- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

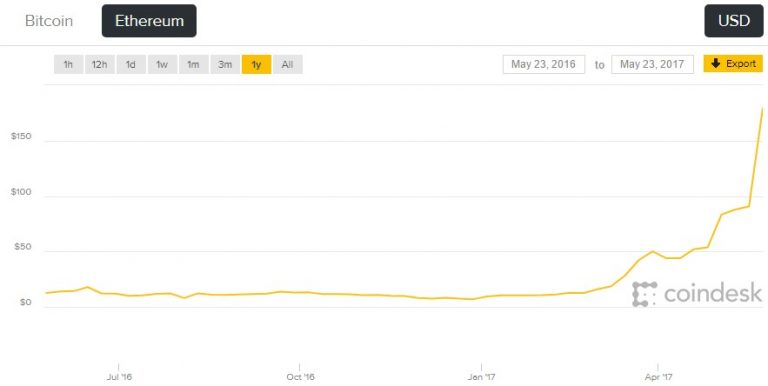

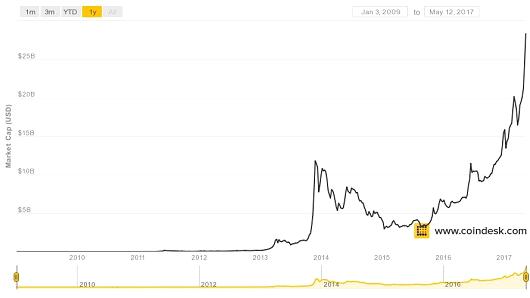

Are Bitcoin and Ethereum the NEW Gold and Silver?

As you can see in the picture above, Bitcoin is often represented by a gold colored token. The world’s second largest cryptocurrency (by market cap) Ethereum commonly has a silver token portrayal. It is no accident that the two leading…

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum