- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

Massive Spending Bill Dangerously Raises Federal Debt Again

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

Last Friday saw Congress vote for a last minute compromise approval of an enormous spending bill. The new bill provides for $1.3 trillion in a budget that only ends the political wrangling until the fall when the two parties in Washington must do it all over again. The bad news is that the new measures will add another trillion to the already highest amount of debt in human history.

The government's obsession with spending money the country can not afford reminds you why you need to include IRA-approved metals in your investment and retirement portfolios. Eventually the debt level which the country can never afford to repay is going to create serious impacts on the economy and markets. This is another reason why gold makes sense in an IRA. Now is the time to consider some Gold IRA allocation strategies.

A Third Government Shutdown of the Year Avoided

Congress came dangerously close to a third government shutdown in only the first three months of the year. Fiscal conservatives fought hard to stop huge spending outlays on Democrat demands even as the Republicans claimed control of both houses of Congress and the presidency.

In the end, the Senate was able to pass the spending bill just after midnight on Friday morning. This had been a top priority for the two opposing political parties. Yet the comprehensive budget arrangement blows off the caps previously set on the budget. This has stirred up opposition for the next spending battle in the fall just before the midterm elections will take place.

The Final Spending Bill Had Bipartisan Support

In order for the bill to pass through fiscal conservative objections, it needed bipartisan support. This was more easily achieved in the House. Thursday, the House passed the spending measure with a comfortable majority of 256 to 167.

It proved how popular the huge spending compromises that fund government operations through the end of September were with the two parties. Both domestic and military priorities enjoy significantly greater spending in the new package.

The Senate had a more difficult time getting the bill approved. Fiscal conservatives attempted to block the measure for as long as possible. Kentucky Senator Rand Paul objected to the enormous 2,200 pages long bill that had only come out the night before the vote, with:

“Shame, shame. A pox on both Houses – and parties. No one has read it. Congress is broken.”

Eventually the opposition gave in to the will of the majority in the senate. When the voting had concluded, the spending package received approval of 65 to 32, also with bipartisan support. They two houses averted the third government shutdown of 2018 a day ahead of the midnight Friday government funding deadline. It has taken Congress five stopgap measures to keep the federal government funded in just this fiscal year.

Where Will the Additional Spending Be Allocated Now?

The bill on spending increased funds to both the domestic and military programs in the U.S. The military received an additional $80 billion while domestic programs gained another $63 billion. Both amounts were above the prior budgetary cap limits.

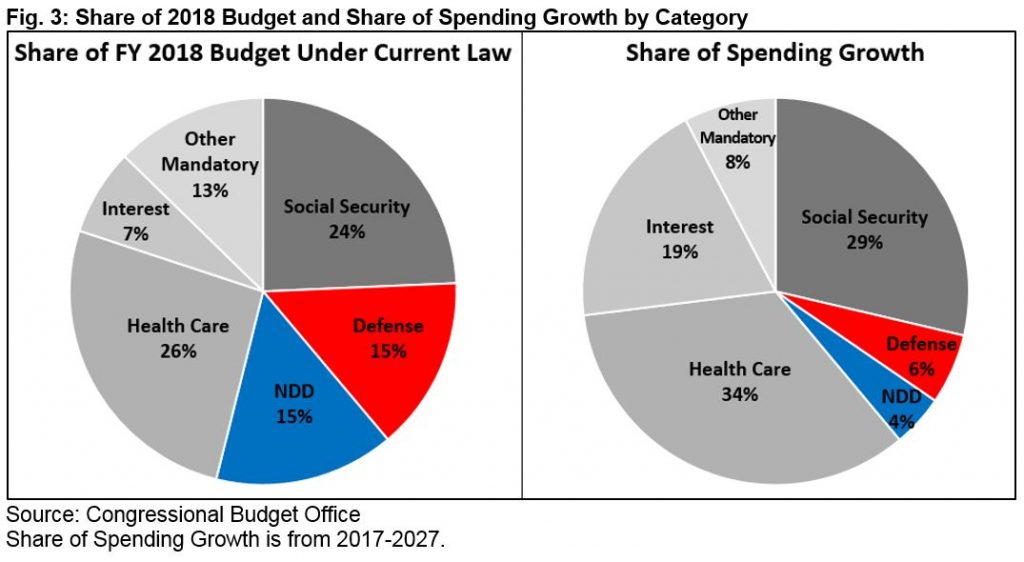

Included in this was $71 billion for the military as war funds that are not covered by the budget caps. Added to the prior $1.2 trillion budget that ended the February shutdown, this brought the total spending bill to roughly $1.3 trillion. This graph breaks down the categories where the budget will be spent:

The spending bill provided important victories to elements in both parties. President Donald Trump received his additional military funding and $1.6 billion towards beginning to construct the border wall with Mexico that he had promised in his campaign. Democrats could claim victory in funding for child care development, building roads, battling the national opioid epidemic, and more.

Omnibus Bill Became A Necessary Spending Compromise

In order to for the omnibus bill to gather the support it required, it had to be a compromise that both parties could support. Legislative Director Marc Short of the White House explained this result, with:

“I can't sit here and tell you and your viewers that we love everything in the bill. But we think that we got many of our priorities funded.”

Compromise across the aisle became necessary because Republican leaders could not get all of their financially conservative members on board with the bill. To encourage additional support for it, they concentrated their efforts on the military spending which factors in heavily to the Republican idea of national security. Despite this, a total of 90 Republicans in the House and 24 in the senate could not vote for it.

A great number of these members were part of the financial conservative movement called the House Freedom Caucus. They had stymied the governing leadership in their efforts to control the party. To try to win over wavering lawmakers, House Speaker Paul Ryan urged his members to:

“Vote yes for our military. Vote yes for the safety and the security of this country.”

Securing a compromise with bipartisan support became necessary because of this. The democrats were able to get additional spending measures built into the bill as a result. Chuck Schumer the Senate Minority Leader opined about the final compromise:

“We feel good. We produced a darn good bill.”

The bill comes at a significant financial cost to the country though.

One Result of the New Spending Bill Is A Trillion Dollars in New Deficits

The cost of the new spending bill along with the recent tax cuts amounts to more than a trillion dollars in new yearly deficits. This is something that conservative lawmakers had campaigned against in their promises to come up with balanced budgets through restrained spending.

President Trump himself was reluctant in supporting the bill. In the end he recognized that getting the needed Democrat support would require spending compromises. Georgia Senator David Perdue explained the president's thinking behind pushing the bill through:

“Obviously he doesn't like this process. It's dangerous to put it up to the 11th hour like this. The president, and our leadership, and the leadership in the House got together and said, Look, we don't like what the Democrats are doing, we got to fund the government.”

This is how you ended up with more unsustainable budgets put together and passed when so many lawmakers were against uncontrolled spending.

The U.S. Federal Debt Just Passed $21 Trillion

Even before the spending bill took effect, the U.S. Federal government debt touched an ominous new benchmark. It reached $21 trillion within the last week. This is the greatest amount of debt in the entire history of the world. It is all the more dangerous as it is greater than 100 percent of the annual U.S. economy. The debt service alone is consuming hundreds of billions from the budget in annual interest payments.

Gold is the answer to safeguard your portfolio when the government is spending far more than it takes in from tax revenues. Fortunately, it is easier to acquire and store the yellow metal now than ever before. Today you can even buy gold in monthly installments rather than in lump sum purchases.

The IRS has made Gold IRA storage options more flexible too. You are able to store your retirement gold in top offshore locations thanks to the changed rules. Now is the time to take measures to protect your retirement funds before the government's unsustainable runaway spending inevitably catches up with it.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum