- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

Bitcoin is Now the Hottest Asset in the Market

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

Last Updated on: 30th November 2017, 06:40 pm

This Monday saw the world's first and foremost digital currency Bitcoin break through the $10,000 per BTC barrier for the first time. This was an especially important milestone as only two months ago it had just made its first run past $5,000.

Without a doubt, Bitcoin has come far since its unveiling in 2009 by the still unidentified creator who uses the name of Satoshi Nakamoto. In less than ten years time, it has catapulted from obscure curiosity to hottest asset in the market.

Searches for Bitcoin Are Now More than for Gold

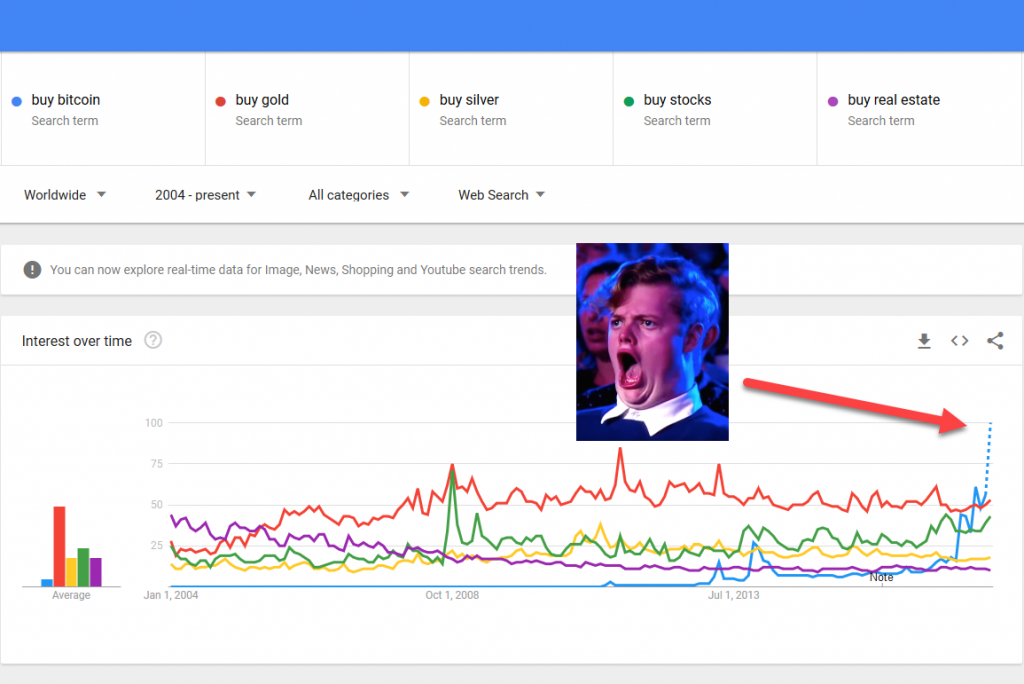

One of the evidences of the wild success the world's leading cryptocurrency has enjoyed is revealed in this chart below:

It shows that the search phrase “Buy Bitcoin” has surpassed its two leading financial rivals of “Buy Gold” and “Buy Stocks.” In fact “Buy Bitcoin” is now massively more researched on the Internet than other significant asset classes under the search terms of “Buy Silver” and “Buy Real Estate.”

The chart shows that the rising interest in Bitcoin only looks set to continue. We'll look at what has fueled this amazing Bitcoin trend in more detail below.

How is Bitcoin the Hottest Asset on the Market?

For anyone still skeptical about the meteoric rise of Bitcoin, consider a few interesting facts about the recent successes of the leading digital currency:

- This past Sunday, over $5 billion worth of money changed hands on the various Bitcoin exchanges around the world. Today it traded nearly $10 billion in volume (per Coinmarketcap.com). To put this into perspective, these are higher dollar volumes than a typical trading day will see in numerous U.S. stock exchanges.

- The record year for leading index the DJIA (Dow Jones Industrial Average) proved to be an 82 percent gain in 1915. Yet this impressive percentage stock market result is a mere ten percent of the gains that Bitcoin has notched for 2017 so far.

- Proponents of Bitcoin are arguing that the incredible performance of the alternative currency is due to the creation of a brand new asset class. They believe it will reach into the typical investment and retirement portfolios of everyday people alongside commodities, stocks, and bonds before long.

Reasons for Bitcoin's Continued Rise

This phenomenal success begs the question why is Bitcion seeing such a stunning sustained rise especially in 2017? As with any asset, currency, or commodity, this starts with a significantly greater level of demand pouring into the market.

BTC prices have reacted dramatically to a massive surge of first-time buyers hailing from around the globe. These people believe that they have come across an alternative, still young investment that has the potential to take its place alongside gold for a safe haven store of value that is beyond the control of governments and corporations.

As a case in point, in only the past few months investors in Japan and South Korea have really begun to embrace Bitcoin. You can now walk the streets of Seoul, South Korea's capital and find a number of stores that allow less technologically savvy people to purchase or sell BTC. It is no accident that the exchanges in South Korea were the ones that first saw the $10,000 per BTC price attained Monday.

These Asian investors and others like them are driven in part by the belief that Bitcoin represents a burgeoning new way to store value. A Bitcoin software programmer Jimmy Song echoed this sentiment with his remarks:

“The reason people own Bitcoin is because it's a great store of value, possibly the greatest that has ever existed.”

But it is not only individual investors who have been pushing up the cryptocurrency's price. A number of hedge funds have been eager to get in on the trade. In fact over 100 individual hedge funds today only invest in Bitcoin and the smaller rival digital currencies.

A new trend pushing the value of BTC has come from significant and respected organizations such as the Chicago Mercantile Exchange Group that has given it their stamp of approval. It was only the end of October when the CME announced that they would begin to provide a means for trading futures for Bitcoin.

Assuming they receive all necessary review approvals in time, they plan to launch this futures market on Bitcoin in the final quarter for this year. This is a significant benchmark for the cryptocurrencies that proves their times has at last come.

It is more than a little ironic that the increasing acceptance by the mainstream economy today has helped to propel the digital currency to the next level. This is especially the case as Bitcoin and its smaller rivals have always been alternatives to the currencies run by the centrally established institutions in the market like commercial and government central banks.

The International Advantage of Bitcoin

Another explanation for how Bitcoin has seen its proverbial stock rise so high lies in the many advantages that such digital currencies offer users not only in one country, but around the globe. One of these is that individual governments can not effectively shut down trade in or seize assets of these alternative forms of money.

This is why the leading cryptocurrency has been wildly popular in places where governments have a history of seizing assets and bank accounts from their own citizens. Still other nations try to stop them from transferring out their money. China, Venezeula, Zimbabwe, and Argentina are all examples of countries where the citizens have increasingly turned to Bitcoin as a place to store their money.

Indeed the software that underlies Bitcoin has proven to be remarkably impervious to government attempts and even hackers to control it. Countries that have tried to seize these bitcoins or stop them from trading for the last nearly ten years have failed to do so.

This underlies the arguments that investors often make for Bitcoin being a new and more easily transported version of gold. Like gold, it is capable of storing money safely and outside the realm of corporate or government control.

Investment Appeal of Bitcoin

There are a few particular advantages which Bitcoin possesses that have increased its appeal to investors as they have come to better understand the cryptocurrency this year. These include the following important ideas:

- Digital assets like Bitcoin are generally not correlated to the financial markets. It means that owning them provides a hedge and diversification against assets such as stocks, bonds, commodities, and real estate.

- The fractional nature of Bitcoin means that there is not a high barrier to entry as with other types of asset classes that offer significant returns. Even though the cryptocurrency has traded at over $10,000 per BTC, you can buy a tiny fraction of one and still participate in the price moves.

- With a maximum total creation of only 21 million Bitcoins able to be produced, the cryptocurrency is extremely limited. This means that it can not be mass produced like other paper currencies governments control. It is one important way that it is much like gold.

- The high volatility of Bitcoin even appeals to some investors who are seeking a greater risk to reward opportunity. Bitcoin's implied volatility proves to be the highest of all major asset classes.

Bitcoin Evolved Past Dependence on a Single Exchange

A few years ago, possibly the biggest thing holding Bitcoin back was its reliance on only one main exchange. Since the collapse of Mt. Gox that handled over 75 percent of all trading in Bitcoin back in 2013, the cryptocurrency has evolved past this vulnerability. Today the biggest BTC exchanges host merely approximately ten percent of the total trades.

All of these factors together help to explain how Bitcoin has become the hottest asset in the market. The original digital currency has proven through its first move advantage and staying power (despite setbacks along the way) that it represents a new asset class which is not going away. Bitcoin today is a revolutionary concept whose time has finally arrived.

How to Invest in Bitcoin

If you are interested in getting involved with the exciting opportunities in Bitcoin, you have several ways to go about this. For IRA purchases you need to choose a company that is a Bitcoin IRA administrator and custodian. They will assist you with rolling over an existing IRA or setting up a new approved IRA.

You can also purchase the digital currency with non-IRA funds. The easiest and safest way to make regular purchases is on cryptocurrency exchanges. San Francisco-based Coinbase is the most popular way to buy and sell Bitcoin and the other major digital currencies. Some of the other highly rated exchanges to consider are San Francisco-based Kraken and United Kingdom-headquartered Bitstamp.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum