- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

Potential Marine Le Pen French Presidential Victory Threatens to Blow Up EU While Global Equities Make New Highs

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

Last Updated on: 21st February 2017, 09:18 am

In another fast-paced week, U.S. President Trump abandoned the decade long commitment to the two state solution in the elusive quest for peace between Israel and the Palestinians.

Investors eyes were mostly focused elsewhere though, as the rise of populist party candidate Marine Le Pen in France has become front page news. Commentators and analysts alike are growing concerned at her increasing chances of winning election and potentially even blowing up the Euro and entire European Union in the wake of her success.

One big data computer model already shows a Le Pen victory in French April and May elections as inevitable. The computer's investment fund firm is predicting her inevitable path to victory will not only upend the EU, but will lead to another global financial crisis.

Despite the continued troubling geopolitical news in the world and with a potential U.S. interest rate hike increasingly likely in March, global stocks somehow managed to defy the world headlines to notch new highs. This is not a time for you to be fooled by the markets and forget that gold makes sense in an IRA.

Investor Fears Shift to Potential for French Marine Le Pen to Blow Up EU and Euro

Last week saw markets finally take notice of the very real possibility and danger of French National Front candidate Marine Le Pen winning the presidency of France in upcoming elections to be held in April and May. Le Pen has been leading in opinion polls for some time, yet investors had managed to shrug this off and say that her support will wane or she will lose in the runoff election of only two candidates to be held in the second round.

Monday's once a day OpinionWay poll revealed that Le Pen has only become more popular since she officially launched her campaign a few weeks ago. Her first-round support increased by a percentage point up to 27 percent. Nearest rivals Macron and his Republican challenger Francois Fillon each stood with no change at 20 percent support apiece.

No official polls have yet to describe a victory for the two-person runoff in May, yet Le Pen is rapidly closing the gap on her two contending rivals. The OpinionWay survey predicted a Macron victory in a one-on-one match up which would supposedly give him 58 percent to her 42 percent. Yet this result means that his advantage has dropped by half in under two weeks.

Marine is growing ever more popular because of her harsh stance on the civil disturbances cropping up around France in the past week's generally peaceful protesting against a police brutality incident which has also seen cars set on fire again in Paris. She has successfully appealed to the unease of French voters who have witnessed over 200 tragic victims of terrorist attacks on the homeland in slightly more than two years. These fears rose to the surface once again as a machete-wielding Islamic assailant screaming “Allah Akbar” on the grounds of the Louvre was gunned down by a French soldier who fired off five shots at the would-be terrorist attacker.

Senior Economist Diego Iscaro of IHS Markit warned:

“Most polls suggest the Front National will lose the election. That said, polls have been wrong recently, so we have to take it with a pinch of salt. The spreads between the two [German and French bonds] are being driven by political risk from the election. If Le Pen wins, I would expect these spreads to increase dramatically.”

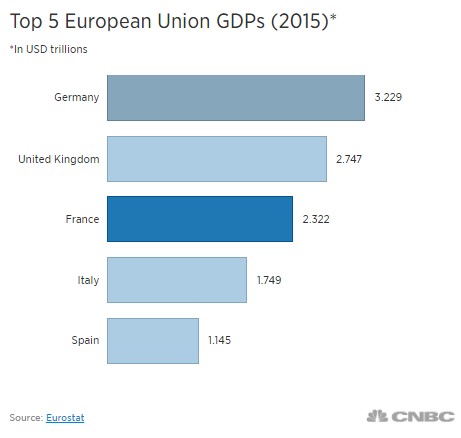

The gap between German and French 10 year sovereign debt climbed to more than .7 percentage points with French yields rising on the mounting financial markets' fears. France is the second biggest economy in the Eurozone and what remains of the European Union with Britain departing from the EU as this graph shows:

Chief Market Economist Peter Cardillo of First Standard Financial (based in New York) warned:

“If Le Pen wins, we're going to have a crisis within the euro. A major disruption would further lift the U.S. dollar.”

This unfolding story is yet another wake up call for global investors to protect your retirement portfolios since gold outperforms traditional asset classes during market crisis periods.

Computer Model Predicts Marine Le Pen Winning French Presidency in May

Populist Party National Front Leader Marine Le Pen has stirred up the nationalistic pot that first Britain's Brexit referendum and next America's President Trump election brought back to the world. Le Pen declared at one of her recent campaign rallies:

“What is at stake in this election…is whether France can still be a free nation. The divide is not between the left and the right any more but between patriots and globalists.”

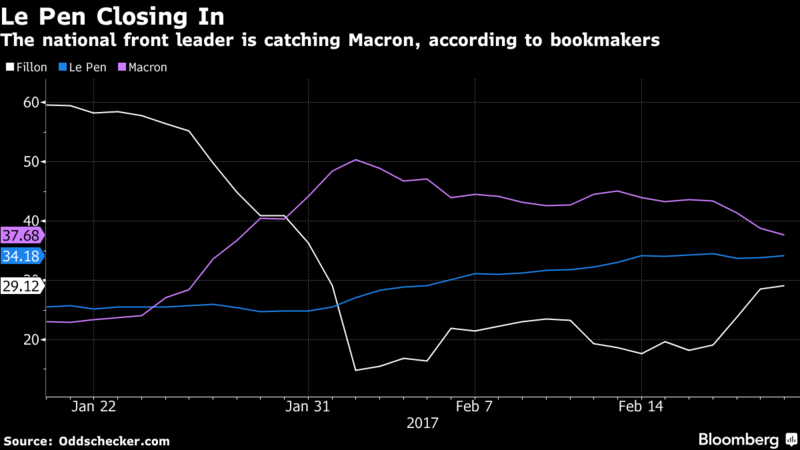

These fighting words no longer represent a long-shot chance of winning the French election and giving her the power to make good on her promise to withdraw France from the Euro single market currency after holding her own “Frexit” styled referendum. This chart shows how her odds of winning the election are rapidly growing:

The same type of big data AI machine that correctly predicted President Donald Trump's surprise election victory has just called the French presidential race for Marine Le Pen this past Thursday. Singapore-based Leonie Hill Capital's Chief Executive and Chief Investment Officer Arun Kant said he anticipates France's right-wing populist leader will win the ultimate race for the presidency of France based on his company's AI systemic analysis of hordes of campaign related data.

Included in the data which is eerily similar to the program that predicted Trump's victory in the U.S. last November election are data points covering polling, traditional and social media discussions, demographics, and economics. His computer program forecasts Le Pen will literally “walk over” her political rivals in the April 23rd first vote and then upset the analysts who have predicted her loss by pulling out a significant victory in the May 7th second vote.

Kant's computer program predicts Marine scoring 28 percent of the first round vote to Macron's 19 to 20 percent and Fillon's 16.4 percent. While the program currently shows the second round to be within the statistical margin of error of around four percentage points, Kant expects she will make significant headway with a first round victory and then ultimately triumph in the second round:

“If she wins the first round, this dynamic will change. With her predicted momentum, Le Pen will likely win the Presidency.”

Kant took his computer forecasts a step further with his analysis showing the only possible way Macron could defeat Le Pen is if some unknown and unanticipated factors were to pull the remaining undecided voters into his column. This matters hugely because Marine Le Pen shares many common policies with President Trump in her fierce opposition to free trade and open borders.

Her love of economic protectionism and nationalism explain the leader's vow to pull France entirely from the European Union. Kant believes that her inevitable victory will spell the European Union's beginning of the end. He forecasts massive currency fluctuations if this occurs, which may lead to a “worldwide financial crisis much sooner than anyone thinks.”

Global Stocks Notch New Record Highs as Yellen Threatens Interest Rate Hike in March

Despite the fact that U.S. Federal Reserve Chair Janet Yellen recently has hinted at her first rate hike of 2017 for as early as next month, global stocks are continuing to push on to new highs. The FTSE All-World index is comprised of over 7,000 different firms in 47 countries. Wednesday it reached 293.31 points and continued even higher the rest of the week. The Bank for International Settlements has been warning about high asset prices since the fall.

Per Reuters, this is the first time a record high in the index has been achieved since the conclusion of May in 2015. Naturally this is all the more possible with the irrational exuberance in the U.S. stock markets brought on by the Trump-quake boost of U.S. equities, which make up slightly over half of the index's weighting. This is yet another reason why IRA-approved gold makes more sense now than ever.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum