- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

European Banks Struggling to Recover as European Wealth Inequality Grows Worse

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

This past week saw more emerging proof that European continental banks continue to struggle beneath mountains of legacy bad debts. A household wealth survey also was released convincingly demonstrating that European citizens are now poorer than they were before the financial crisis, with wealth inequality continuing to spread on the common man's continent. U.S. regulators added insult to injury by settling for multi billion dollar fines with two mega European banks and announcing their lawsuit against one of the largest British-based global financial institutions Barclays Bank.

Three Charts Prove European Banks Continue To Struggle Financially

It has been over eight long years since the global financial system crashed into near-oblivion. In all of this time, the European banks kept struggling as if they were still trapped in a slow-motion train wreck. The bad news is that things soon may only become worse. The most recent threat to the banks of the troubled Eurozone comes from Italy's oldest and third largest bank Monte dei Paschi di Sienna. They are rapidly burning through their dwindling stockpiles of cash.

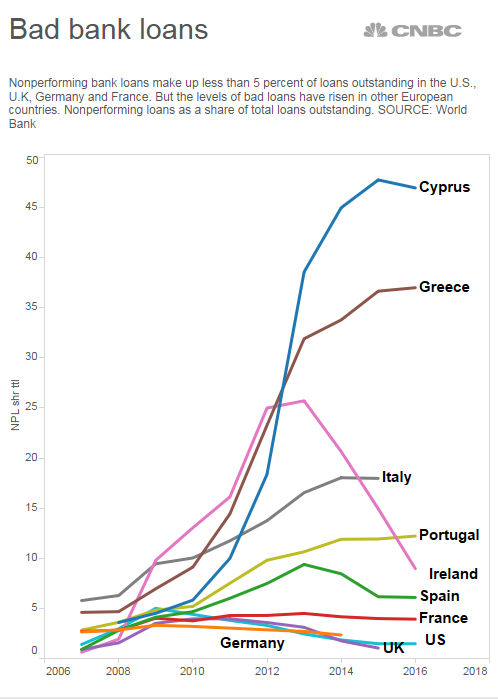

The bank revealed the full extent of its dire predicament this past Wednesday with the warning that if it does not receive a major cash infusion of fresh capital soon, it will become completely insolvent in four months or less. This compares to the once 11 months operating cash it was supposed to have. This is no idle threat from Monte Paschi. Their failure would do more than only destroy the savings of literally thousands of Italians. It would resound through the remainder of the troubled Italian banking system, one which is well known to be simply too big to fail. The segment boasts fully a third of all the loans gone bad within the Eurozone. The chart below shows part of the reason Italy's banks can not get ahead of their bad loans.

Even though the Italian parliament pushed through an emergency approval for a 20 billion Euro rescue fund this past week, the bailout will only provide the bank with more time. It will not reverse the trends that are steadily sapping away at the financial reserves of the once-mighty banks of the European continent, particularly those which are outside the more prosperous core nations of France and Germany. The increase of European banking problems and growth malaise has only boosted the popular anti-globalization movements based around the continent, such as Italy's poll-leading pro-nationalist Five Star Movement headed by former actor Beppe Grillo, who has promised to hold a referendum on continued euro membership if elected. Chief Economist of High Frequency Economics Carl Weinberg warned that “If Italy moves out of the eurozone and away from the European Union, the economic and financial implications will throw European economies into a depression.”

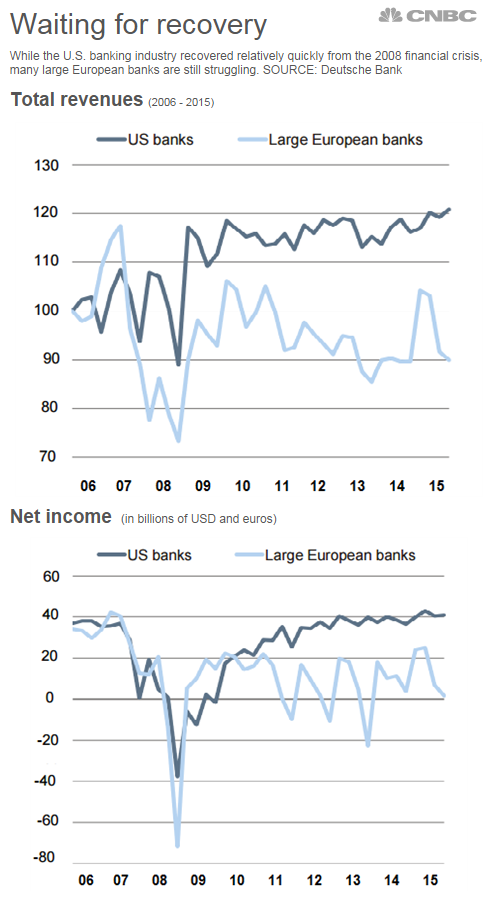

The continuing economic stagnation continues to fuel the financial angst of voters across the cultured continent. The bad debts remaining from the 2008 financial crisis continue to plague the books of many peripheral nations' banks to this day. A significant number of them now labor on under the weight of literally billions of euros in bad bank loans on which many analysts have now concluded they will never be able to collect repayment. This chart below shows that while U.S. banks have taken their hits and moved on, the major continental European banks are still struggling with debt-reducing lower revenues and profits:

The sluggish national economic growth rates pictured in the earlier graph above demonstrate why the demand for new loans has been severely hamstrung, weakening the profits of Eurozone-based banks. Thanks to the historically low and even negative European Central Bank championed interest rates, numerous corporations have found it much cheaper to borrow by issuing their own bonds on the capital markets instead of borrowing from the struggling banks.

It is these weaker profits that have made it so much more difficult for the European continental banks to increase their capital levels which they require in order to write off the soured debts. While the U.S. and its central bank the Federal Reserve begin to raise rates in a move which will help their own national banks, the European banks will have no choice but to keep struggling with lesser profit margins that lower rates practically guarantee them.

Inequality Spreading Through Europe Exacerbating the Problems and Tensions

A new survey of households in Europe demonstrates that consumer wealth dropped ten percent during the post-crisis years of 2010 to 2014. The European Central Bank-conducted and -released survey states that ten percent of eurozone area families now possess over half of the continent's vast wealth. Nearly every household fared worse by 2014 than in 2010 at the same time as a standard inequality measure increased by a slight measure.

This is more fuel for the populist party-led fire which is so angry about the growing wealth divide in a continent long characterized by greater equality than on the other continents and countries of the world. The average family in the Eurozone possessed 104,100 in net wealth by 2014, approximately a tenth less than in the year 2010. The wealthiest ten percent owned an average of 496,000 euros while the poorest five percent boasted a negative net wealth where their liabilities were more than their assets. The Gini coefficient inequality statistical measurement increased from 68 to 68.5, where 100 represents complete inequality. The workers which are self-employed are typically the richest, possessing median net assets amounting to 256,100 euros. Homeowners themselves commanded 226,700 euros without a mortgage and 144,300 with a mortgage. Renters in Europe proved to be the poorest ones with only 8,900 euros net wealth.

This all matters hugely as the coming year 2017 will see major elections in Germany, France, the Netherlands, Italy, and potentially Greece. With populist parties enjoying an unprecedented surge (and in some cases an outright lead) in popularity across the region, it will make for a tumultuous year in cliffhanger elections that could possibly see these anti-euro and -E.U. parties seize power in Italy, France, and the Netherlands. This all adds up to still more reasons to acquire some additional retirement gold holdings in 2017 as you can.

Deutsche Bank and Credit Suisse Settle with Anti-European Bank U.S. Regulators

It was a very merry Christmas for the U.S. regulators thanks to the news this past week that they had managed to effectively plunder the European banking cabal once again. Not content with attacking the London-based financial district over the past several years, the always jealous and greedy U.S.-based regulators are now getting their proverbial pound of flesh from the continent's banking leaders in settlements ranging from Deutsche Bank to Credit Suisse this past week. After months of wrangling and watching its stock price tank, largest German lender Deutsche Bank has finally settled on a mere $7.2 billion fine for its inappropriate toxic mortgage securities sales before the Great Recession and financial crisis kicked off stateside.

Swiss behemoth bank Credit Suisse has also consented in principle to pay the U.S. regulators $2.48 billion for their roles in the bad mortgage backed securities, per the spokesman for the Swiss banking giant last Friday. Credit Suisse will also pony up an additional $2.8 billion worth of “consumer relief” for American investors and victims during the period of the next five years it revealed. This brings the total settlement from Credit Suisse to $5.28 billion. Apparently unsatisfied with their bloated anti-European bank settlements, the Justice Department has announced last Thursday that it is going head to head with British global banking giant Barclays in the coming year for similar complaints. With the European consumer and banking problems unlikely to simply go away anytime soon, you should not let anyone talk you out of your hedging retirement gold holdings now or ever.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum