- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

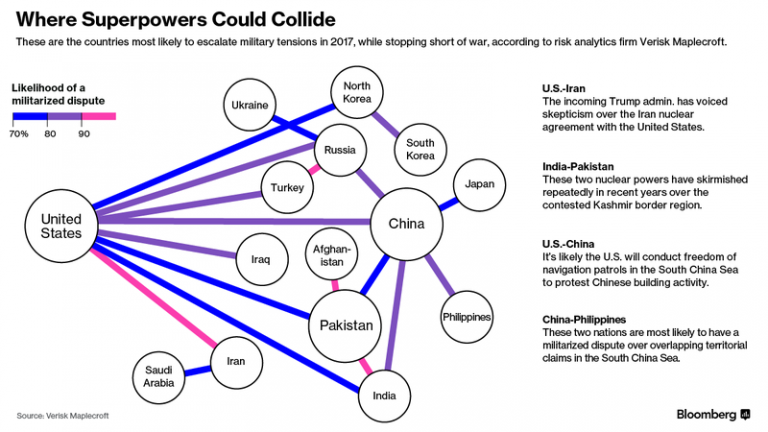

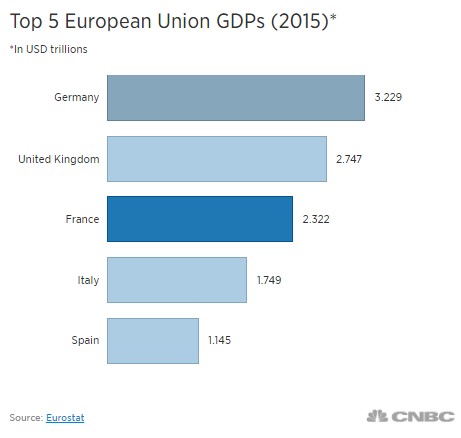

Potential Marine Le Pen French Presidential Victory Threatens to Blow Up EU While Global Equities Make New Highs

In another fast-paced week, U.S. President Trump abandoned the decade long commitment to the two state solution in the elusive quest for peace between Israel and the Palestinians. Investors eyes were mostly focused elsewhere though, as the rise of populist…

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum