- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

Fed Raises Interest Rates At Last and No One Cares As All Eyes On Italian Banks and Greece

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

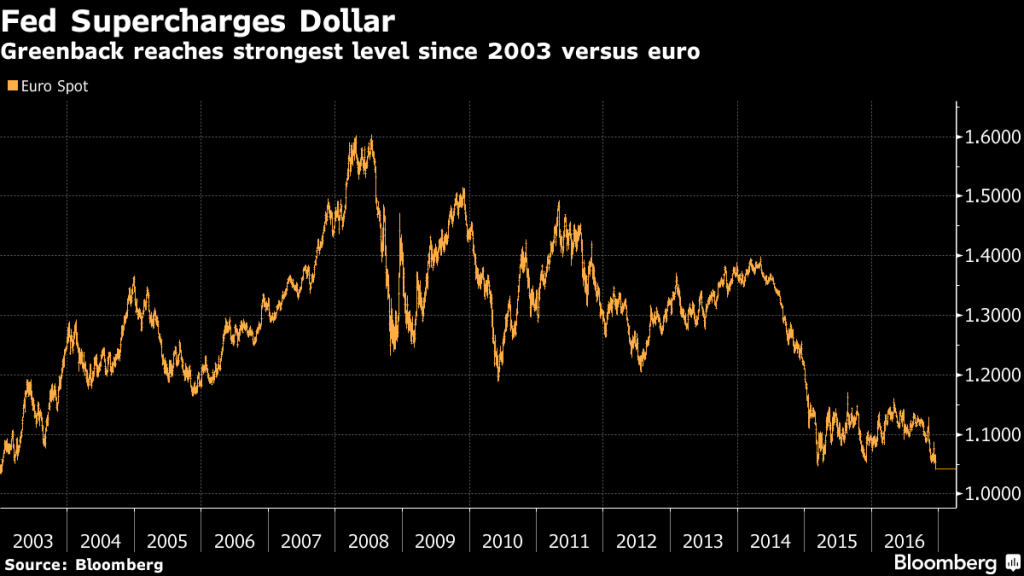

After a year long hiatus, and for only the second time in ten long years, the U.S. Federal Reserve managed to increase the benchmark interest rates by an underwhelming one-quarter of a percentage point. Markets had been anticipating this action for months upon end. Market participants took it in stride, hardly caring based on the muted reactions in most markets. One market that has been dramatically affected proved to be the currency markets, where the U.S. dollar is now moving rapidly towards its first time parity with the euro in more than 15 years. This past week, the problems in Greece with their never-ending economic malaise threatened to delay their lifeline of EU bailout package money. Italy defied the European Union and its strict bank bailout rules by hastily preparing a bailout for its three most troubled banks. Gold remains your best and only protection against the global geopolitical chaos threatening your retirement portfolio.

Fed Finally Raises Interest Rates and Markets Mostly Shrug It Off

The Fed long ago lost any credibility in its efforts to telegraph the eventual increase in interest rates. Markets were expecting the rate boost from last spring and finally received a paltry quarter of a point bump. Stock markets mostly shrugged it off as old news, but one market did take note and react. This was the currency markets where the U.S. dollar has been on a veritable tear against practically every other major currency pair. Nowhere was this more pronounced than versus the euro.

The dollar proceeded to rally like a freight train up to its highest point versus the single market currency since the year 2003. Gold similarly followed its sympathetic colleague the euro down by plunging on the concerns of a sharper rate increase path for U.S. interest levels in the coming months and year. Gold touched its 10 month old low in the process. Along in the wake of stronger U.S. interest rates, 10 year Treasury bond yields attained their loftiest levels in over two years.

The U.S. Federal Reserve and its long-delayed move into a hawkish stance proves to be a shift away from its peer major central banks of the world. The European Central Bank, Bank of England, and Bank of Japan are still all actively engaged in market loosening strategies in efforts to kickstart their faltering economic growth. The Bank of England maintained its current interest rate at all time lows on Thursday of this past week. The ECB itself had just extended its long-standing quantitative easing policies the week before last.

Greece Fighting With Creditors Again Over Next Bailout Funding Release

Greece was already on the ropes financially this Christmas as its economy remains mired in a nearly decade long recession. The government saw that it had exceeded some of its benchmark targets set by the hated triumvirate of creditors that keep its failing economy afloat and decided to provide the first Christmas bonuses to its 1.6 million pensioners in more than five long years. This enraged the European creditors who declared last Wednesday that they would suspend their short-term debt relief proposals because of the Greek government's charitable expenditures on Christmas time pension bonuses. The creditors called such a move unilateral and in deliberate disrespect of the 86 billion euros bailout program which they had agreed upon mutually. A European Stability Mechanism spokesman stated, “Following recent proposals by the Greek government to spend additional fiscal resources for pensions and VAT our governing bodies have put their decisions temporarily on hold.”

This has only increased the pressure on Greek bonds last week. The important ten year bond yield metric jumped by 35 basis points as a result of the European creditors' decision. Teneo Intelligence Co-President Wolfango Piccoli said, “If Greece's Prime MInister Tsipras goes ahead, this would further antagonize the Euro Zone creditors, putting at risk the promised short term debt relief. On the other side, giving in to the creditors' pressure would make Tsipras look amateurish at best, and at worst, further undermine his credibility and standing domestically.” Not too surprisingly, the embattled Greek ruling government party has witnessed a dramatic decline in popularity whileit has been forced to implement the popularly much-despised reforms of the nation's bailout program.

The news for Greece had been more positive as the European Commission demonstrated that the deficit in Greece would drop to lower than three percent for 2016. Athens would also best its agreed upon primary surplus target of .5 percent this year. This has not translated to relief for the vast majority of Greeks who continue to feel the economic squeeze on their jobs, livelihoods, and bank accounts. Nonetheless, the European Commissions representatives on the ground in Athens are not sympathetic. They have delayed approval of the next funds disbursement. The International Monetary Fund, waits for these stalled conclusions from the second bailout review in order to determine if it will contribute to the third Greek bailout program. They have recently declared their intentions to only help materially and technically if Greece obtains the substantial debt relief and lowered fiscal surplus targets its economy so desperately needs to pull out of the vicious downward spiral. One anonymous IMF official ominously declared that, “It is getting more and more difficult to see the IMF joining the latest Greek bailout program.” They are most upset by the fact that significant debt relief does not seem to be forthcoming from the combined alliance of stubborn Greek creditors.

Italy Seen Obstinately Defying EU Rules in Preparing Troubled Italian Bank Bailout Program

In the wake of the failed Monte Paschi Bank last ditched fundraising efforts, the Italian government has leaked that it is prepared to inject a hefty 15 billion euros capital into Monte dei Paschi as well as several other struggling banks. These sources reported this major development as the oldest and third largest Italian bank tries one last time to complete its ill-fated private rescue plans that are now widely anticipated to fail. Italy has been left with no practical alternative, since if the bank can not come up with the cash by December 31st, then the European Central Bank will wind it down and spark a massive banking crisis throughout Italy (and possibly the entire Euro Zone, by unfortunate extension). To prevent this from happening, Italy is prepared to step in on behalf of Monte Paschi and a few other of the smaller banks. Among these other banks which would benefit from the state-backed rescue fund are Veneto Banca and Banca Popolare di Vicenza, as well as potentially Banca Carige.

Italy has let it be known that it is prepared to decree this emergency relief on December 22, according to La Repubblica newspaper. The Italian banking sector has been weighed down with over 355 billion euros in soured loans. This staggering amount represents almost a third of the entire euro zone total bad debts. They are a painful legacy from the global financial crisis of 2007-2009 when Italy chose to leave their banks to manage the crisis on their own all the while Ireland and Spain were moving aggressively to assist their own respective banks.

As if this were not bad enough, it seems Italy's embarrassment about their ailing banking sector only continues to get worse. Its largest retail bank Intesa SanPaolo has just been fined $235 million by the financial regulator of New York for violating banking secrecy and money laundering laws. This puts Intesa in common foreign banking company including the likes of nearly every major Swiss Bank, Britain's HSBC and Barclays, and France's BNP Paribas, each of whom have been fined billions of dollars by New York in recent years. Never let the naysayers talk you out of your retirement hedging gold portfolio.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum