- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

Italy In Political and Economic Chaos as President Rejects Proposed Populist Government

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

Last Updated on: 28th May 2018, 10:41 am

In a country which is no stranger to constantly falling governments (65 of them since World War II ended), this week's latest collapse could be a new world record. It took less than four days for the newly appointed Prime Minister Giuseppe Conte to resign in protest over Italian President Mattarella's rejection of his choice for Economics Minister Savona. The populist party dominated parliament is sure to block the president's technocratic alternative prime minister in coming days. This means that Italy is almost certainly headed back to general elections later this summer in an unlikely scenario that would become the first such in its modern history.

Markets have been swinging wildly on the chaotic news reports. It is precisely this sort of geopolitical chaos that insists you include gold in your investment and retirement portfolios alike. Gold makes sense in an IRA when the third largest economy in the Euro Zone elects an anti-EU establishment government which will likely emerge even stronger in parliament from a redo of the March national elections. It's time to learn about the Gold IRA rollover rules and regulations now while you still can get into the yellow metal at a reasonable price for the ultimate historically proven safe haven metal.

Wait, What Just Happened in Italy?

For the last several weeks the two leading populist parties the Five Star Movement and the Northern League had been working out the details of posts and positions in order to form Italy's first elected populist government. They managed to get their controversial Prime Minister Conte approved by President Mattarella last week. Yet when Conte submitted his list of names for the new ministerial appointments, the president refused to sign off on them over the one most controversial anti-EU Economics Minister appointee Savona.

Rather than simply nominate a different economics point man, the prime minister immediately announced that he could not form a government (thanks to the machinations of the German and French-controlled president of Italy). The country fell into political chaos rapidly as both the populist party leaders angrily attacked the president for bringing down their fledgling government over the German-bashing finance minister appointment.

Reactions from the two populist parties ranged from outright rage to real death threats against Mattarella. The Five Star Movement announced that it is considering trying the president for impeachment following the veto. Northern League head Matteo Salvini went one further by alluding to a shadowy pro-EU coupe that had taken control of the Italian presidency and subverted the will of the Italian electorate.

Salvini stopped just short of calling for new elections in his remarks. Italian newspaper Corriere della Sera joined others in anticipating that new elections might happen as quickly as September 9th. This is the first such time in modern Italy's history that a government could not be formed (or was blocked by the sitting president of Italy). Di Maio wrote conspiratorially on his Facebook page:

“Let's be clear then, what's the point of going to vote since governments are decided by the credit-rating agencies and the financial lobbies.”

Di Maio was referring to Friday's action by international credit ratings agency Moody's. They placed Italy's credit rating up for review on a potential downgrade. The argument was based on increasing risks to the country's fiscal position based on the radical government spending policies and programs proposed by Di Maio and Salvini.

The euro itself rallied over the weekend on the likelihood of Italy sidestepping a hard core populist government agenda that pledged itself to staunchly opposed the EU juggernaut. This is only a temporary respite though, as anyone paying close attention to the story ultimately realizes. The anti-EU League continues to gain support.

Recent polls hint strongly that the populist parties will only emerge stronger in a re-election repeat thanks to the chaos created by those opposing them. It threatens still more volatile European and bond markets in the coming months. This is the last thing struggling Italian markets, debt, banks, and businesses there need right now.

As for the aged President Mattarella, he is now the target of even death threats against his life. His argument that he is acting in the best interests of safeguarding the finances of families' savings (which increasing bond spreads had been steadily eroding) has fallen on mostly deaf ears. Italy's constitution nominally gives Mattarella the ultimate decision-making powers on whom the prime minister and his minister's will be. This is supposed to be a mere formality based on the choices of the parties or coalition with the largest bloc of parliamentary seats in both houses.

Credit Ratings Firms Running Italy?

Is there any truth in the accusation that the ratings companies and international pro-EU block in Brussels are actually dictating terms to Italy? The fact that the Italian president himself even cited the threatened downgrade to the national credit rating as his justification seems to indicate that there is some basis for Di Maio's charge that the credit ratings firms are actually the puppet masters of Italy. Di Maio squarely laid all blame for the government torpedoing at the door of Moody's and its cohorts in the credit ratings analyst business.

Meanwhile, not to be outflanked by his bitter arch-enemies, Mattarella called a favorite former Director of the IMF Carlo Cottarelli to see him in the presidential office today. Analysts expect that the president is trying to have this well-respected former IMF boss form an interim government to smooth out the uncertainties between now and any re-runs of the elections late summer.

Cottarelli is famously remembered as “Mr. Scissors” for his strident ideology on cutting public finances. The man had praise for some of the ideas of the populists at least, with his Bloomberg Television interview:

I like their proposals to fight corruption and bureaucracy as well as to speed up legal proceedings for civil justice. Other aspects though are “quite worrisome.” I can't countenance the idea that “if Italy has to grow more it probably needs higher deficits and that is going to be conflicting with the European rules as our deficit is supposed to decline, not just stay at the current level.”

Needless to say, Salvini and Di Maio will vigorously oppose his nomination. Since they have the votes between them in both houses of Italy's newly elected parliament, this will tip the country back into historically consecutive elections within a matter of several months.

Euro Currency and Italian Bond Markets Suffer from the Italian Political Chaos

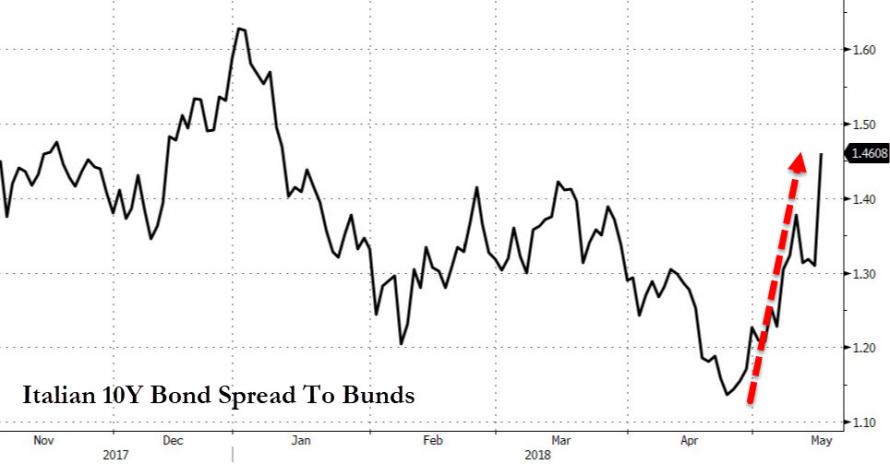

The euro has declined for the past six weeks in a row thanks to the political uncertainty in Italy. Friday saw the spread between Italy and German's 10 year bonds touch their widest point going back to 2014, as this chart below indicates:

Public Policy Lecturer of Rome's Luiss University Rosamaria Bitetti worried that:

“Mattarella's choice delays risk but may lead to stronger populist sentiment at the next elections, which is worrisome. People voted for these parties and it may be hard to explain to them why they can't have their government.”

Both Di Maio and Salvini were passionate about Savona as finance minister. They each pressed on the president to approve him in their individual consultations with Mattarella Sunday afternoon. Mattarella emerged from the two meetings with:

“I agreed to all the ministers except the finance minister. I asked for a figure who would mean not risking an exit from the euro. Now some political forces are asking me to hold elections. I will take decisions on the basis of how the situation evolves in parliament.”

Salvini was having none of the so-called presidential excuses. He wrote (on his own Facebook page over the weekend) for a call to another round of elections in Italy with:

“We worked for weeks, day and night, to ensure the birth of a government which defends the interest of Italian citizens. But someone (under pressure from whom?) said no to us. At this point, with the honesty, coherence, and courage of always, you must now have a say.”

Meanwhile the Five Star Movement leaders are also considering a constitutional clause that mandates the president is not responsible for actions performed by his office, excepting in cases of violating the constitution or high treason against the state. This might give them the ability to impeach President Mattarella and put an end to his political meddling once and for all.

Gold is the IRA-approved precious metal you most need to safeguard your hard-earned retirement funds. Thankfully you can now fall back on top offshore storage locations for your IRA gold. Consider stocking your IRA up with some IRA-approved gold now before things spiral any further out of control in Italy and the European Union in general. Too much is at stake for the global economy now for you to sit idly by.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum