- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

Extreme Measures for Extreme Markets

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

Last Updated on: 25th December 2020, 06:55 am

Market instability and volatility is beginning to escalate all over the world. The ongoing uncertainty in Europe and market sell off in China are attracting the headlines at present, but both events are likely the first visible signs of a more systemic economic rut which has never properly healed since it first hit in 2008. Nearly every market in the world is showing signs of dysfunction. Crude oil, the lifeblood of the global economy, has fallen nearly fifty percent over the past two years, and is the clearest sign yet of just how strained the real economy has become, despite years of easy money policies from central banks.

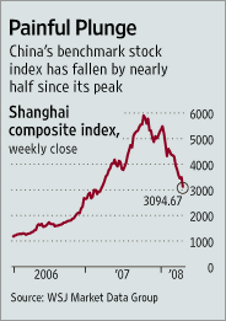

The broad rout in prices across the commodity complex has given some relief to individuals via falling gasoline prices and input costs for other goods, but these price declines have occurred largely on the back of falling demand worldwide. This fall in demand, especially in emerging market economies, is threatening to escalate into a full blown worldwide recession. Emerging markets have been an important engine of economic growth for the world economy since 2008, and any stress in these economies is likely to have a significant spill over effect into developed markets. In the meanwhile, all eyes are increasingly on China as fears grow of the potential contagion which could occur from ongoing weakness in the country’s stock market.

China Bans Selling of Stocks

Chinese authorities have been scrambling to avert the fallout from the ongoing rout in the country’s markets over the past two weeks, which have seen prices crash nearly thirty percent from their highs set earlier this year. Authorities seem increasingly concerned about the recent influx of retail investors who have been speculating on margin finance without adequate awareness of the risks associated with such investment strategies. The feel good factor which helped lure millions of housewives, taxi drivers, and farmers into the stock market in the first place, has been replaced by what the Chinese regulators describe as “irrationally driven panic sentiment” crash.

The feel good factor which helped lure millions of housewives, taxi drivers, and farmers into the stock market in the first place, has been replaced by what the Chinese regulators describe as “irrationally driven panic sentiment” crash.

In an attempt to shore up confidence, the government has implemented a series of rescue packages with limited success. Over the past three weeks, the government has cut reserve requirements and interest rates with the aim of boosting liquidity, loosened regulations on margin financing, reduced exchange fees, and extended direct credit lines to brokers with the aim of propping up the market. None of these measures have had the desired effect so far, which has led China to the next step – an outright ban on selling for state owned companies and “large” investors and criminal prosecution for foreign short sellers.

The ability of China to stem the stock market crash is important for the confidence of markets worldwide, and even more so for China’s neighboring countries. A slowdown in China could open up the next front in the ongoing global crisis. The Asia Pacific region depends heavily on Chinese demand for its goods and services, and is also extremely vulnerable to any currency gyrations which might occur as a result of China’s current wobble.

Emerging Market FX hang in the balance

Should China enter the global fray of QE in a big way as means of stimulating its domestic economy, Asian exchange rates would fall against the dollar in unison, placing real stress on corporates who have borrowed heavily in dollars since 2008. Such a scenario could trigger a potential repeat of the Asian financial crisis of the late 90s.

Greek Bank Closures and Withdrawal Restrictions

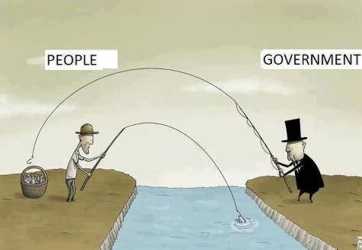

While market fears in China are weighing on confidence in the Asia pacific, Greece continues to undermine stability in Europe. Following the historic referendum last weekend, which saw an emphatic rejection of the bailout proposals on offer from the country’s creditors, Greece remains locked in limbo with the EU political process. Banks still remain closed, and cash from ATM machines has been rationed to a paltry sum, sparking large queues by pensioners and savers desperate to withdraw as much money from their accounts as possible. The turmoil in Greece and China have both negatively impacted individuals in a big way – the inability to sell stocks, and the inability to withdraw cash are both fundamental financial freedoms, which if removed, signal an urgent need for individuals to ensure their wealth is beyond the reach of adverse policy measures.

Individuals Need to Take Control of their own Finances

As market tensions, continue to escalate, it is becoming increasingly evident that individuals are the next targets for central bank and government institutions looking to shore up the flagging financial system.Bail Ins, stock market closures, restrictions of financial freedom, none of these measures should be present within a well functioning marketplace, and savers who are overly exposed to the system need to seriously evaluate the dangers of leaving their wealth at the mercy of increasingly desperate decision makers.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum