- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

Could Venezuela’s Level of Inflation Be In Store for the U.S.?

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

Last Updated on: 16th September 2018, 09:11 pm

This last week the situation in Venezuela became even more desperate as the IMF warned that the economy is collapsing so fast that inflation is predicted to reach a million percent this year in 2018. There have been some eerie parallels drawn between Venezuela and the United States in decisions and polices that have been made by both countries on money printing. Partly because of this printing press spree, legendary billionaire guru investor Jim Rogers has given an interview this past week in which he declared the death of the dollar as the world's reserve currency is a mere few years away.

If there was ever a time to acquire some IRA-approved gold, that time is now. Gold makes sense in an IRA because it protects and safeguards the value of money and assets like no other historically proven asset class can. Now is the time to look into the top five offshore storage locations for your Gold IRA while you still can.

The News Out of Venezuela Goes From Bad to Worse

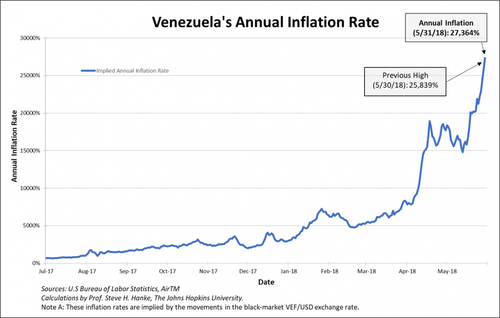

The International Monetary Fund is now forecasting Venezuelan inflation to the tune of one million percent by end of 2018! The IMF also showed comparable countries in the region and their inflation rates. Chile is looking at three percent while Peru has a still reasonable 3.7 percent inflation in the cards. What it means is that the once- wealthiest nation in the region for decades is now the worst off by far in a bitter twist of irony. This chart describes how quickly the inflation genie has escaped from the bottle in Venezuela:

Meanwhile the country's output is plunging. In terms of real GDP, the true value of services and goods the nation produces adjusted for the crazy inflation is negative 18 percent for 2018. It marks the third year in a row in which the national economy of Venezuela has crashed by two digits according to IMF estimates. The country is falling apart so fast economically and socially that it is difficult to keep up with its demise. The IMF shared the tragic news in their report with:

“We are projecting a surge in inflation to one million percent by end 2018 to signal that the situation in Venezuela is similar to that in Germany in 1923 or Zimbabwe in the late 2000‘s.”

On a personal level, the shop keepers estimate how much they should sell their goods for, while restaurant prices shift weekly, and the dollar itself has gained in value to 3.5 million bolivars. A critical shortage of crucial medicine and even common food has motivated hundreds of thousands of Venezuelans to flee for their lives. Just last week the Colombian government admitted it is sheltering 870,000 people from Venezuela within its borders.

The IMF does not mince words in this its latest report on Venezuela. The global economic group blames its huge macroeconomics imbalances and oil production decline as the prime culprits in the nation's devastating financial troubles. Far from providing any hopeful outlook for the future, the IMF stuck to its grim theme of severe and increasing hardship on the people of Venezuela over the next months. They believe that Caracas will choose to engage in still more ruinous fiscal spending that they will cover with additionally printed and increasingly worthless bolivars. This “will continue to fuel an acceleration of inflation.”

Venezuela has its own excuse for why the country is in a never-ending unstoppable tail spin. They argue that the troubles come from a full scale “economic war” or economic embargo that the U.S. and its allies wage against it on supplies they sell to the common person. For sure, Venezuela is on a short road to ruin in the worst possible example for South America.

Other Sad Examples of Ruinous Inflation Like Venezuela's

The most tragic example of runaway hyperinflation in fairly recent history dates back to pre-World War II and the ill-fated Weimar Republic of inter-war Germany. Before World War I, the U.S. dollar bought 4.2 marks. In 1923, one dollar equaled 4.2 trillion marks. Many millions of Germans suffered complete ruin before the country substituted in another currency and managed to stabilize the situation.

Germany during the interwar period was not alone in this sad predicament either. Zimbabwe experienced a brutal encounter with hyperinflation. While dictatorial Robert Mugabe pursued totalitarian rule for years and confiscated white farmers' lands as often as he could get away with it, the nation collapsed financially.

The country set a new world record for all-time high value of its currency when it produced its final note with a face value of 100 trillion Zimbabwean dollars. It was not too much longer before the nation wrote off its currency as a lost cause as with Weimar Republic Germany.

Is Double Digit or Even Hyperinflation Possible in the United States?

The real question on your mind now should be what about the United States and all of its money printing policies of the last decade plus. This is actually a dangerous and prescient point. The legendary investing guru Jim Rogers has weighed in on this concern and others in a recent RT interview. According to Rogers, the long-time investment partner of fellow master currency trading billionaire George Soros, the U.S. dollar has only a couple of short years left until it is no longer globally dominant any longer. Rogers soberly warned:

“In the next few years, the American dollar is going to lose its position as the world's reserve currency and the world's medium of exchange.”

Is there truth in these claims from a man revered by hundreds of thousands of currency, stock, and precious metals investors around the world? Numerous sources have reported the increasing endeavors of nations including China, Russia, Iran, and others to reduce or eliminate entirely their U.S. dollar dependence. They are working tirelessly, nations on a determined mission to circumvent the U.S. order with an ever increasing number of alternative options besides the worldwide dollar trading and settling system.

A new danger along with this triumvirate threat is that now longtime U.S. allies and economic powerhouse partners including Germany and France are attempting to de-dollarize the international order. It was only in August that the Foreign Minister Heiko Maas of Germany called out for the nations of the EU to create a brand new payment system that is outside the jurisdiction of the U.S. Other central banks have decided to invest heavily in gold bullion tonnage as a most effective means of diversifying off of the dollar and dependence on it.

As part of his reasoning for why the dollar will lose its luster imminently, Rogers has the force of history behind his argument. His examples of what has come before and what awaits the dollar include the once-almighty British pound sterling, the French franc, the Dutch guilder, and the Spanish peseta. None of those formerly globally dominant currencies (save the pound) even exist today, as Rogers pointed out:

“They all had that position at one time or another but then went to excess and are not that sound anymore, they lost their position… People don't like Washington's power, so they are moving away and finding ways to get away from the dollar. It has happened throughout history, it happened to the pound sterling, you know the rest of that story.”

End of the Dollar As Globally Dominant Currency Spells Inflation or Worse for the U.S.

Even the long-time friends of the U.S. the European Union have turned on the United States' global order that they helped to effectively build after the end of the Second World War with the IMF. President Jean-Claude Juncker of the European Union stated that he will evolve the euro into a new international reserve currency that will likely rival the American dollar in the European Union's ambition to decrease the block's financial dependence on America.

This is an ominous quote from Junkcer picked up by the Financial Times in London. He referred to reports that the EU was paying over 80 percent of all imported energy bills with dollars when a mere two percent of such imported energy originated in the United States:

“We will have to change that. The euro must become the active instrument of a new sovereign Europe.”

The reason for their frustration is clear to the Financial Times. The Europeans are angered by the American choice to weaponize the dollar in foreign policy moves designed to punish rivals to the United States. According to this FT article, the Europeans have not forgiven the U.S. for its threat to restrict European firms from any access to the American financial system should they choose to defy American sanctions against Iran. It is clear why investors are seeking out the Top Five Gold Coins for Investors today. Now all you need to understand is your Gold IRA storage options.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum