- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

Chinese Local Debt Staggering Even as Chinese Treasury Holdings Drop to 14 Month Low

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

Last Updated on: 26th October 2018, 05:18 pm

This past week you saw further revelations emerge about the true picture and nature of the quietly exploding debt mountain in China's local governments. Analysts are aware of an up to 60 percent debt to GDP official total for the nation. The scary part is that the off-balance sheet debt for local government in China could be a few times higher than what they have officially disclosed. S&P Global Ratings has warned that this could be as high as almost $6 trillion for just the local governments.

This sobering fact should goad you into immediate action. The debt situation in China has real bearing on the U.S. debt financing machine as the Chinese have continued to divest themselves of U.S. federal government debt at an alarming pace. Gold makes sense in an IRA precisely because this is the debt that allows the American government to continue deficit spending each year. IRA-approved gold is the answer to the conundrum of how to protect your investment and retirement portfolios. Today is the time to start investigating the top five gold coins for investors.

The Chinese Debt Bomb Turns Out To Be Far Worse Than Anyone Imagined

Everyone knew the Chinese had a growing crisis on their hands with debt in an ominous deja vu scenario reminiscent of the Japanese in the 1980's. It turns out that this could be far worse than anyone foresaw. S&P Global Ratings just published a report that lifted the veil of secrecy from the Chinese local government debt.

Per S&P Global Ratings, this could amount to trillions of American dollars. The disturbing revelation means that the real debt to GDP ratio of China amounts to “alarming” levels, as they sternly warned with:

“And that's a debt iceberg with titanic credit risks.”

The S&P analysts observed that the actual gap between official funding and spending in local infrastructure means the off-balance sheet debt might be even a few times more than the Chinese government officially shares. S&P estimates it could easily range from $4.4 trillion to as much as $5.78 trillion (from 30 trillion yuan to 40 trillion yuan), per the Credit Analysts Laura Li, Gloria Lu, and team in the S&P Global Ratings report.

The central authorities do allow this off-balance sheet arrangement. Estimates of the actual Chinese debt levels are 60 percent of GDP, but it could be substantially higher in practice.

Why Have the Chinese Not Moved to Address this Crucial Issue?

To the credit of the Chinese authoritarian central government, they are trying to do something about it, but unsuccessfully so far. The local governments became addicted to heavy investments in infrastructure to spur local area growth and meet national growth targets more effectively. The structures they preferred are called LGFV's, “Local Government Financing Vehicles.” The very nature of them is ambiguous. This is where the team at S&P Global Ratings have uncovered a great amount of the hidden debt held by local governments.

Beijing is trying to cut back on this type of dangerous financing, as other international institutions like the IMF have warned them about it in the past. Yet success to date has been elusive. Now the S&P Global Ratings believes that it will not be so long until the central authoritarian machine permits more of the local government financing vehicles to default on their debt. This is a dangerous trend that China is increasingly willing to permit.

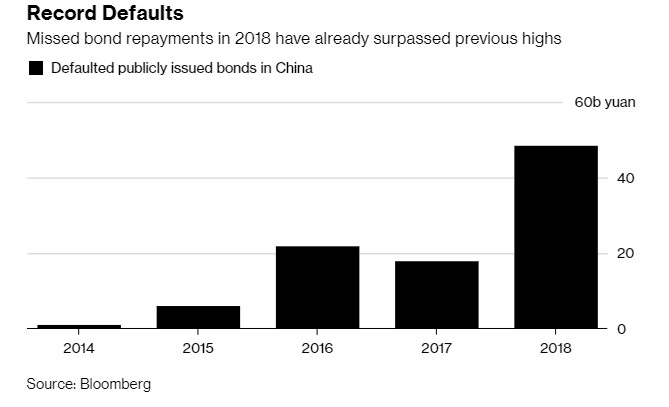

S&P Global Ratings sees the risks and is reacting to get ahead of them. Only last month in September they cut their credit ratings for long term issuers on seven of these LGFV vehicles. Two of them were for the Beijing neighboring city Tianjin. This year is already a record breaker for numbers of defaults on publicly issued bonds in the Middle Kingdom as this chart grimly shows:

It is a warning to anyone who is paying attention today.

And As China Sinks, It Cuts Back On Critical U.S. Treasuries Purchases…

The potentially greater danger of the Chinese debt markets going bust is an associated news item that also quietly hit the news wire last week. For the month of August, China cut back on its U.S. Treasuries holdings substantially. They reduced their net holdings by around $6 billion. This was the lowest amount dating back to June of 2017.

The total amounts of Chinese-owned Treasury bonds, notes, and bills declined to a total of $1.165 trillion versus $1.171 trillion as of July, per U.S. Treasury supplied data. This may not sound like much in terms of percentage change, but it is extremely worrying for several key reasons. The first of these is the trend, which in this case is not your friend. This Treasury total drop represented the third consecutive month in decline. It was also significantly beneath the high from the prior year of $1.2 trillion.

The second reason is because of the concern that this reduction has to do with the unfolding trade war with the United States. The bond traders have closely studied the situation in an effort to discern if Beijing has reduced its total holdings deliberately. The verdict is still unclear on this point. U.S. Rates Strategist Jon Hill from BMO opined:

“The fact you're seeing a slow downward drift is not surprising. Chinese holdings are now the lowest since June 2017, when they were at $1.147 trillion.”

Per CNBC, China's huge assortment of the U.S. bonds, notes, and bills reached a six month low in July when it declined from $1.178 trillion in June to $1.171 trillion for July.

China is critically important in this Treasuries market because it is the biggest single holder of the American government's debt. Japan is the second player in the market. Tokyo has similarly reduced its holdings for August. Japan's Treasuries' assets dropped from $1.036 trillion from July to $1.030 trillion in August. Hill reminded that:

“It's something a lot of people are paying attention to give its importance to the market.”

In fact Hill is not the only analyst warning about the dangers of this worrying series of events. Rates Strategist Boris Rjavinski of Wells Fargo Bank explained that:

“The Treasury market is growing; the government is issuing more Treasuries so foreign buyers are still significant participants, but overall in the relative sense, their share of the Treasury market has been in decline for several years.”

That is exactly the problem. At precisely the moment when the Treasury needs to start financing trillion plus dollar deficits every year for the foreseeable future (through 2030 at least), the foreign buyers and holders of American government debt are quietly disappearing, some of them possibly permanently.

Gold Is The Antidote To Chinese Debt Implosions and Threats to the U.S. Government's Treasuries Financing Machine

One thing to keep in mind is that the United States federal government can not finance its debt without an ample supply of buyers of its debt instruments. Just as the federal reserve has begun significantly reducing its purchases (and total holdings of the same Treasuries), the key foreign buyers are now net sellers. The Federal Reserve was the largest domestic purchaser of the debt too. Who is going to buy all of these newly floating Treasuries so that the government can continue to spend the U.S. economy into growth?

You do not need to wait around for the all too silent answer to this pressing question surrounding the future fiscal health and solvency of the U.S. and Chinese governments. Gold is your antidote for both Chinese debt implosions and the associated dangers to the American federal government spending and debt financing machine that depends on continuous, consistent old as well as new buyers of the debt in order to keep going.

The good news about the yellow metal is that you can now buy gold in monthly installments. Now is the time to learn more about the process of Gold IRA rollovers while there is still time. The federal government may fail you one day, but gold will not abandon you in a time of national economic crisis.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum