- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

Has Inflation Finally Arrived?

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

Last Updated on: 25th December 2020, 06:35 am

One often-repeated claim, as I noted in “A Boiling Point… For Gold” and “Is the Conventional Wisdom Wrong About Gold?” is that gold (and other precious metals) likely won't rally because inflation remains subdued. However, recent data suggests that the latter may no longer apply.

It's no secret that the Federal Reserve, the European Central Bank, the Bank of Japan and other central banks around the world have been seeking to boost inflation in their domestic economies, but so far, it seems, their efforts have largely been unsuccessful. Earlier this month, for example, data confirmed that Japan, the world's fourth largest economy, is in recession for a fourth time since the global financial crisis erupted. Separately, a poll of Japanese retail investors found that “36.5 percent of the respondents…believed that [their] economy will slip back into deflation, up from 27 percent in a similar poll” taken in 2014.

Meanwhile, comments from Mario Draghi this past week that the institution “will do what’s necessary to reach its inflation goal rapidly” highlighted the fact that, as the ECB President noted, “inflation has already been low for some time.” According to Bloomberg, his comments “underline the ECB’s concern that the inflation rate in the 19-nation euro area, currently 0.1 percent, will slip further from its target of just under 2 percent amid a high degree of economic slack and slumping oil prices.”

Commodities have also remained under pressure, with Goldman Sachs, among others, warning that prices could fall further. Copper, widely viewed as a key barometer of economic activity, has recently tested six-year lows amid weak demand. In the wake of Saudi Arabia's efforts to maintain market share and drive out marginal U.S. producers, oil prices languish near multi-year lows of around $40 per barrel, showing few signs of a bottom.

The winds of change?

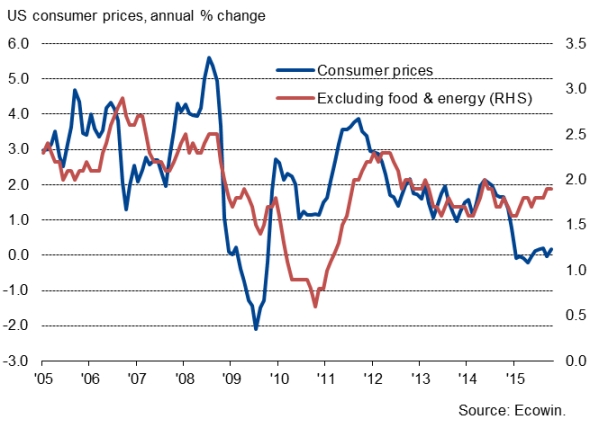

Things may be at an inflection point, however. For one thing, the October rise in the headline U.S. consumer price index, following the flat-year-on-year reading in September, was seen by some as evidence of a turnaround. As Markit's Chief Economist Chris noted, “core inflation, which strips out volatile energy and food prices, held steady at 1.9%, a level not seen since the middle of last year prior to September.” He added that “inflation should get a boost next year as the weak readings from late 2014 and this year drop out of the calculation.”

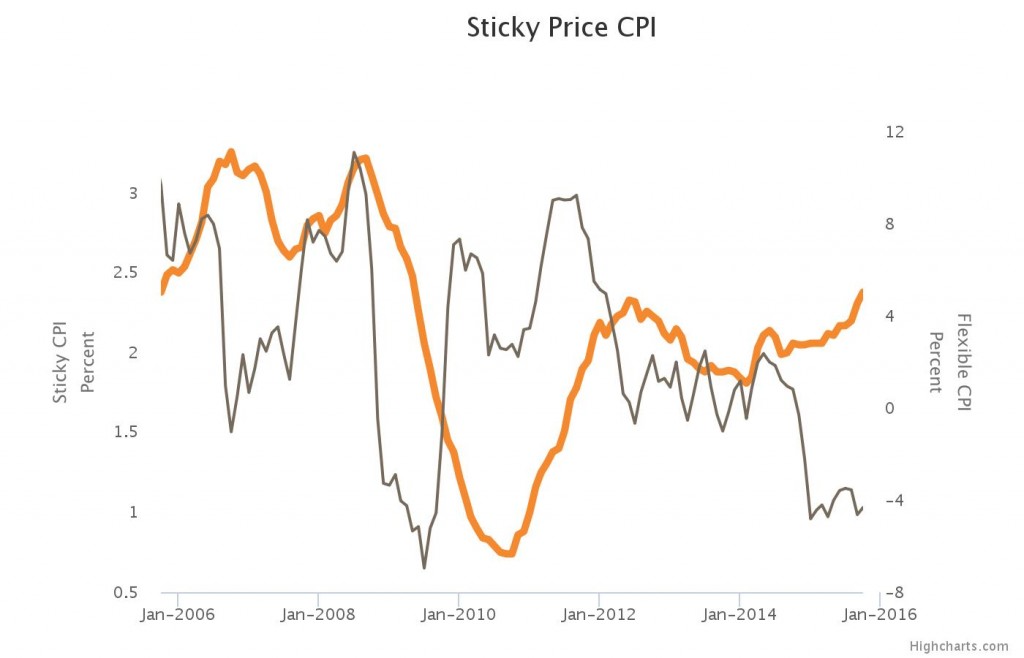

A more granular analysis of consumer prices reveals that prices which are relatively slow to change rose at an annualized rate of 3.3% in October, the fastest pace in more than five years. Published by the Federal Reserve Bank of Atlanta following each month's release of CPI data by the Bureau of Labor Statistics, the Sticky Price index tends to reflect trends that are expected to persist. In theory, it is a better gauge of future inflation than the mainstream release.

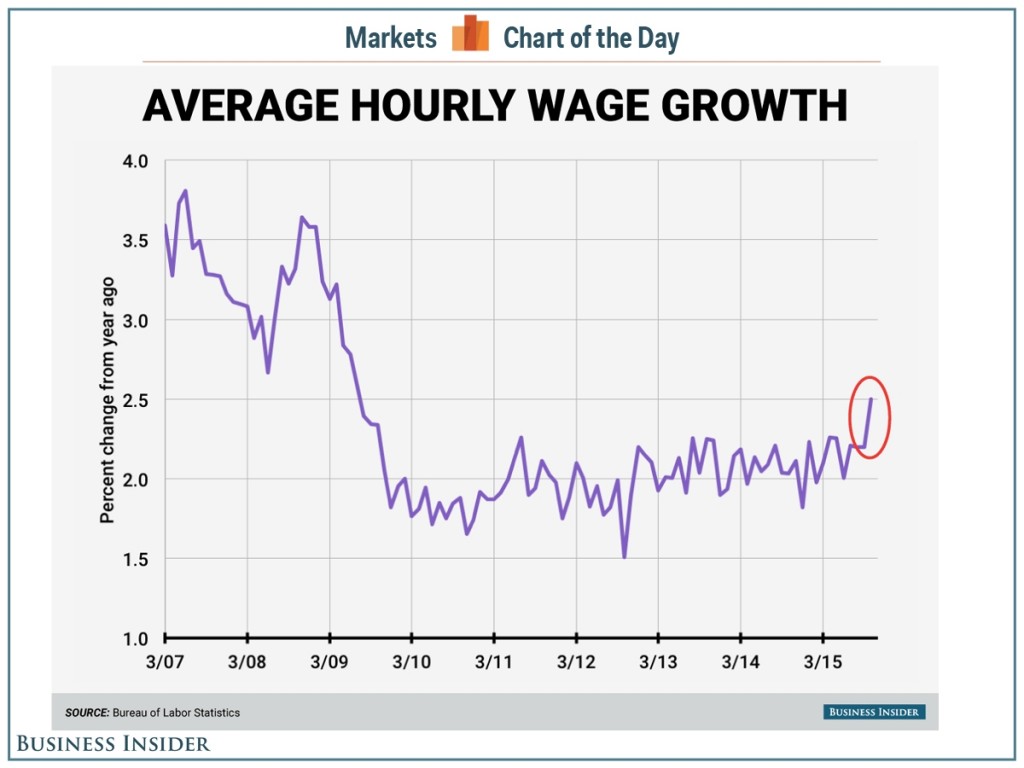

Just as notable, it appears that the long-anticipated rise in labor costs is also at hand. Aside from widely covered reports about fast food workers, airport employees, port workers and others going on strike or pressing for better pay and benefits, some data indicate that compensation rates are, in fact, moving up. In “Wage Growth Is Finally Happening,” Business Insider reported that “average hourly earnings grew 2.5% between October 2014 and October 2015, the highest growth rate we have seen since the Great Recession.”

Other data points to an uptick in inflationary expectations. On the heels of the U.S. CPI data, Treasury inflation-protected securities, or TIPS, break-even inflation rates rose to their highest levels since August, according to Reuters, while the appetite for the securities reportedly “intensified following solid investor demand at Thursday's $13 billion auction of 10-year TIPS” by the U.S. Treasury.

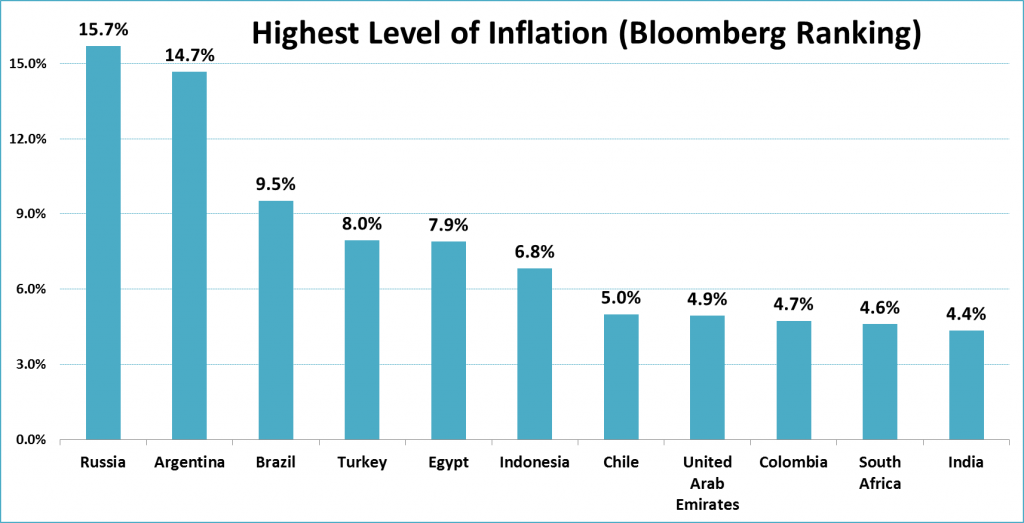

Already a problem for some

And, while inflation is not really apparent across the developing world, it is becoming problematic in a number of developing economies, which could eventually infect the mindset of billions of Internet-connected consumers. To be sure, reports that McDonald's is charging Venezuelan consumers the equivalent of $126 for a large order of french fries have grabbed the headlines, but as the following chart shows, the inflation rate is elevated in various countries, including Brazil, India and Russia, the world's seventh-, ninth- and tenth-largest economies.

Interestingly, a prospective fundamental catalyst could also alter the dynamic. By some accounts, this year's El Niño, a phenomenon that has in the past affected rainfall patterns in some parts of the world, “could be the biggest in recorded history,” potentially leading to droughts in South America and Australia that will drive up the cost of various agricultural products. While rising food prices don't necessarily translate into more generalized inflation, they could prove to be the straw that breaks the deflation camel's back.

Of course, it is always possible that the latest signs of a prospective liftoff in prices may go the way of previous false starts, leaving the recent uptick as little more than a blip.

But then again, maybe not.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum