- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

Gold Breaks Bear Trend As Fears Grow Of Stock Market Rout

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

Gold makes strong start to the year

Gold has put on a great rally since the beginning of the year after having reached a most recent low at the beginning of December last year. Since its close on December 31st it has risen nearly 14%. That doesn’t really come as a surprise. When most other assets have suffered, especially stocks, Gold has always taken the status of a safe haven asset.

Last year the Bear trend that started in 2012 seemed to protract even further, although at a slower rate. The greatest factor being the fear of imminent rate hikes that would further depress the value of holding Gold as bonds would begin to pay higher coupons. Another factor has been the supply and demand balance. Excess supply was created during the large rally that started with the financial crisis and took price to nearly reach $2000 an ounce. Supply adjustments however are slower at being reduced and were still being felt. The strongest factor that will turn Gold price around is ultimately increased demand. An increase in demand can happen for a variety of reasons, one of them is broad market stress and we may be running into such a period.

Fear of recession driving markets

It would seem that the fear factor of higher interest rates has given way to other more imminent fears. There are now concerns of a market fueled recession, this is a novel way of seeing how the relationship between the stock market and the economy works. The concept of this idea lies in human psychology and confidence for the future. Presumably the lack of confidence would come from a market sell off. Businesses need to decide whether to invest and hire according to their outlook for the future. When their view turns bleak, that is to say markets are in free fall; then everything gets put on hold with the consequence of reduced economic activity.

The stock markets have seen an overall decline since reaching an all-time high in May 2015. And they have done so with increasing bouts of volatility. The VIX index, also known as the fear gauge, has increased steadily over the past 3 months. Various factors have come into play with the fear of a hard landing for the Chinese economy and a general slowdown in the recovery of developed economies in Europe, leading to concerns of a global recession.

High Yield Corporate bonds have also declined in value sharply over the past year. The Bank of America US High Yield index shows that current yields at 9.87% have not been seen since October 2011. At that time the stock market had just completed 5 consecutive months of negative returns, and there were concerns of a double dip in the economy. Previously to that this level of High Yield bonds had been seen in May 2008, at the onset of the financial crisis. When investors perceive high levels of risk of a stock market rout it’s not only stocks that are sold. Any asset deemed risky gets the same treatment and High Yield bonds are no exception.

Russia, Venezuela, Qatar and the world’s largest oil producer agreed to freeze crude Oil supply to January levels. That gave crude oil price some relief as price rallied for both Brent and WTI, more recently the stock markets and crude oil have been showing signs of correlation. Reduced economic activity will lead to a reduced demand for petroleum products, putting further downward pressure on price. So a rally in crude oil prices is seen as giving stocks a boost, however the effect of the production freeze was short lived. Crude oil is trading below the highs reached yesterday after the news headline was released.

Speculators in Gold Futures maintain aggregated net long positions

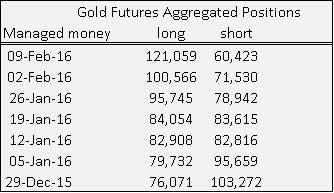

Commitment of traders from the CFTC has shown a big change from a large majority of short position in Gold futures to a large majority of long positions. The CFTC reports show this change has happened over the past 6 weeks. This change of data in commitments of course has also coincided with the worst start to the year in the history of the S&P 500 index.

I have taken a look at the positions for managed money, as it can be considered the speculative side to trading in futures. The table above shows the steady progression as Long positions grow to outnumber Short positions. The last week of December 2015 saw long positions with money managers totaled 76,071 lots, while short positions totaled 103,272 lots. By the week ending February 9th 2016 that relationship had been completely reversed, with 121,059 long positions, more than double the short positions of 60,423 lots.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum