- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

As President Trump and Germany’s Merkel Trade Fiery Exchanges, Fed Pledges End to Easy Money

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

Last Updated on: 31st May 2017, 12:49 pm

This past week saw a flurry of unsettling events in the geopolitical world. President Trump finished his first nine day overseas trip that began impressively in Saudi Arabia and Israel then fizzled out into a series of testy exchanges with long-time European allies, including Germany. He and Germany's Angela Merkel are now engaged in a back and forth war of words signalling a significant breakdown in the post-World War II transAtlantic alliance and age.

Meanwhile, the Federal Reserve announced plans to “shrink its balance sheet” that has sat at a historical all-time high of $4.5 trillion since the end of the Global Financial Crisis and Great Recession of 2007-2009. Their actions signal an end to the era of cheap money and artificially inflated stock market prices in coming months as they commence.

In Italy, the four main political parties began working earnestly on changing electoral laws to a system most akin to Germany's. This would likely lead to snap Parliamentary elections as early as September of this year. An earlier election favors the ultra-nationalist anti-Euro party of the Five Star Movement led by Beppe Grillo. Italy is the weakest link of (and represents the greatest danger to) all the founding members of the EU, not France or the Netherlands as some have incorrectly assumed.

Wherever you turn, you see plenty of reasons to hedge your investment and retirement accounts with physical gold and silver bullion. Gold is the ultimate vehicle to protect your IRA assets. Now is the time to look into the Gold IRA rules and regulations and to secure some of the yellow metal while it is still relatively cheap.

President Trump Finishes First Overseas Trip With Fiery Exchange Against Germany's Premier Angela Merkel

U.S. President Donald Trump ended what began as a successful and much-lauded trip through the Middle East and Israel in a tense set of meetings with European NATO and G7 allies in Brussels and Sicily. The frustrations between the European leader Germany's Angela Merkel and the American administration did not stop after the conclusion of the Taormina G7 meeting.

Germany's Premier Merkel gave a speech at a campaign rally in Bavaria where she warned that neither the EU nor Germany can count on the U.S. any longer, with her:

“The times in which we could completely depend on others are, to a certain extent, over. I've experienced that in the last few days. We Europeans truly have to take our fate into our own hands.”

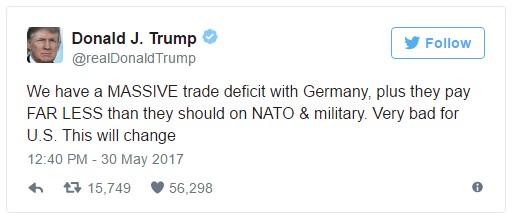

President Trump is never one to back down from a good verbal duel. He took to his favorite medium Twitter to hit back at Merkel's comments against American abandonment. Trump lashed out at Angela Merkel with this Twitter post:

These comments only ratcheted up the tensions between long-time post-Second World War allies Germany and the United States even higher. The American President has already accused Germany of manipulating the euro single block currency in an effort to gain an enormous trade surplus advantage.

Merkel has argued profusely that both she and the Bundesbank lack the authority or ability to control the euro. She opined the reason global and American consumers choose Germany's products is because they are better quality, more competitive goods.

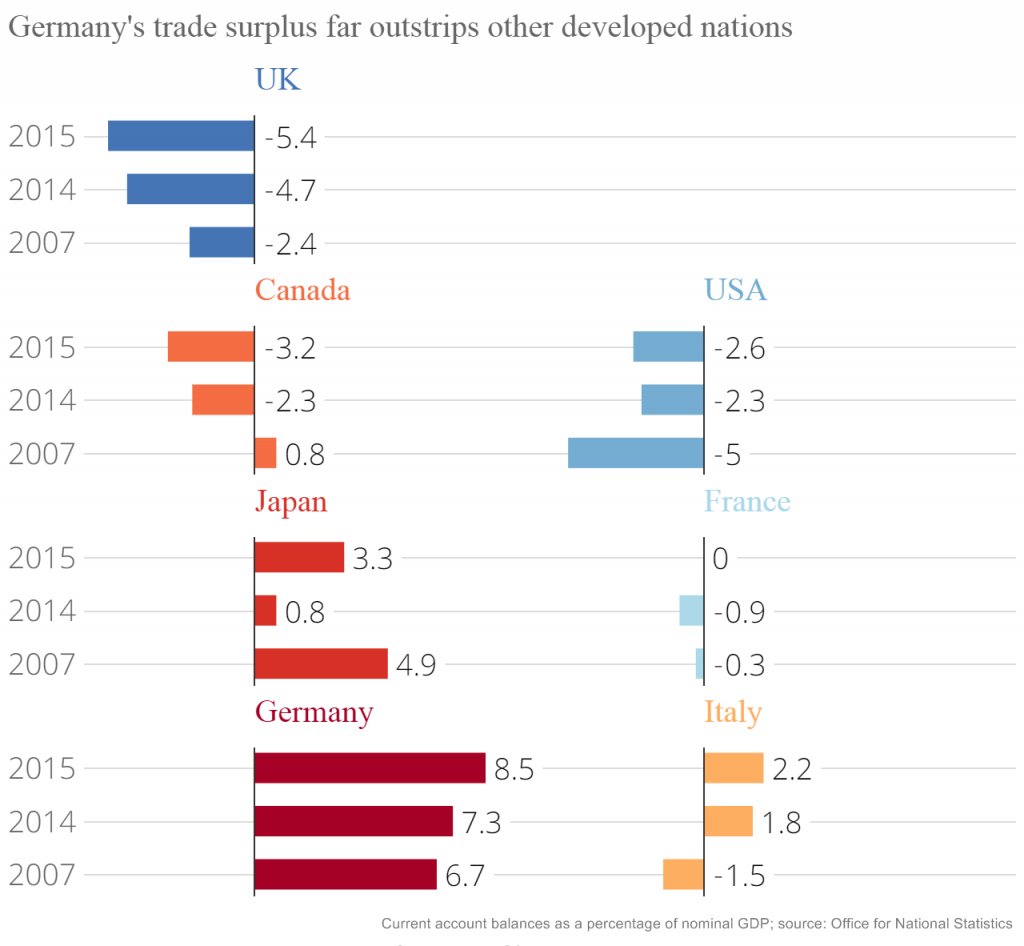

The problem is that both sides are right. The data release from the German Federal Statistics Office demonstrated in February that the German trade surplus increased to 252.9 billion euros (or $270.05 billion) for 2016. This broke the prior all time high of 2015's 244.3 billion euros.

This means that if Germany stood alone as a trading block, it would represent the fifth biggest trader with the United States. Despite this place, it has the third biggest trade surplus with the United States, close behind China and Japan. Just look at how skewed the global German trade is compared to other major global trading nations:

An equally thorny problem pushing the U.S. and Germany farther apart surrounds the NATO defense commitments and expense sharing of the European allies. President Trump has continuously demanded that the NATO European allies increase their contributions to the required levels of the charter. Right now there are only five out of 28 NATO members who meet their targets for spending minimally two percent of their national GDP (gross domestic product) for defense.

The United Kingdom is one of the handful of nations that meets its obligations, while Germany is the leader of the profligate European defence spending countries. Germany's Finance Minister Wolfgang Schauble has recently stated that sending two percent of Germany's enormous GDP on defense is “unrealistic.” NATO data reveals that Germany only spends 1.2 percent of national GDP for NATO defense, compared to the 3.6 percent which the United States pays out every year.

Federal Reserve Announces Plans to “Shrink Balance Sheet”

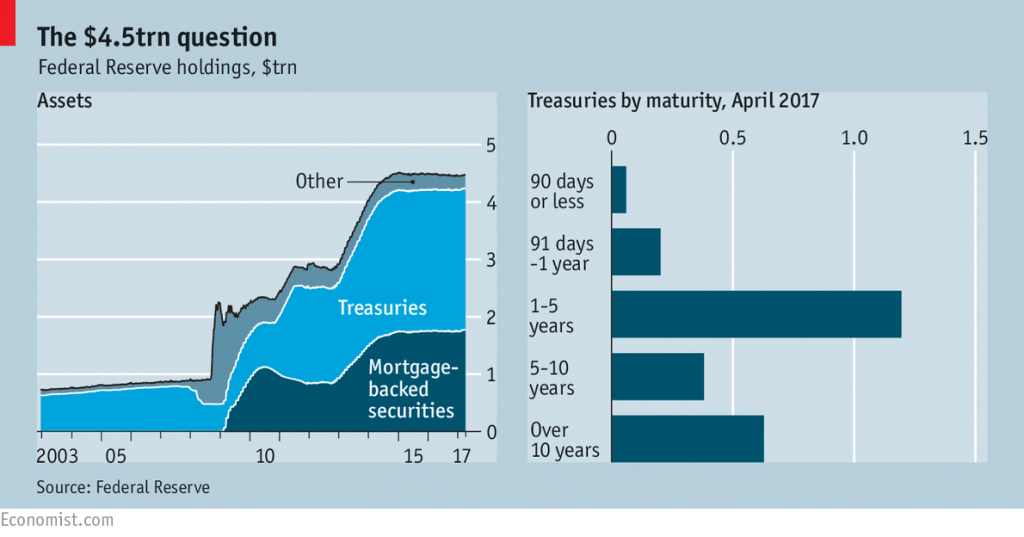

After nearly a decade with an “elevated balance sheet” of around $4.5 trillion, the United States Federal Reserve announced last week via its May meeting minutes that it intends to pull the cheap and easy money out of the American economy. They will do this by not reinvesting the proceeds of their investments into the derivatives, Treasuries, mortgages, and MBS mortgage backed securities any longer.

The blunt explanation for this is that the Fed is finally going to attempt to take the U.S. economy off of the emergency life support it has been on since 2008/2009. The problem is that there could be dramatic ramifications in this decision for stock market prices, interest rates (which move inversely to the prices, meaning as demand dries up, rates soar), and mortgage backed securities. Take a look at this graphic below:

Most ominously for the Federal Government, the Fed has become among the largest buyers of U.S. Treasuries, and this will soon change. The Fed did not mention in their notes who they expect will pick up the slack of buying the American government debt, as the Chinese and Japanese (largest and second largest customers) are buying less of it all the time.

This situation bears close watching, as the U.S. Federal Government can not service its debt if the interest rates on the over $20 trillion rise to anything resembling historically normal interest rates of from four to five percent.

Italy Moves Towards September Snap Parliamentary Elections

For many months now, analysts have warned that the real threat to the future integrity of both the eurozone and possibly even the European Union in general is not really the Netherlands or France, but fellow co-founding member Italy.

Lawmakers from the four major parties in Italy have just made the prospect of an early parliamentary election in September closer to becoming a reality as they meet to discuss finally passing electoral reform in June. Political Risk Analyst Wolfango Piccoli of Teneo Intelligence in London recently warned:

“The biggest obstacle to early elections so far has been the lack of a workable electoral law… yet after months of dithering, it seems that the main parties are edging towards an agreement to endorse a German-inspired electoral system, using proportional representation with a five percent threshold.”

This week the four primary political parties in Italy began discussing introducing the German proportional voting system. According to what is known as the “German model,” only a five percent threshold is necessary for smaller parties to enter into the Italian parliament.

This new proportional representation system is likely to cause snap elections to be held before the budget debate fuels anti-European Union feelings among the frustrated and angry Italian electorate even more. The Italian lawmakers are expected to conclude a deal sometime in June.

This would likely pave the way for Beppe Grillo's Five Star Movement to take over the government of Italy. Most recent Italian voter intention opinion polls have the Democratic Party (PD) of ousted former Prime Minister Matteo Renzi (who is once again head of the party) running head to head against the Five Star Movement (5SM) party. Italy is the one to watch for the potential impending dissolution of the eurozone. Investors have been worrying over this troubling scenario for months now.

You should be aware of it too. Whether or not the euro is headed for a catastrophic Lehman Brothers-like moment or not, there are plenty of other reasons in the news today to make sure your portfolio is hedged by IRA-approved gold. Gold makes sense in an IRA because of all the geopolitical instability facing the world seemingly every week now. Time to learn about Gold IRA allocation strategies for your retirement accounts.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum