- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

As German Chancellor Merkel and President Trump Meet in Washington, G20 Battles Over Free Trade in Germany

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

Last Updated on: 20th March 2017, 12:21 pm

This past week, the international meeting of the minds known as the G20 took place at about the same time as U.S. President Donald Trump met with EU ironwoman Germany's Chancellor Angela Merkel.

Those who were looking for major breakthroughs on significant differences that exist between President Trump's administration and the pro-global establishment championed by the European Union, China, and Japan were set up for disappointment.

In no small part because of the pivot away from anti-tariff, free trade which the United States has begun making since the new President's election, the European Union and China began making serious overtures toward aligning themselves together into a new free trade alliance block.

The shift away from the stability of the post-World War II order is well under way. This is one of the many reasons why gold makes sense in an IRA as a hedge against financial instability. It also helps to explain why gold still glitters for many world leaders.

President Trump and German Chancellor Angela Merkel Hold Frosty Meeting in Washington D.C.

This past Friday saw the rescheduled meeting of the two most powerful leaders in the free world— U.S. President Donald Trump and German Chancellor Angela Merkel. The long-expected meeting in Washington D.C. got off to a rocky start between the pair as there were a few uncomfortable moments.

President Trump did not shake hands with Chancellor Merkel during the Oval Office photo op, nor were there many light-hearted moments besides the President Trump comment that they possibly shared the “in common” past of U.S. intelligence surveillance. Angela Merkel did not laugh or even smile though.

The two leaders had their share of clashes on global and U.S.-German trade relations throughout the Friday meeting. President Trump insisted:

“The negotiators for Germany have done a far better job than the negotiators for the United States. But hopefully we can even it out. We don't want victory; we want fairness.”

Chancellor Merkel responded with her own world view on the subject:

“When we talk about trade talks, the European Union negotiates for all of the member states in the European Union. In this spirit, I would be very happy if the European Union and the U.S. can take up talks again.”

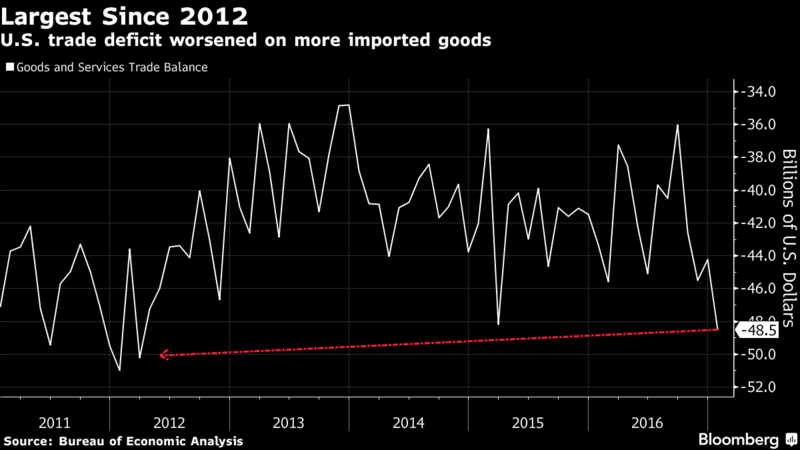

The differences of opinion from the two global leaders showed how far apart the “America First” agenda and pro-global world order really are. This chart demonstrates the severity of the United States trade deficit (currently at over $48 billion), which President Trump correctly pointed out worsened over a number of the years of the Obama administration:

The meeting of the two leaders was long viewed as a significant test for President Trump and his vision of global foreign policy. In Angela Merkel, he met his match with not only the leader of the European powerhouse economy and exporter Germany, but also the de facto leader of the European Union and greatest champion of the international order that has existed since the end of the Second World War. President of the Council on Foreign Relations Richard Haas succinctly summed up their different global positions and experiences:

“He's been president less than two months; she has been chancellor more than 10 years. She has all this experience. She's the most important leader in Europe. Some would say she's the most important leader in the world right now.”

After the cordially frosty meeting between the pair ended, President Trump raised another issue that divides the two long-time allies. He articulated via his 27 million follower-strong Twitter account on Saturday how the United States will not budge on the claim that Germany needs to contribute more to the United States for providing Germany's national defense from aggressors like Russia:

“Germany owes vast sums of money to NATO & the United States must be paid more for the powerful, and very expensive, defense it provides to Germany!”

Trump had already harshly criticized NATO and the EU in an interview he gave in January. The German response to these comments was quickly forthcoming. Their Defense Minister Ursula von der Leyen responded to President Trump's comments with:

“There is no debit account in NATO. We all want fair burden-sharing and that requires a modern concept of security.”

President Trump and Chancellor Merkel continue to have wide position and policy differences as evidenced by this meeting and its aftermath. Council on Foreign Affairs Richard Haass summed up the differing positions between the two global leaders' relationship and positions well with an explanation of the divergent political roles they bear:

“Trump is a disruptor and she is a preserver. She wants to maintain the EU, she wants to maintain NATO, she's wary of Putin. And Trump in every one of these is different: He supports Brexit and is questioning traditional support for NATO and potentially open to a very different relationship with Russia.”

The lack of harmony in arguably the most important defensive alliance in the world today is another reason why you need to remember that gold outperforms traditional asset classes during market crisis periods.

G20 Clash of the Titans Emerges Between Protectionists and Free Trade Blocks

Even as President Trump and German Chancellor Merkel were wrapping up their meetings in Washington D.C., the G20 was ironically beginning their meeting in Baden-Baden Germany to discuss the state of free trade and anti-protectionism, among other issues.

The weekend meeting of the globally dominant Group of 20 preserved a semblance of policy agreement by issuing a joint communique which attempted to cover cracks rapidly developing in the world economic order. The omissions of the statement were more telling of the new disagreement on the future of global trade between the world leaders.

UBS Wealth Management Global Chief Economist Paul Donovan from London argued:

“Saying that the G-20 wishes to avoid protectionism does not necessarily make it so — arguably protectionism has risen in the past few years in spite of public pronouncements. However, the deliberate change in tone reinforces the idea that on trade, the Trump administration will implement at least some of the the campaign rhetoric.”

United States Treasury Secretary Steven Mnuchin insisted on the wording of the communique statement to include the importance of trade being “fair.” China became the champion for free trade by defending the current rules of engagement existing within the World Trade Organization.

By the time they came to some agreement, the ministers concurred on a weakly positive trade message that “we are working to strengthen the contribution of trade to our economies,” as a compromise position to save the free trade movement foundations of the G-20 organization. EU Commissioner for Economic and Financial Affairs Pierre Moscovici decried:

“The single most important decision which helped to fend off a type of depression like in the 1930s in the wake of the Lehman Brothers collapse was that we avoided a fallback into protectionism and that we kept the global economy open. I cannot overstate the importance of avoiding any rollback on this.”

Moscovici's words regarding trade battle lines being drawn represent a dire warning and good argument for using gold to hedge your portfolio from financial instability in the world today.

Free Trade Talks Between EU and China Opened With Overtures at G20 Meetings

An interesting result of this new rift on trade between the United States and European Union is that it is forcing decades-long tense rivals China and the E.U. to move closer together on plans for free trade. Just this past week, Germany's Angela Merkel and Chinese President Xi Jinping held a phone conversation (reinforcing the rise of Chinese power) and agreed together they would “continue their trusting cooperation” concerning open global markets.

The pair have not missed a chance to reaffirm their mutual stances as pro-free trade economic entities. Former Chinese Trade Official in Europe Professor Wang Yiwei declared:

“There are still many obstacles to cooperation. We don't look to Europe to balance the United States, but we can hope that Europe might help with the kind of American unilateralism or its tendency to do whatever it pleases that we've seen in the past.”

Even as you read this, Chinese President Xi is planning his visit to Berlin for this year to move the E.U. and Chinese camps closer together on free trade. U.S. Secretary of Defense General Mattis said it best in his confirmation hearings before the U.S. Senate that “the world order is under the greatest attack since World War II.”

Be sure your investment and retirement portfolios are protected within a gold IRA in these geopolitically disruptive and divisive times.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum