.”

What Next For Italy, the EU and the G7 Nations?

Of course the big question is: What comes next for the G7 nations? The International Monetary Fund along with the Bank of Italy both are predicting a .6 percent Italian growth rate for 2018. This is better news, yet still under half the economic forecast for the total 19 country member euro zone.

Rome got some of what it wanted in the budget standoff anyway. In the revised government spending plan, there is a lower 2019 deficit target. The Italian government still can offer income support to the Italian poor and a lower retiring age for some of its workers as it promised in the campaign last year.

We may be talking about Italy this week, but Germany could very easily be the next to fall. As the Italian statistics miss and disappoint, the whole euro zone area is increasingly suffering from the worldwide economic slowdown. Germany argues its economy will still grow by a mere one percent for 2019. This will still be good for the slowest rate of growth in six years. This of course does not take into account the effects of an increasingly likely no-deal Brexit that could easily bring German exports to the United Kingdom to a grinding halt at the end of March next month.

A dramatic slowdown in U.K.-euro zone trade flows would hit Germany especially hard. The United Kingdom is Germany's largest auto export market. That one percent target growth in Germany could quickly be revised to negative very soon if a political breakthrough and solution is not quickly found to the worsening Brexit departure crisis, and soon. With under 55 days to go till Great Britain bids farewell to the European Union, time is quickly disappearing to stop the next outbreak of recession in G7 countries of the world.

In A World Of Increasing Geopolitical Chaos and Economic Threats, Gold Is Your Safest Line of Defense Today

These are not times to ignore the threatening geopolitical and economic headlines and just trust that institutions like the ECB and the Fed will make everything alright. In point of fact they are already demonstrating (as they have many times in the past) that they can not do this. You need a plan of action to defend the value of your retirement portfolio. Gold is your best direction to turn to for defensive posturing in uncertain economic and financial times.

You are lucky to be able to store gold in top offshore storage locations today. You can also focus on buying gold in monthly installments to build your way into a position in the yellow metal. Whatever you decide to do, you should not wait until the Italian recession spreads to other G7 countries. Look into Gold IRA allocation strategies ideas now while you still can.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum