- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

Mainstream sentiment for gold reaches new low

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

As commodity markets continue to sell off worldwide due to deteriorating global growth, many mainstream financial media outlets have been quick off the mark to highlight the ongoing “rout” in precious metals – with most of the mocking and jestful comments saved for the gold market and its advocates in particular. Some of the more disparaging headlines include “Let’s be honest about gold: It’s a pet rock” from the Wall Street Journal, “Gold is Doomed“ from the Washington Post, and “Gold is only going to get worse” from Bloomberg. In case you were in any doubt, these headlines ram home which way the conventional wall street wisdom believes the wind is blowing for the gold market. For the most part these headlines have a solid basis. Gold has certainly been under pressure in the past few weeks, falling nearly eight percent from its long term support level of $1200 / ounce which held for most of 2015, but seasoned players in the precious metals world know that volatility comes as part of the territory.

What most of the media outlets and analysts who are currently bashing gold fail to realize is that the current weakness in commodity markets could actually be an early warning signal of the turmoil which is about to be unleashed across ALL markets worldwide. Should the current slump in China turn out to be a full blown recession, the underlying structural factors in the world economy which are causing gold to fall could eventually be the very same factors which justify holding gold in the first place. It’s important to look beyond the current headlines of the mainstream financial press, and identify the potential path which the global economy is likely to travel down in the next six months in order to establish if the case for holding gold has changed.

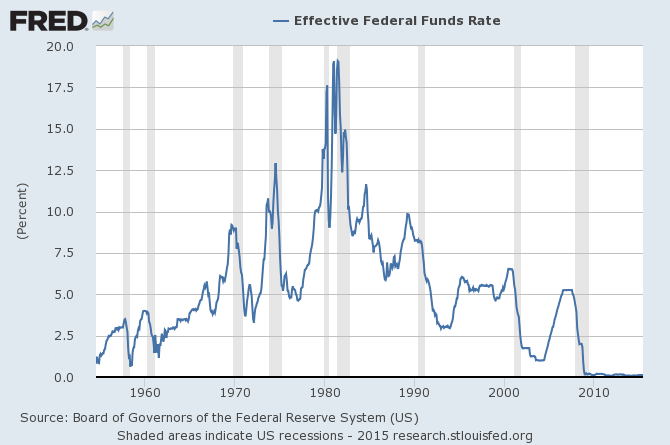

The Fed looks increasingly unlikely to raise rates

One of the biggest catalysts for gold’s decline in the past few months has been the market’s firm belief that the Federal Reserve will begin “normalizing” interest rates, diluting the appeal of gold for investors, with their first hike penciled in for March, then June, then September, now December. The Fed’s recent minutes from its July FOMC meeting in which rates were left unchanged for the 54th consecutive meeting were noncommittal on a rate rise in September. If September comes and goes without any move, then December would be the last possible opportunity in 2015. Under this scenario, the Fed would be raising rates when the vast majority of the global marketplace is on holiday – an unlikely environment for the first rate hike in nearly a decade.

Instead the Fed said it would not rule out the “possibility” of a rate hike in September, and would be monitoring employment and inflation data in the coming weeks to help them come to a suitable decision. The upcoming data, according to a recent report by Deutsche Bank, and rooted in common sense, is likely to be a grim one. In the report, the bank’s analysts forecast that the recent 29 percent drop in the CRB commodity index should translate to a year on year drop of nearly one percent in the headline CPI inflation data. Should the CPI reach even half of their forecast, it would send shivers down the spine of central banks and their centrally planned equity markets worldwide.

Gold's hedging properties remain intact

Where does this leave us? Well firstly, should deflation raise its ugly head again, it seems reasonable that we can forget any meaningful increase in interest rates in the near future. Under such conditions, the next major move by the Fed would likely be another round of QE! If QE4 is launched, stocks and other financial assets may experience some initial euphoria, but the longer term implications will be a complete loss of faith in the financial system and the credibility of central banks would be shattered. The sense of disillusionment such an environment would create is hard to imagine, but it's even harder to imagine the price of gold not being significantly north of where it is currently trading. Holders of gold have to ask themselves what has changed in the past year or two which justifies abandoning the need for insuring themselves against the eventuality that the central banking experiment which has been taking place since 2009 could start to fail. In reality, nothing has changed, and there is still a huge incentive to hold gold as part of a well diversified portfolio to preserve wealth against all potential market eventualities.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum