- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

Italy Is the New Greece and This Threatens Global Markets

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

Last Updated on: 14th October 2018, 10:26 pm

Last week you saw Italy go from a mild-mannered EU member state to a country practically at war with the rules, institutions, and even leaders of the European Union that it helped to found. In the tug of war that has gone on between the EU and Italy, the viability of Italian finances, budgets, and even sustainability have been heavily questioned. Italian government officials have taken a calloused attitude and even taunted the bond markets in the meanwhile.

Yet they are quick to deny that their ambitious and generous spending plans are putting Rome on the Greek path from 2010 that ultimately led to misery, suffering, and three separate long, drawn out bailout programs for the country of Greece. Italian, European, and world markets have been shaken by the news coming out of Europe this past week. Some analysts include it as a reason for the 800 point drop seen in the Dow Jones (DJIA) this past week.

It is a poignant reminder for why you must have IRA-approved precious metals in your portfolio. Gold makes sense in an IRA for the very reason that you can not begin to predict which major country will be the next one to blow itself up in the world we live in today. You should seriously start studying the top offshore storage locations for your IRA gold now while there is still time to roll over into an IRA-approved gold IRA.

Italy Is Increasingly Seen As Riskier Than Greece?

The government bonds of Italy have finally become viewed as higher risk investments than Greece over the last few months. Thanks to the one-two combination of the populist government's public spending goals and the Italian cabinet's anti-EU establishment position, Italy's bonds are actually approaching a level that is comparable to the Greek counterparts.

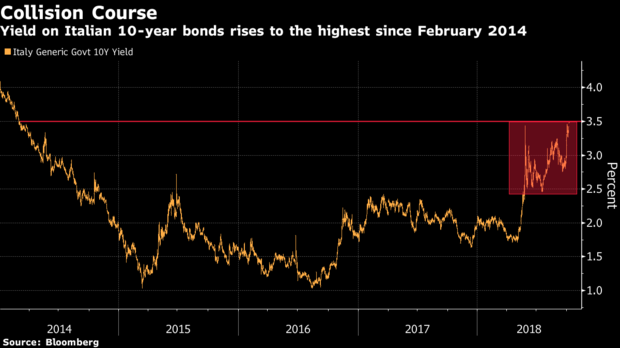

This last week saw an Italian national 10 year government bond at 3.58 percent. It amounted to the greatest level in more than five years. This is crucial because the interest rate on these government bonds reveals the investor perception of the government's paper investment. So when these yields march higher, it indicates that watching investors conclude a greater amount of risk comes along with that particular country's bonds. This explains why they then insist on a larger interest rate in exchange for their hard-earned euros.

When you compare today's Italian government 10 year bonds to those of other EU national states, Greece is the only one that boasts a higher yield. While Spain is at 1.59 percent and Portugal is at 1.95 percent, Greece is at 4.64 percent. Italy at 3.58 percent is not far behind Greece and considerably worse than Spain or even Portugal today. It tells you that investors perceive Italy along with Greece to be considerably higher risk countries than both Spain and Portugal.

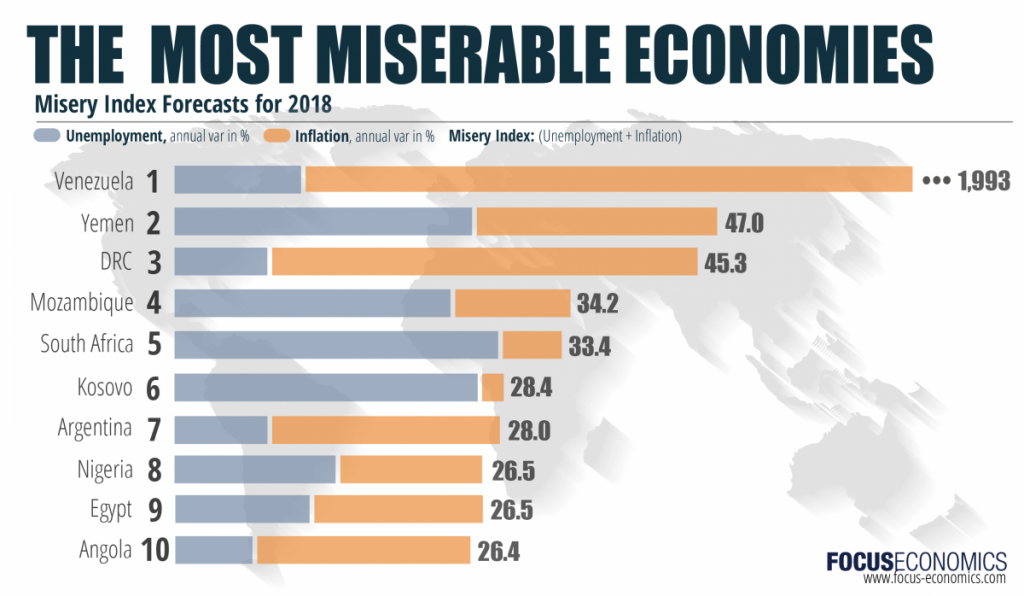

None of these four nations have yet made the list of the top ten most miserable economies in the world (for 2018) according to this chart below (populated by such sad cases as Venezuela, Yemen, and Argentina):

Who knows what the future holds in the increasingly geo-politically chaotic world in which we live though?

Populist Italian Government's New Spending Plans Spook International Investors…

What has really set off international investors of course is the still-new populist coalition government's ambitious plans to boost already sky high public spending over the next few years. The concern is real. Italian debt amounts to $2.6 trillion (or 2.3 trillion euros). Market participants are well aware that the newfound spending plans will hinder the Italian Republic from paying down its enormous pile of debt.

…And Also Enrage Brussels and the European Union

As if Italy and the EU bureaucrats did not have enough animosity brewing between them these days (over immigration and border control), now the budget plans from Rome have turned the normally placid Brussels' representatives into furious opponents. This reached an explosive new low in rhetoric last Monday when Deputy Prime Minister Matteo Salvini of Italy branded the Economic Affairs Commissioner and European Commission President alike as the enemies of Europe.

This was the angry Italian's response to the prior salvo from Brussels. The Friday before, the European Commission infuriated Rome by writing a letter criticizing their plans for spending. They called these a “significant deviation” off of the promises Italy had pledged to uphold in July.

Among other issues, Brussels pointed out that Italy had consented to reducing its structural deficit by a solid .6 percent GDP for next year. Instead the deficit will deteriorate by .8 percent GDP for 2019. Deputy Prime Minister Luigi Di Maio ignored these critiques, warning that his government's anti-establishment and -austerity views are only getting stronger around the European continent.

Unfortunately for Italy, they are on the losing end of the argument where markets are concerned. The Italian assets' declines only worsened following the escalating battle. It had been four years since the ten year bonds had increased over 3.5 percent, as this graphic below reveals:

Meanwhile stocks reached a near bear market in Rome in response to the European Commission's declaration that the Italian government's plans to increase the deficit are a breach of the EU common rules. It will all come to a head this next week as Italy must hand over its complete budget proposals to the European Commission on October 15th for “review” (which actually must be approved by the EC).

But the EU is not overly concerned about the Italians deviating too much from the rules and regulations. The Brussels' bureaucrats know all too well that ratings downgrades are likely in the cards for Rome. If anything can dent the resolve of the Italian populist government, it will be these Moody's Investors Service and S&P Global Ratings sovereign credit reviews that are due out near the end of October. Chief Analyst Jens Peter Sorensen of Danske Bank A/S explained it this way:

“The Italians are continuing to test the EU's resolve. If neither the EU or Italy back down, yields will continue to climb higher from here…”

Italian Government Declares War on the EU At Long Last

Needless to say, the increasingly cornered populist leaders Di Maio and Salvini are angry enough about the whole affair to start calling out their enemies by name. Salvini went all out with his declaration that the real enemies of Europe are the de facto leaders of the European Union that insist on open border policies and forced budgetary restrictions:

“We are against the enemies of Europe — Juncker and Moscovici — shut away in the Brussels bunker. The politics of austerity of the last few years have increased Italian debt and impoverished Italy.”

Those are desperate fighting words from Italian politicians who will not stand idly by while they lose face to out of touch EU leaders.

Italian Banks and Stocks Take A Beating

For signs that the Italian bond selloff is not over, you do not have to look any further than the open interest in the 10 year Italian bond futures. This has increased alongside the yields, per the October 4th latest data. It indicates that nervous investors are preparing to sell off the Italian sovereign debt (since aggressor sides in a trade record the open interest).

Meanwhile Italy's stock market declined for a third straight day. The FTSE-MIB shares index slid a stark 2.5 percent to touch the lowest point dating back to April of 2017. It only needed an additional 1.2 percent decline from this point to reach an official bear market in Italian stocks (20 percent decline).

Italian banks took it the hardest as before. Largest Italian mega bank UniCredit SpA had shares trading halted temporarily after crashing five percent. Banco BPM SpA plunged 5.6 percent.

Gold Is Your Ultimate Best Defense Against Financial Craziness from Italy and Around the World

Remember that Italian banking trouble is a serious contagion threat to not only continental European banks, but also to British and American mega banks. It is yet another timely reminder for why the only asset you can ultimately count on to protect and defend your retirement portfolio is gold. Now is the time to start looking at the Gold IRA rollover versus transfer procedures before it is too late.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum