- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

China’s Golden Alternative Another Reason Gold Prices Headed Much Higher

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

As the trade war rages on between the U.S. and China, it is important to know that China has recently worked out a way to avoid being reliant on U.S. dollars for its enormous oil imports. This is what some analysts call Beijing's Golden Alternative. This official national policy has become the latest reason for why gold prices are headed much higher this year. It is something that you ignore at your own financial peril.

China's major policy is another reason for why gold makes sense in an IRA. When the world's second largest economy is accepting payment for enormous daily transactions in gold, you need to be looking at the top five gold coins for investors. Getting some IRA-approved precious metals will allow you to diversify and hedge your investment and retirement portfolios more effectively as well.

China's Golden Alternative Policy Began Taking Shape in 2017

As geopolitical tensions rose between the United States and North Korea back in 2017, the U.S. Trade Secretary under President Donald Trump articulated a threat to throw China out of the American dollar system if it did not apply serious pressure to North Korea. This raised more than eyebrows in Beijing. They knew that if such a threat were actually applied against them, this would amount to a financial nuclear bomb drop on China.

China denied ready access to dollars would find itself unable to meet its enormous daily oil import needs or pursue its considerable and growing international trade (both settled in U.S. dollars). This would have brought their economy to a dead stand still. The Chinese took it as a serious wake up call. They decided not to rely on an enemy with such power over them. It spurred them into creating their Golden Alternative policy.

Golden Alternative Started with the Shanghai Crude Oil Futures Contract

In 2018, the Shanghai International Energy Exchange marked a major crucial milestone by launching the world's first crude oil futures contract denominated in their own currency the Chinese yuan. This was a ground breaking day for the world too, as it was the first instance since the end of the Second World War that major oil transactions could occur without the U.S. dollar.

Analysts may not have taken the new oil contract too seriously at first. How many major oil producers want to build up a huge yuan reserve after all? Yet China recently completed the link to gold. They connected their crude contract with the capability of converting yuan into physical gold using gold exchanges in Hong Kong and Shanghai. Many people are not yet aware that Shanghai is now the biggest physical gold market on the planet. These conversions will not require the Chinese to part with their official government gold reserves either.

It was a policy masterstroke. The Golden Alternative that China created means that effectively now oil producers are able to sell their oil for gold to China. They get to sidestep any of the financial regulations, restrictions, and sanctions from the United States financial system. Thanks to this Beijing crafted alternative, a huge amount of oil money will soon start moving through yuan into gold rather than through American dollars into U.S. Treasuries.

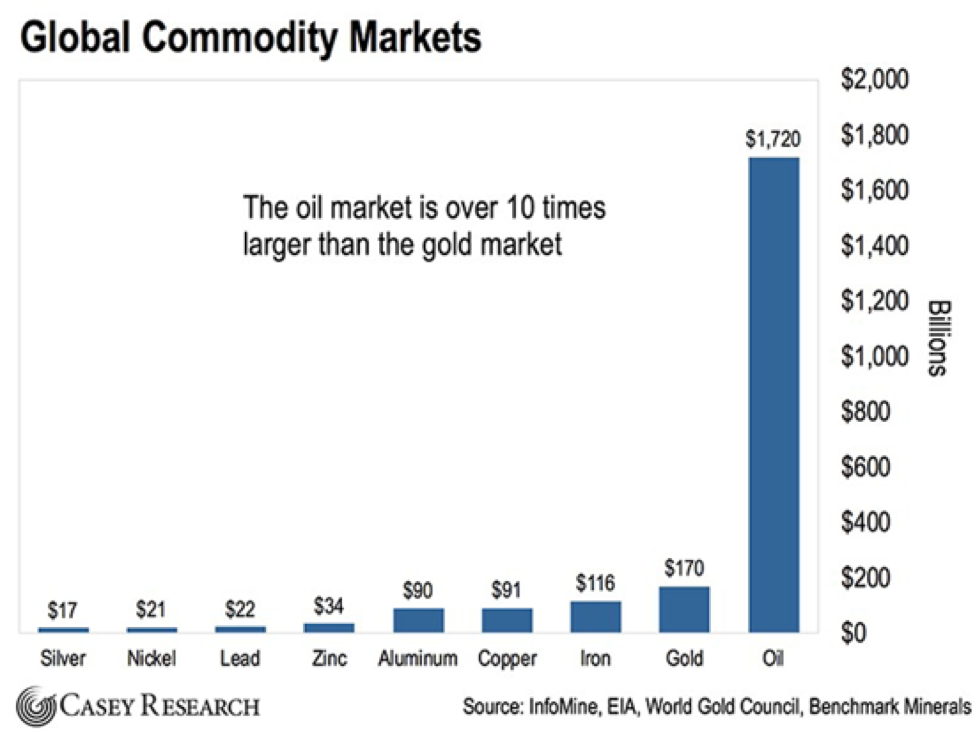

This is a zero-sum game, meaning that China's win will be the United States' great loss. Consider what CNBC said about it. They claim that the quantity of redirected oil funds will eventually reach between $600 and $800 billion. A great amount of this money will then move into the gold market, which by itself is comparatively tiny at a mere $170 billion.

China the World's Largest Oil Importer Means Much More Money Will Move Into Gold

What makes this so significant is that China has become the biggest oil importer in the globe. Consider that in the first six months of this year, China's daily oil imports have amounted to about 9.8 million boed (barrels of oil equivalent per day). Analysts estimate that the total will only expand by minimally 10 percent every year.

At today's oil prices, the black gold is holding close to $60 per barrel. It translates to China spending about $588 million each day on oil imports. In gold terms (with gold holding about $1,330 per ounce), China imports oil that equates to more than 442,105 gold ounces every day.

Be conservative and make the assumption that only half of such Chinese oil imports will be bought with gold soon. This amounts to a greater demand for gold amounting to over 80 million more ounces every year. This is over 70 percent of total global gold production. Indeed, the chart below reveals how much larger than gold the global oil markets actually are:

Oil markets are 10 times greater than gold markets today. The impact of this amount of oil money moving through gold markets can not be exaggerated on the near future pricing of the yellow metal. For sure, such a major economic shift has not yet been priced into the world gold prices. As this impact realigns prices, this higher demand of gold from the Golden Alternative policy will stun the gold markets and prices. In other words, the Golden Alternative is going to be a huge part of gold becoming re-monetized in the not too distant future.

Oil markets are 10 times greater than gold markets today. The impact of this amount of oil money moving through gold markets can not be exaggerated on the near future pricing of the yellow metal. For sure, such a major economic shift has not yet been priced into the world gold prices. As this impact realigns prices, this higher demand of gold from the Golden Alternative policy will stun the gold markets and prices. In other words, the Golden Alternative is going to be a huge part of gold becoming re-monetized in the not too distant future.

Turkey and Iran Using Similar Golden Alternative Payment Arrangement

If it were only China that had caught on to this Golden Alternative idea, it would be an seismic shift for gold, dollar, and oil markets around the world since China is the largest oil importer on earth. Yet other countries are also pursuing their own versions of the Golden Alternative policy. Russia has been dumping dollars, U.S. Treasuries, and other reserves for gold in the last few years. It has enabled them to largely break free from exposure to American financial sanctions as a result.

Other significant economies have been doing similar deals to avoid U.S. dollar hegemony and sanctions. In 2016, Iran and Turkey engaged in an early version of the Golden Alternative when word got out to international markets about their gas for gold plan. Though Iran was under restrictive American sanctions, Turkey the American ally found a way to work around these without suffering punishment. They simply paid for their imports in gas from the Islamic Republic using gold directly.

Venezuela has been doing the same with Russia, selling oil directly for gold and sidestepping crippling U.S. sanctions. All of these countries have in common that they are doing business and settling their transactions and trade successfully using gold shipments that the United States government simply can not control or restrict. It is the way that gold is set to benefit enormously from the U.S. choosing to deploy its dollar as a mega financial weapon around the world.

Gold Makes Sense As A Dollar Hedge For Your Retirement Portfolio

Russia is of course taking this to a much publicized level. They continue to import huge amounts of gold to their central bank reserves. At present trends, they will shortly leapfrog past both France and Italy to become the third largest holder of gold, per the World Gold Council.

This is why you need to start considering Gold IRA rules and regulations. The helpful news is that now you can even buy gold in monthly installments and choose to store your safe haven retirement account investment in top offshore storage locations for your IRA gold. Only be sure to buy from top gold IRA companies and bullion dealers while you are at it.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

The Central Bank of China has been actively buying gold for many years. For China, gold is a tool to reduce the trade surplus and contain the growth of the dollar.

The most likely full-scale economic war between the United States and China. China does not want to depend on its main enemy. It is the world’s largest importer of oil. And he does not want to buy oil using US dollars. That is why China is using a new way to buy oil. For the first time it is possible to conduct a large-scale exchange of oil for gold. If we assume that only half of the imports of Chinese oil will be purchased for gold, this will lead to an increase in demand of more than 60 million ounces per year. This is more than 50% of the annual gold production.