- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

Brexit Negotiation Standoff a Growing Concern

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

Last Updated on: 12th February 2018, 01:17 pm

Last Friday saw the critical Brexit negotiations between British and EU representatives end with hostile words and accusations. Chief Negotiator Michel Barnier of the European Union conjured up the specter of Britain leaving the trading block in 2019 without a deal and legal clarity. Naturally the comments aroused angry responses in the U.K.

The dispute is important because the two parties only have a month to come to terms on a transitional period deal which will bridge the March 2019 Brexit. The two sides can not move forward to hammering out a future trade relationship until they get past this. The clock is rapidly ticking.

Geopolitical instability like that going on in Europe right now reminds you of why you need gold in your retirement portfolio. Britain crashing out of the EU could cause financial chaos in regional and global markets. Gold makes sense in an IRA precisely because it outperforms in times of market crisis. Now is the time to look into IRA-approved metals and to consider the the top five gold coins for investors.

Meeting Between EU and British Negotiators Ends Badly

The February 9th meeting ended in discord for several main reasons. EU negotiator Barnier claimed to be uncertain of what Britain wishes to gain out of the talks. The U.K. is resisting the EU terms of the two year transition period that now appear to be non-negotiable.

Barnier went so far as to claim that the chances of obtaining an agreement that British businesses especially want are slipping away. In Brussels he explained to reporters that:

“Transition today is not a given. Time is short, very short, we don't have a minute to lose if we want to succeed.”

This left both sides hoping that they can resolve the arguments within the next round of negotiations. Yet the British did not take the criticism idly. U.K. Brexit Secretary David Davis retorted at how surprised he was by the unhelpful Barnier comments. He called the entire EU approach to discussions a “fundamental contradiction.”

Britain and the EU Both Stand to Lose from No Deal

One thing is clear. Both sides stand to lose if no deal can be arranged by the arrival of the Brexit date. Businesses on the two sides of the English Channel require the stability of a bridge to carry them to a future point trade arrangement.

Otherwise there will be regulatory and legal limbo for companies of both parties the day that Britain is no longer part of the EU in March 2019. This would start with goods encountering tariffs coming into and leaving the U.K. Beyond this, there could be significant disruptions to food imports, airplane travel, and even data transfers.

One of the problems the transition negotiations suffer from is the tougher approach that British Prime Minister Theresa May has been forced to take. The embattled prime minister is under continuous threat from the hard Brexit party members in her own cabinet.

In the beginning London was anticipated to agree to all EU conditions on the transition period. The terms were strict enough that hard Brexiteers raised the prospect of Britain becoming a vassal state to the European Union. This forced May to object to many of the terms.

What the Transition Means

The deadline for the transition has been set by businesses at end of March 2018. If they do not have one at this time, then they will proceed with contingency plans. This means that companies and jobs will relocate from Britain to other EU countries to preserve market access. As it is, British banks are already preparing to move EU account offices so that they do not rely on transition deals. Yet they do need to make preparations that include rewriting contracts.

The transition means that Britain has to obey all rules of the EU. It would get to maintain full access to the common market. The downside is that the U.K. would not get to vote in the block or contribute to the rule making.

London is afraid to be subjected to any new rules that come into effect in the transition period. The concern is that the new EU rules might negatively impact British interests. Davis expressed his frustration about the transition with:

“Given the intense work that has taken place this week, it is surprising to hear that Michel Barnier is unclear on the U.K.'s position in relation to the implementation period.” We wish to remain “the closest of friends and allies.”

At the same time, the European Union is hardening its own position. They have already pledged to suspend Britain from all single market benefits if the U.K. breaks any rules in the transition two years. According to Barnier, this is merely the EU maintaining the cohesion of the single market.

Europe also stands to lose significantly if Britain walks away from the deal. The British have provisionally agreed to a 39 billion pounds (or about $55 billion) Brexit settlement. This is the British leverage that gives them confidence the EU will compromise in the end. Besides this, the EU companies are also desperate to see a transition deal in place before Brexit goes into effect.

British Economy Already Suffering from Brexit Effects

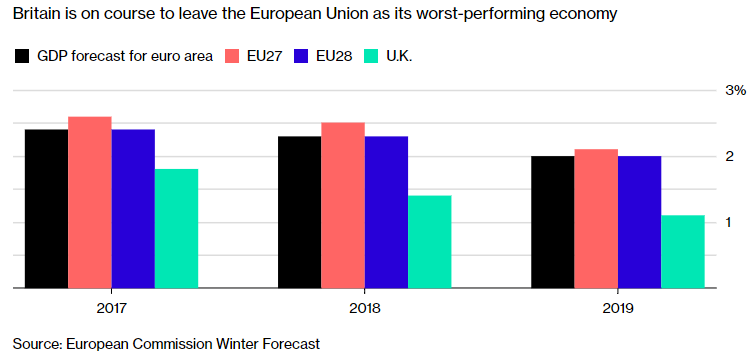

The British economy is already slowing down in good measure due to the side effects of Brexit. London's growth rate is projected to fall behind every other EU 27 country both in 2018 and 2019. This is now a base line case even if the EU allows Britain to have the same trading access after they leave the block.

The European Commission's winter economic forecasts project that the U.K.'s growth will decline to 1.4 percent in 2018 and only 1.1 percent for 2019. This report also revealed that inflation will rise to 2.7 percent for 2018 before it tapers off to two percent for 2019. While uncertainty continues to hold back investment from businesses in Britain, the inflation is similarly constricting consumer incomes.

The report is quick to state that its U.K. assessment relies on “purely technical assumption of status quo in terms of trading relations” for year 2019. In other words, if a deal can not be reached and Britain crashes out of the EU, then the economic results likely would be worse. This chart shows how the United Kingdom's economic performance is projected to stack up against the EU's own:

The European Commission summarized its findings with:

“Business investment is projected to remain relatively weak while net exports are forecast to moderate in line with export markets. The positive effect of lower consumer price inflation on consumption is expected to be offset by an increase in the household savings rate.”

Meanwhile strong trade has helped to hold the British economy up so far. Both the National Institute of Economic and Social Research and the EC project this trade boost will taper off throughout this year as the pound drop's beneficial effects decrease.

Gold Insures Your Retirement Portfolio

These threats to the British and European economic growth and trade have implications for the wider world economy. This is why you need to safeguard your retirement portfolio with IRA-approved gold. It is even easier than ever today thanks to your ability to buy gold in monthly installments. You can also keep retirement assets in top offshore storage locations for your gold IRA that the IRS now permits.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum