- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

MicroVentures Review

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

Last Updated on: 25th March 2023, 12:00 am

MicroVentures

- Phone : 1-800-283-9903

- URL :

- Global Rating

- Very Good

User Rating

- 0 No reviews yet!

Review Summary :

For private equity investments in business startups via a crowdfunding platform and concept, it is hard to beat MicroVentures. Among their incredible investment success stories are such legends as Facebook, Twitter, and Yelp. Their customer service and due diligence selection process are first-in-class.

Pros:

- Have discovered and crowdfunded such huge names as Facebook, Twitter, and Yelp.

- Thorough due diligence means that you do not have to personally vet investment opportunities on the platform.

- Customer service is a refreshing change from many of their crowdfunding competitors who lack transparency with customer contact information.

- Already work with non-accredited investors on certain investment opportunities.

- Provide an emergency option to sell out of startup investment via a quietly run and unadvertised secondary and private equity side market they maintain.

Cons:

- Many investments on the site are still mostly restricted to accredited investors until the news SEC rules unlimiting investors from these types of investments come into effect in early 2016.

- The company is clear that these investments should be regarded as 7 year long investments in which your capital is mostly illiquid.

Quick Facts about MicroVentures

Reviewed By:David Crowder

Have you purchased products from MicroVentures? Leave a review!

Investment banks are few and far between in the world of Peer to Peer Lending and crowdfunding. Microventures is such an unusual entity that combines the very best of both worlds, equity crowdfunding and venture capital. In fact, this company and platform proves to be among the very first such outfits ever that combined the crowdfunding and venture capitalism models. As such, they perform due diligence on business startups and after approving them, assist them in raising their startup capital from various angel investors who participate in the site.

MicroVentures Intro & Background

MicroVentures creation goes back to the year 2009. Since then, they have developed their platform for allowing accredited investors to have access to businesses and startup companies. So far, their platform has raised more than $80 million. In the past, these types of high risk-high return investments have been jealously protected by the banks and major Venture Capitalist companies. Thanks to the efforts of MicroVentures, you too can participate in these same kinds of deals, and much of the time with the same or similar advantageous terms that they enjoy.

MicroVentures counts an impressive 10,000 different investors among its platform participants. While investors like these know that there is a fair amount of risk involved with these types of investments, the rewards can be staggering. Consider that previous clients of the company and platform include such massive and highly successful operations today as Twitter, Facebook, Yelp, and Graphicly. Who would want to miss out on the chance to get in on the ground floor with these kinds of major and legendary names?

MicroVentures Founder and Management Team

The Founder and CEO Bill Clark used to manage a $1 billion portfolio of small business accounts. His experience in dealing with merchant accounts and risk management is the stuff of legends. It was his idea to make all of the company employees email addresses and phone numbers available to members of the platform to encourage accessibility and transparency.

Chief Technology Officer Jake Carlson began professionally creating and designing websites back in 2001. Since then, he has helped to create sites for government agencies around the world, multinational corporations, and individual startup companies. His technical and creative expertise has been showcased in roles as varied as working for HomeAway, Inc. and Apple.

Director Andrew Dude brings a tremendous experience with SaaS sales and financial services to the MicroVentures table. Before this, he worked with Marketo, UBS International the Swiss Banking giant, and Morgan Stanley in their Venture Capital and Private Equities Services division.

Deal Flow Manager Ernesto Paiz came to MicroVentures from his role at Ecosystem Ventures where he worked at the Venture Capital seeding stage company. There he served as the Investment Manager and successfully double the business' portfolio size. As such, Ernesto led the way with numerous ground-floor investments throughout foreign countries and the United States.

MicroVentures Loans

MicroVentures is fairly unique in that it does not handle loans for its business startups. It is helping you the investor to buy private equity investment shares in businesses that it vets and for which it prices their offerings.

How MicroVentures Works

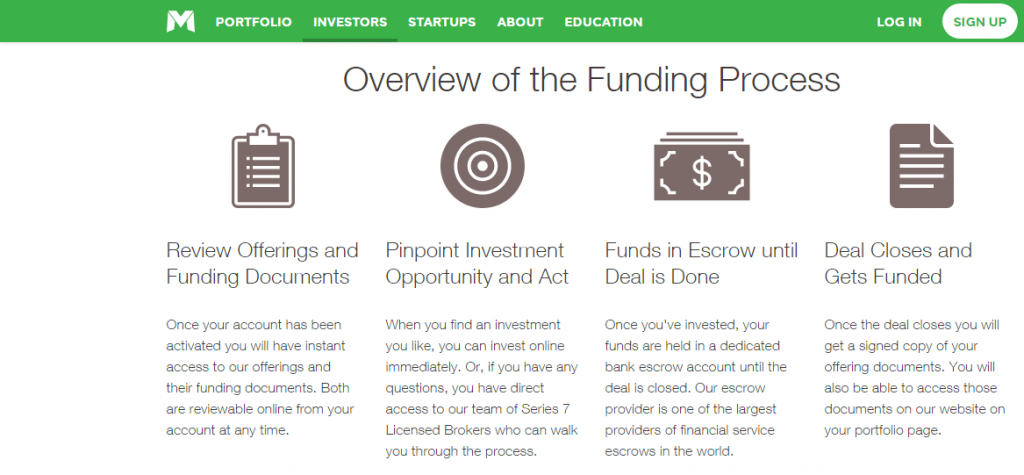

MicroVentures is big on reviewing, approving, and performing due diligence, and not just for its business startups seeking funding either. You as an investor can expect to be scrutinized and analyzed before you are given automatic approval to join the site and equity investment platform. Literally, you will have to apply and then be considered for your suitability and viability as an equity investors in venture capital types of deals in which MicroVentures specializes. As part of this, you can expect to be contacted for a mandatory verbal conversation after you fill in the accredited investor survey. Even after the accredited investor requirements drop off early in the year 2016, it is likely MicroVentures will still conduct such investor interviews to be certain that investors are aware of the risks in the investment for which they are signing up.

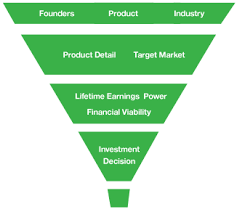

Companies are similarly examined under a microscope. As few as between 1% and 5% of the ones that make an application for funding are ever approved, making it easier to get into Harvard University (with an approximately 7% acceptance rate) than it is for a business to be accepted with MicroVentures. The company is actually on the hunt for companies that will be capable of turning a profit within one to three years.

There are competing equity crowdfunding sites who complete their funding process in shorter time frames than MicroVentures, which typically requires between eight and sixteen weeks to finish the process. The company is dealing in private equity shares that may not be sold in under a year, per SEC rules and regulations for these types of private share investments. Funds are held in escrow accounts until the funding deal closes, at which time they are transferred through the company's well regarded U.S. based bank.

The majority of companies applying for funding are seeking fairly significant investment dollars ranging from $100,000 to $500,000. This is why the company is so adamant about going through the expertise and experience of the founders and their corporate business plans. Businesses pay for certain fees such as due diligence and an application fee along with the 10% commission rate of funding they charge, for which MicroVentures handles all fees associated with funding documents and escrow services.

MicroVentures Services

We like the well-rounded assortment of services that MicroVentures provides to both investors and startup business with their platform.

• Private Market and Secondary Market Options – though unadvertised, the company does have and make available certain special opportunities for a secondary resale of investment market and private equity market.

• Vetting of Startups – MicroVentures invests a huge amount of efforts into pre-vetting their early stage business startups and the private equity secondary market business opportunities they provide.

• Data Provision – The platform investigates and obtains all relevant disclosure, funding, and business profile information and then makes all of this available to you via your personal dashboard and investment deal listings.

• Selectivity – While many equity platforms for crowdfunding work under the premise that any applying business is a good one, MicroVentures prides itself on selectively picking out only the best of opportunities in startup business investment.

• Due Diligence – Each firm that they offer investment opportunities in has undergone numerous rounds of professional careful analysis and due diligence review by their highly experienced team of financial people.

• Access – With the recently passed law about to change the ability of non-accredited investors to invest in these previously highly guarded investment opportunities, MicroVentures is one of the few crowdfunding companies that can claim to have already put together deals that permitted non-accredited investors to invest in companies alongside the Venture Capitalists on the platform.

• Education – the site features an impressive education section which includes articles, whitepapers, and case studies.

MicroVentures Locations

MicroVentures has two offices. The corporate headquarters is based in Austin and is found at 2905 San Gabriel Street

Suite 212, Austin, Texas 78705. They maintain a second office in the crowdfunding center of the country in San Francisco. It is found at 38 Keyes Avenue, Suite LL06, San Francisco, California 94129.

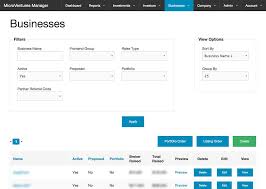

MicroVentures Interface Screenshots

MicroVentures Safety

The company is unusually concerned with its continuity of business operations. They have a plan in place to address every possible scenario for critical business disruption. MicroVentures maintains a designated backup facility that is far enough away from the main office to escape the effects of a disruption or destruction of their main office. They also keep both backup record books and backup client files, which are stored at secure off-company site facilities. They stand ready to replace their principal records with backup ones in the event of a catastrophic destruction of their office or company records and books. We like that they are so concerned with the potential problems their customers would experience if something unforeseen happened to the company headquarters, such as a fire, terrorist incident, or severe hacker attack.

MicroVentures pledges to never sell or disseminate your private or financial data as part of their company policy. Their privacy policy is rooted in their sincere commitment to protect all of your personal data and to maintain its confidentiality. To this end, they promise to never sell, lease, license, or disclose any of your personal data to any outside party for marketing purposes or for any other reason than the execution and operation of your investments with them.

MicroVentures Complaints and Ratings

Strangely enough, we did not find any ratings from the usual business ratings and review sites like Better Business Bureau or Yelp. This is especially odd since MicroVentures has been in business since 2009 (and actually provided startup funding for Yelp). On the other hand, we similarly did not turn up any noteworthy complaints on the company either.

MicroVentures Customer Support

MicroVentures is all about easily accessible customer support. We admire how they go above and beyond in this respect. It is not just that they give out their company phone number and customer service email. They also reveal each of their employees' phone numbers and emails so that clients, investors, and businesses alike may be assured of having any pressing concerns addressed. Their representatives are all Series 7 licensed individuals who are all well-experienced and legally permitted to field any number of questions regarding the investments that are made available on the platform. They also boast that their phone number actually works and one of their well-trained and licensed reps will cheerfully answer your call and talk about anything you need to discuss when you do. This gives MicroVentures the very best customer service and support that we have seen in any crowdfunding company that we have reviewed so far.

MicroVentures Costs & Fees

Investors do not pay anything to participate in the crowdfunding and Venture Capitalism opportunities for private equity investing on the platform. It is the businesses who pay dearly to keep the platform, due diligence, business operations, and customer service running well. Both completed and partial campaigns are subject to a steep 10% fee of all investment monies raised. There are also a number of transaction fees that businesses looking for funding pay once they apply, and regardless of whether or not they are among the under 5% of businesses accepted into the program or not. These include:

• $100 Application fees

• $250 Due Diligence fees

Final Words on MicroVentures

MicroVentures has come up with a successful and winning formula for crowdfunding via private equity investments in mostly business startups but also in secondary private equity offerings. We love that they handle the financial transaction side of the equation for you the investor, and all at no charge to you either. Between their due diligence and careful screening of business startup offerings, they really do present the best of the best opportunities to their investors as they claim. All this and you will not be disappointed by their world-class customer service either. Thanks to the big time names of clients who received their startup funding with MicroVentures, such as Facebook, Yelp, and Twitter, you can hardly afford to not check out this platform for at least a portion of your potential investment dollars.

MicroVentures

- Phone : 1-800-283-9903

- URL :

- Global Rating

- Very Good

User Rating

- 0 No reviews yet!

Review Summary :

For private equity investments in business startups via a crowdfunding platform and concept, it is hard to beat MicroVentures. Among their incredible investment success stories are such legends as Facebook, Twitter, and Yelp. Their customer service and due diligence selection process are first-in-class.

Have you purchased products from MicroVentures? Leave a review!

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum