- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

President Trump Mends Fences with Japan’s PM Abe as Brexit Moves Forward and Grexit Fears Return

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

Last Updated on: 25th December 2020, 06:12 am

President Trump proved this past week that he can be reasonable with long standing traditional allies of the United States by his warm and successful meetings with Japan's Prime Minister Shinzo Abe both in the capital Washington and on his Palm Beach golf course.

They talked strategic defensive alliances against Japanese regional rivals North Korea and China and opening up discussions on a bilateral free trade agreement deal modelled on the now defunct Trans-Pacific Partnership pan- Asian trade deal that President Trump cancelled as soon as he was inaugurated.

Meanwhile, across the pond in Britain, Prime Minister Theresa May scored critical moral victories for her upcoming triggering of Article 50 with the successful British Parliament approval votes. Despite the fact that the British economy has so far proven far more resilient than many analysts had predicted before and after Brexit, signs of weakness and damage to the British economy are starting to appear throughout the U.K.'s markets and projected growth data.

In a scary throwback to the Grexit fears of past several years, Greece entered into a dramatic war of words with its creditors regarding demands for yet more austerity. Greek relations with the International Monetary Fund particularly soured this past week and over the weekend as hard words came from Greek Prime Minister Alexis Tsipras. The global geopolitical news demonstrates why you should pay attention to this deep study which argues why and how gold makes sense in an IRA.

President Trump's Successful Meeting with Japan's PM Abe Raises Hopes for a Bilateral Free Trade Agreement with Japan

President Donald Trump concluded a highly successful series of meetings with long-time American ally Japan and its leader Prime Minister Shinzo Abe this past weekend. The meeting went so much better than analysts had projected that Trump spoke in glowing terms of his chemistry with Japan's Prime Minister after their two day visit which included holding hands, hugs, and even five solid hours on one of Trump's golf courses in Palm Beach, Florida.

Golf course diplomacy appears to be back in style, as Abe has invited U.S. Vice President Mike Pence to come play golf with the Japanese Finance Minister Taro Aso in Japan where they hope to flesh out the fine details of a new bilateral free trade agreement between Japan and the United States. The pair will discuss ways they can cooperate better on trade, cooperative projects, and monetary policy in the future.

Abe walked away from the meeting with several reasons to feel pleased. He received the fully committed backing of the traditional U.S.-Japanese military alliance from the President when North Korea test-fired another nuclear carrying-capable missile. Besides this, the agreement for the second tier leaders to take up the trade and other thorny issues between President Trump and Japan means that the two leaders' warming personal relations will not be soured by difficult negotiations going forward.

The way forward will not necessarily be easy though. President Trump has publicly lashed out at Japan both in the oval office and while campaigning. He does not approve of their currency manipulating policies nor their trade surplus they run with the United States, which is second only to the one China maintains.

The majority of the trade imbalance comes from Japanese auto exports to the United States. President Trump has called this scenario unfair as he pulled the U.S. out of the TPP Trans Pacific Partnership 12 country trade pact which required a number of years to work out and prepare for ratification.

Brexit Parliamentary Vote Means PM May Cleared for Beginning of Divorce Proceedings from EU as Markets Turn Bearish on the U.K.

This past week, the British Parliament voted in favor of Theresa May's Brexit triggering of Article 50 set to occur in March. While the proverbial champagne corks were popping in the House of Commons, all is not well financially as the two economic behemoths prepare for potentially two long and drawn out years of divorce proceedings.

There are many analysts who forecast that Brexit will not be so severe for Great Britain after all. Many of them claim that it will in fact harm the European Union more than it will the United kingdom. Yet other economists point out that the Brexit has already damaged Britain economically both now and for the foreseeable future.

This began with the drop in consensus forecasts of economists for British GDP. These estimates fell over 75 percent, down to a possible .5 percent for the year versus the previously expected 2.1 percent before the Brexit polls closed, per Bloomberg. These same economists similarly dropped their 2018 economic prognosis for the U.K. from 2.2 percent to 1.3 percent. Should such forecasts turn out to be true, the nation will then experience the second worst annual growth rate of all G20 nations (behind only Japan) as early as the final quarter of 2017.

The jobless rate in Britain is similarly predicted to rise from its eleven year low print of 4.9 percent in 2016 to around 5.2 percent for 2017 and then 5.5 percent for 2018 Bloomberg forecasts.

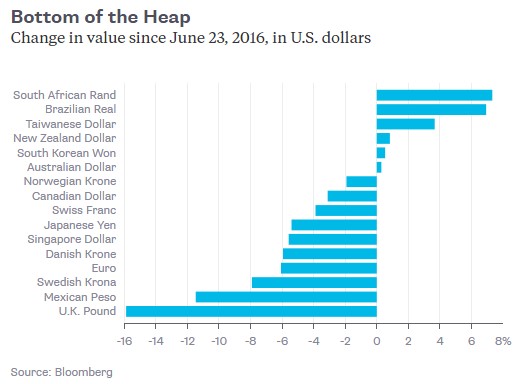

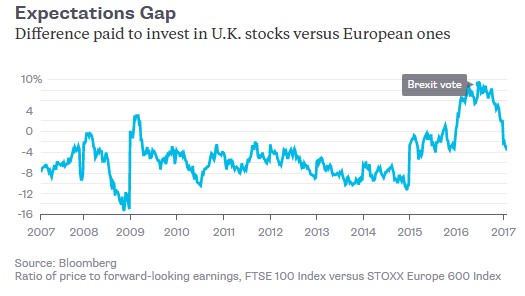

The chart above demonstrates how badly the British pound has been pounded by the Brexit. Bloomberg finds that the market expects pound sterling will rally up to 26 percent in the next few years to reach its high before the Brexit of over 1.50 between now and 2020. Still, as the chart below demonstrates, the difference which investors pay between British stocks and European ones has dropped from a nine percent premium for U.K. stocks before Brexit to an almost four percent discount to European ones now. By this measure, British stocks are on sale compared to their U.S. and European peers.

Grexit Fears Revived Again As Standoff With Creditors Turns Hostile

Friday saw an unusual meeting of the various Greek bailout creditors as the European Central Bank representatives sat down with the European Commission, the European Stability Mechanism, and the International Monetary Fund to insist that the Alexis Tsipras government of Greece pass laws to cut their fiscal spending by another two percent of GDP if the nation is unable to achieve the creditor-required budgetary targets.

Tsipras, notorious for his previous statement, “Not one penny more of austerity,” responded with harsh words in response to this surprise demand by the bailout auditors:

“The IMF doesn't have the courage of its convictions, is afraid to tell Europeans the truth, and is playing a perpetual poker game.”

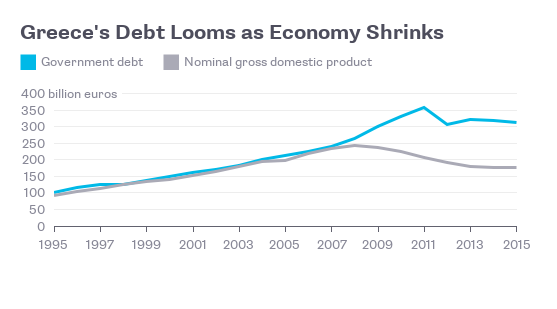

If the IMF drops out of the bailout auditing arrangement, then both Germany and the Netherlands have said they will shut down the Greek bailout program. Already it looks increasingly likely that the February 20 deadline for Greece to pass the review will be missed. There is much at stake as the chart below shows how much higher the Greek government debt is today than its national GDP output in a year.

If Greece can not strike the deal before the tumultuous and potentially populist-winning European election season gets underway this spring, the country will not be capable of paying back the nearly six billion euros in bonds that reach maturity in July. It once again raises the spectre of a much-feared Grexit potentially this summer even as Europeans are deciding the future of the EU in their various national elections. Director of Studies Janis Emmanouilidis of the European Policy Center in Brussels opined:

“There is a risk that the Greek government misreads key creditors such as Germany and the IMF and is too uncompromising on the reforms being demanded. In the worst case, this would make it unnecessary for the euro area and the IMF to bridge their differences and could revive the danger of Grexit.”

The turbulent world political and financial news these days all gives you plenty of reasons why gold still glitters for many nations and world leaders. Gold is the ultimate in diversification insurance for your retirement portfolio.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum