- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

Prosper Review

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

Last Updated on: 25th March 2023, 12:16 am

Prosper

- Phone : 866-615-6319

- URL :

- Global Rating

- Good

User Rating

- 0 No reviews yet!

Review Summary :

This grandfather of the Peer to Peer Lending companies has made huge strides in improving its underwriting criteria. As an investment opportunity, it allows you to realize potentially high returns of in excess of 9% by backing loan notes that you can pick yourself.

Pros:

- You are not limited to investing in fixed increments of $25.

- Folio the secondary market for Prosper is liquid and effective at buying up your unwanted notes before maturity.

- Prosper is extremely transparent and lists out all of their both good and bad data.

- Prosper's platform proves to be simple for both investors and borrowers to utilize.

- Quick Invest makes it easy to come up with a full book of notes to fund.

Cons:

- While you are able to sell off your loan notes on Folio whenever you need to, you will quite possibly receive less than the amount you invested in the first place.

- Those living in North Dakota, Maine, and Iowa may neither invest nor borrow from Prosper.

- Ongoing concerns about the future of a legacy class action lawsuit that is unsettled.

- Any loans that default cost you most likely 100% of principal invested.

Quick Facts about Prosper

Reviewed By:David Crowder

Have you purchased products from Prosper? Leave a review!

Among the various peer to peer lending outfits in the U.S., Prosper.com turns out to be the very first one in the country. This lending company is not so much a bank as it is a matchmaking service. The organization matches individuals who wish to invest and loan out money to people who want to borrow money. Thanks to the interest rate that is lower for borrowers than they can find elsewhere and the higher rate of return that investors receive out of the deal, this match looks like one made in heaven.

Prosper Intro & Background

Prosper started out being like a charitable uncle who will loan out money to anyone based on the goodness of his heart. They were making loans to anyone who asked for one back in 2006, and this caught up with them so badly that for a time the SEC actually suspended their operations while the dust settled. Investors had lost money backing these personal unsecured loans. When it all had cleared, Prosper emerged as a healthier, better, stronger, and smarter peer to peer lender. They substantially tightened up the underwriting loan standards and turned the whole operation around substantially.

Fast forward to today, more than three years after Prosper totally revamped their lending process and started a clean slate with a new batch of loans. Now they have more than 2 million members and in excess of $5 billion worth of funded loans under their belt. Their last three years track record proves the revised underwriting standards have worked well. This last go round of loans have matured and demonstrated lower and reasonable default rates. The results are in, and they look good now. Prosper investors have received profitable returns on every category of loans with similar results to those solid results demonstrated by their arch-rival Lending Club.

How Prosper Works

The way that Prosper works is really pretty simple, and this is the part of its near-universal appeal. First borrowers sign up with new accounts at Prosper and indicate how much they would like to borrow. Next investors like you who want to loan out money review the available loans and decide which ones meet their own standards. This gives you a great deal of personal choice and control over your investment's ultimate fate. Finally, when you fund the loans, the borrowers receive the money then pay monthly agreed upon amounts which are then deposited back into the investors' accounts.

The loans themselves are actually unsecured notes. For you this means that much like with credit cards, they are not backed up by any kind of asset. The loan terms which borrowers can select, and from which you will have to choose the ones to fund as investor, are 1 year, 3 years, or 5 years long. The loan amounts range from as little as $2,000 to as high as $25,000. Borrowers and their notes are given ratings of from AA to A through E, to HR, or high risk. A higher letter means a greater risk for you as lender, and it gains you a better interest rate return. The rates that borrowers pay presently run from between 5.5% to 35.8%.

When you start to decide on your loans you will fund as investor, you will see an available pool of loans from which you can choose. These loans are fewer than the ones offered on Lending Club's site, and their notes on Prosper similarly come with a little greater risk and accompanying higher APR return. Research indicates that the loss rate is a bit higher than with Lending Club as well. This is not a negative assessment of Prosper as an investment, but merely an interesting observation. You need to be careful in choosing your loans. The silver lining in this higher APR offered is that you might gain a better return than with Lending Club commiserate with the additional risk you take. The important thing is that you are aware of the risks and are comfortable with them before you start investing your hard-earned money.

Prosper Services

- Quick Invest – We really like this handy feature that is perfect for you if you do not have the time to select your own loans. It is especially beneficial if you are investing over $100,000 in the platform loans, since it would take enormous amounts of time to sift through and pick up so many notes as that.

- Superior Searching Filters – Prosper has probably the best search engine and criteria choices among the Peer to Peer lenders to help you pinpoint the loans which exactly meet your personal criteria as a lender.

- Excellent and Precise Borrower Profile – They offer you an extremely detailed profile on each borrower. Once again this may be the best profile provided in the business.

- Fantastic and Liquid Secondary Market – Folio is the name of Prosper's secondary market. Here you are able to relatively easily unload any notes that you no longer want to hold, at a 1% of the loan face value service charge.

- Easier Diversification – Prosper tells you that it only requires that you buying into 100 notes at minimally $2,500 to achieve recommended diversification and reduce exposure to defaulting notes.

- Loan History Including Prior Customer Status – Prosper has been around long enough that many of their borrowers are now repeat customers who successfully paid off their prior obligations. The odds are statistically good that a person who had an account with Prosper that they paid off previously and maintained in good payment history is far less probable to default.

Prosper Locations

Prosper maintains one office in the San Francisco Bay Area. Their corporate headquarters is found at 221 Main Street, Suite 300 | San Francisco, CA 94105.

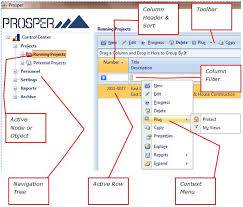

Prosper Interface Screenshots

Prosper Safety

Prosper's investment safety comes down to a number of considerations. For starters, they release a great deal of more loan data and history than their rivals do. Though past performance never indicates future returns with any investment, Prosper's results are comparable to their chief rivals.

It is good to be aware of the main risk, which is that the borrowers whose notes you hold could walk away from the loan payments in default. Since these loans are unsecured, you would probably not recover the principal in these instances. The firm does employ a collections agency that makes calls and attempts to recover part or a large percentage of your principal (minus the 30-40% collection agency fees). Prosper has other means that they recommend you utilize to reduce your personal exposure and risk to this primary concern of defaulting borrowers.

The first safeguard against default is to be careful to only take on notes of high-quality borrowers. They make this easier for you by reviewing the borrowers' credit histories and scores and then rating them officially for risk. A lower score means a higher amount of risk, but similarly equates to a greater return from a higher interest rate. You can reduce exposure to defaults by choosing to loan only to the better rated borrowers. You might also diversify into many different categories of note risk, spreading around your proverbial chips among the different note ratings.

The surest way to lower your default risk is to take on as many different notes as you can afford. Prosper claims that the investors who are most satisfied with their results and returns are the ones who invest in minimally 100 loans. That would cost you $2,500 investment at $25 minimum per loan. Even greater diversification would come with several hundred notes, though this would raise your minimum investment by $2,500 per 100 notes that you fund.

We feel that the most encouraging news about the safety of the Prosper Peer to Peer loans is that at the time of review writing at least, every one of the loan rating classes with Prosper are profitable, even after factoring in the defaulting notes. It tells you that Prosper's underwriting criteria are working well, and that their results are solid.

Prosper Complaints

The Better Business Bureau maintains an A+ rating on Prosper. They based this highest level of rating on their amount of time the business has existed, the numbers of complaints filed for a business of their size, and the response to and resolution of the complaints that were lodged against Prosper. Prosper had 139 complaints that they closed over the prior three years, of which 68 were closed out in the past 12 months.

Prosper Customer Support

Prosper actually takes care of most of the heavy lifting for your by servicing the loans of the notes you hold. If they go into default, they handle collections on your behalf. All of this is done at no extra charge. Besides this, the company has made advance arrangements against the unlikely possibility of the company going into bankruptcy. Their pre-made arrangement with a third party servicer means that the loans would continue to be paid and credited to your bank account even if Prosper no longer operated or even existed. Should you need to speak with the employees at Prosper, they offer support via phone and email.

Prosper Costs & Fees

Prosper is compensated based on the balance of the loans that you hold. This means that you as an investor will pay 1% of the balance on your invested notes annually. If a given borrower is paying you 8% each year in interest, then you will actually receive 7% after fees. Borrowers also pay loan-originating fees when their loans are funded with the money that you invest. This goes to Prosper, and not to you as an investor.

If you need to sell your loans in advance of their maturity date, you will pay a 1% fee of the loan face value in a transaction fee. This is done through Prosper's liquid and world-class secondary market Folio.

Final Words on Prosper

Prosper has come a long and impressive way from the early days of the wild west of Peer to Peer Lending that ended abruptly with the timely intervention of the SEC back in 2009. It is true that Lending Club brings in twice as many loan applications as does Prosper, but this does not mean that Lending Club is a superior platform. It has to do with the slightly riskier nature of the Prosper loan notes, which scare away some more conservative investors. Still, the fact that all of Prosper's note class categories are profitable speaks volumes about the viability of investing money with them. For those of you who are comfortable with a little higher risk and an accompanying higher rate of return, we believe that they are a solid choice for investing in the crowd funding market.

Prosper

- Phone : 866-615-6319

- URL :

- Global Rating

- Good

User Rating

- 0 No reviews yet!

Review Summary :

This grandfather of the Peer to Peer Lending companies has made huge strides in improving its underwriting criteria. As an investment opportunity, it allows you to realize potentially high returns of in excess of 9% by backing loan notes that you can pick yourself.

Have you purchased products from Prosper? Leave a review!

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum