- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

The Entrust Group Review: Can You Trust This IRA Provider?

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

The Entrust Group

- Phone : 1-800-392-9653

- URL :

- Global Rating

- Very Good

User Rating

- 0 No reviews yet!

Review Summary :

The Entrust Group proves to be a well-regarded account administrator for tax-advantaged plans and self-directed retirement accounts. They boast more than four decades of experience in the industry, as well as around $4 billion in assets under administration. Entrust Group currently services 45,000 clients across the nation. A key selling point is that they offer more traditional office locations than any of their rivals in the self-directed IRA administration and custodian business. From these branches, they deliver plans for both individuals and businesses.

Pros:

- The company has over four decades of experience in the retirement plan business

- Their assets under administration are around $4 billion, making them a large and well-regarded operation

- The company boasts more physical branch locations than any of their rivals

- They deliver retirement plans for both individuals and businesses, including Roth IRAs, SEP IRA's, and Simple IRAs

Cons:

- The company's $150 yearly record keeping charge does not cover any storage or depository costs

- Clients must arrange their own storage option as the firm does not partner with depositories

Quick Facts about The Entrust Group

Year Founded:1981

Reviewed By:Wesley Crowder

Published On:December 29, 2022

Have you purchased products from The Entrust Group? Leave a review!

The Entrust Group (www.theentrustgroup.com/) is a well-regarded account administrator for tax-advantaged plans and self-directed retirement accounts. They boast more than four decades of experience in the industry, as well as around $4 billion in assets under administration. Entrust Group currently services 45,000 clients across the nation. A key selling point is that they offer more traditional office locations than any of their rivals in the self-directed IRA administration and custodian business. From these branches, they deliver plans for both individuals and businesses.

Note that as of February 2023, Entrust Group has enhanced payment features and security measures for clients. Entrust Group now utilizes Stripe for online payment processing, with Apple Pay and Google Pay integration slated for later this year.

Table of Contents

- The Entrust Group Management

- The Entrust Group's Prices and Products

- The Entrust Group Ratings & Complaints

- The Entrust Group's Contact Details

- Always Review the Competition Before You Buy

- Contact Us if You Own or Represent The Entrust Group

- How We Rank IRA Custodians

- Why Equity Institutional is One of the Top-Ranked IRA Custodians in 2024

- Next Step

The Entrust Group Management

The company's Founder and CEO is Hubert Bromma, a pioneer in the field of self-directed IRAs with nearly 5 decades of experience in the financial industry. Mr. Bromma's expertise includes banking, real estate, alternative investments, financial institution consulting, and mergers and acquisitions. Hubert Bromma started Entrust Group in 1981, and has built the company into a nationwide enterprise. In fact, this custodian has 30 walk-in offices throughout the country.

Hubert Bromma – Founder and CEO The Entrust Group

The company's president is Jason Craig, former Assistant Vice President at Greater Bay Bank. Mr. Craig has nearly 15 years experience in the financial services field. To learn more about The Entrust Group's Management, see The Entrust Group Team page.

The Entrust Group's Prices and Products

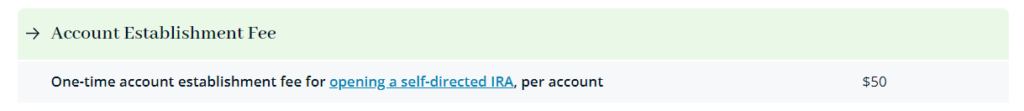

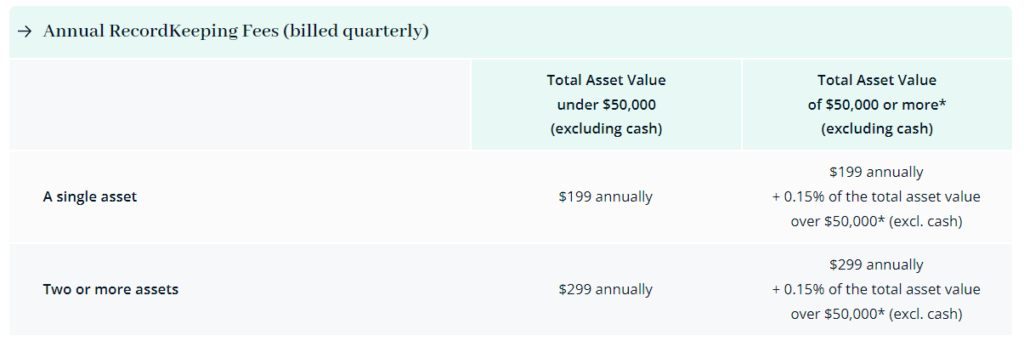

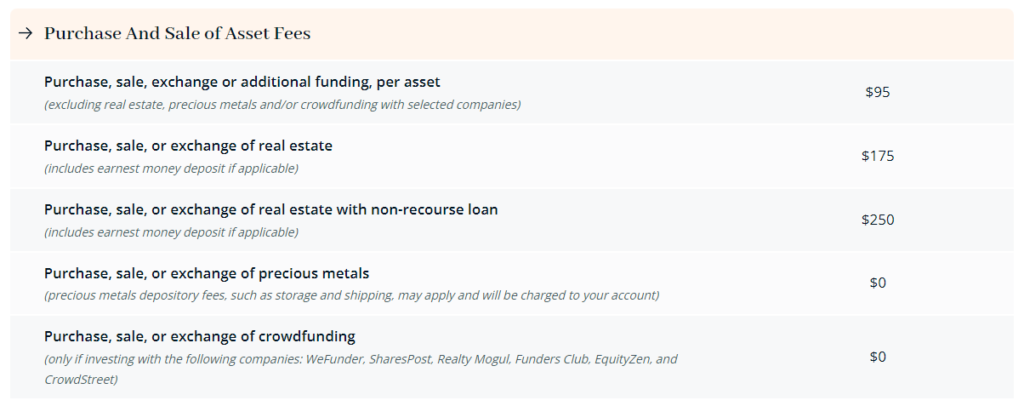

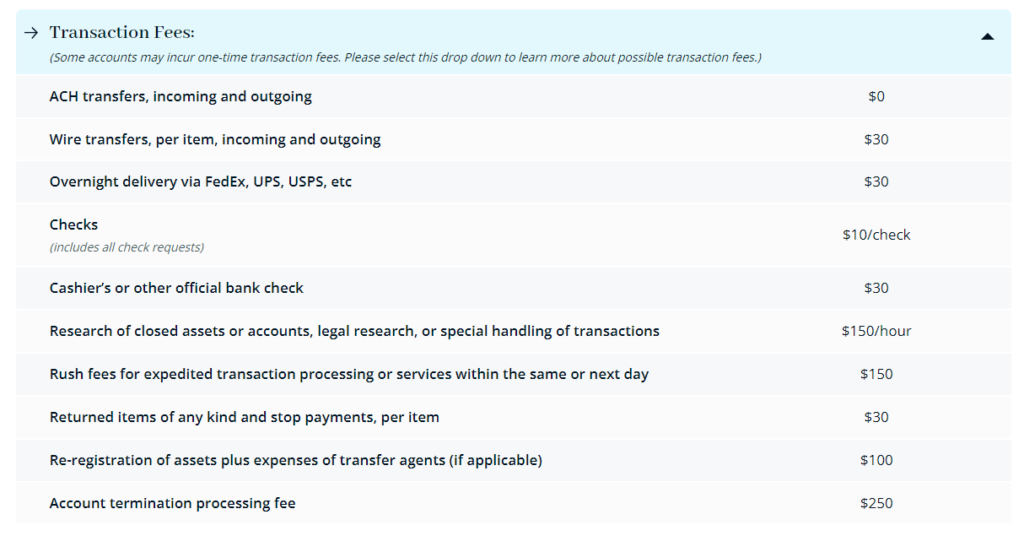

The Entrust Group offers custodial and administrative services to investors interested in adding alternative investments (such as precious metals or real estate) to a self-directed IRA. They provide plans tailored towards individuals (Traditional and Roth IRAs) and businesses (SEP IRAs, and SIMPLE IRAs). The following screenshots from their Fees page effectively summarizes their account pricing:

The account setup fee is relatively cheap at $50. However, the annual record keeping fees are sliding fees rather than flat fees for accounts with more than $50,000. However, The Entrust Group applies a cap of $2,299 on record keeping fees. So, as your account grows you won't keep spending more of your money to maintain your investments.

The purchase and sale fees for some assets may seem a bit high. But as they are flat fees, accounts with large enough amounts should not be too hindered by these costs. What is nice to see is zero costs for purchasing and selling your precious metals.

Transaction fees seem inline with the majority of IRA custodians. Notice there is a termination fee, which has increased considerably since our last review, and is now $250. Overall, the fees at The Entrust Group may not be the most competitive, but we appreciate their transparency.

The Entrust Group does not partner with any depositories, and they do not include storage fees within the $199+ annual recordkeeping fee. However, the storage costs charged by your depository will be billed directly to your account. Thus, the overall cost of owning a precious metals IRA with The Entrust Group will depend on the annual fees charged by your preferred depository. It's always best to choose a storage provider that charges a flat-rate storage fee, as opposed to sliding scale fees that increase with the value of the account. Also keep in mind that some custodians include the cost of storage within their annual fees. To learn more about The Entrust Group's fees for a precious metals IRA, see their complete fee schedule.

The Entrust Group Ratings & Complaints

- Better Business Bureau: ⭐, A+ (Details)

- BBB: ⭐ Out of 9 Reviews

- BBB: 8 Complaints Closed

- Business Consumer Alliance: Rating B (Details)

- Birdeye: Rating ⭐⭐ Based on 42 Reviews (Details)

- Trustpilot: Rating ⭐⭐⭐ Based on 2 Reviews (Details)

Regarding Entrust Group's complaints, we've found only 8 verified complaints on accredited consumer protection websites, each of which has been closed and successfully resolved. Although their Yelp score leaves something to be desired, it's worth noting that most, if not all, IRA providers have Yelp and Yellow Pages scores disproportionately below their actual value, as these sites tend to draw reviews from competitors.

The Entrust Group's Contact Details

- Address: 555 12th St #1250, Oakland, CA 94607

- Toll-Free Phone: 800-392-9653

- Local Phone: 510-587-0950

- Fax: 510-587-0960

- Website: http://www.theentrustgroup.com/

Always Review the Competition Before You Buy

The general consensus is that investors should be looking to allocate about 5%-20% of their overall retirement portfolio towards precious metals. This portion of your portfolio is intended to fulfill two primary purposes. It acts as a rather predictable and effective hedge against inflation. When the inflated dollar's value decreases, the value of gold typically rises. And it provides the opportunity to boost the value of your retirement savings multiple times over in the event of another recession or depression (which could dramatically increase the demand for and price of gold).

What does all this ultimately mean? It means you should be extra careful about how you invest that seemingly small portion of your portfolio. As it could wind up becoming the most important investment you can make for your retirement in the long-term.

Fortunately, we've made it easy for anyone to conduct their own research and compare the leading gold IRA companies and top IRA custodians. Our guides and comparison charts provide convenient resources from which to research how Gold IRAs work. As well as which companies are the most trusted and cost-effective service providers and bullion dealers.

Contact Us if You Own or Represent The Entrust Group

If you're an owner, representative, or associate of The Entrust Group and you've found any of the details in this review to be erroneous, misleading, or outdated, please do contact us with your concerns. With the intent of providing the most accurate reviews on an ongoing basis, we will gladly revise or remove any content that is outdated or incorrect.

How We Rank IRA Custodians

While building this year's list of the top 10 IRA custodians, we considered numerous different companies before narrowing down the candidates presented in the finalized custodian comparison table. We've made it easy for anyone to conduct their own research regarding the history, features, reputations, and fees of the leading precious metals IRA custodians. Each company has been thoroughly researched and ranked based on the following factors:

- preferred/partnered depositories and storage options

- whether storage fees are included in the annual charge – some companies require you to pay storage fees in addition to annual administration/renewal fees

- setup charges and account startup cost

- fee structure – sliding scale annual feesvs. flat-rate annual fees

- company reputation and industry presence

Why Equity Institutional is One of the Top-Ranked IRA Custodians in 2024

In addition to excelling in the above aspects, Equity Institutional also ranked as the #2 custodian this year because of their partnership with Augusta Precious Metals, the #3 company on our list. You can check out our 2024 list of the top gold IRA companies here.

Equity Institutional partners with bullion dealers, brokers, and investment firms to bring retirement investors cost-effective, streamlined access to precious metals IRAs. While you can setup an account with Equity Institutional directly as an individual, there are numerous benefits associated with opening your account through Augusta Precious Metals.

If you'd like to learn more about the advantages of opening an Equity Institutional precious metals IRA through Augusta, and for a free information kit, see our full review of Augusta Precious Metals.

Next Step

You may have found Entrust Group a perfect match or you may still want to compare other companies before making a final decision. You can check out the reviews of another 9 top trusts on our list here. Then you may need an IRA company that specializes in bullion. You can read the review of one of our top picks for IRA precious metal companies, Gold Alliance.

The Entrust Group

- Phone : 1-800-392-9653

- URL :

- Global Rating

- Very Good

User Rating

- 0 No reviews yet!

Review Summary :

The Entrust Group proves to be a well-regarded account administrator for tax-advantaged plans and self-directed retirement accounts. They boast more than four decades of experience in the industry, as well as around $4 billion in assets under administration. Entrust Group currently services 45,000 clients across the nation. A key selling point is that they offer more traditional office locations than any of their rivals in the self-directed IRA administration and custodian business. From these branches, they deliver plans for both individuals and businesses.

Have you purchased products from The Entrust Group? Leave a review!

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum