- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

As Bitcoin Soars to New Highs, Ransom Ware Hijackers Hold the World’s Computers Hostage for Bitcoin Payments

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

Last Updated on: 15th May 2017, 09:03 pm

This past week saw the world's most devastating and far-reaching cyber attack on computers across three quarters of the nations of the world (so far). A flaw in Microsoft's various operating systems made it possible for the ransom hijackers to lock up files by encryption on firms and organizations ranging from America's FedEx, to Britain's National Health Service, to Spain's Telefonica phone giant, to Japan's Nissan, to Russian, Taiwanese, and Ukrainian government and business computers. The full extent of the damage will not even be known until people return to work and start up their computers throughout the beginning of the work week.

Meanwhile, the very same Bitcoin in which the ransom hijackers were demanding to be paid reached all-time highs this past week. Bitcoin soared more than 13 percent to top $1,800 per BTC at one point. Analysts have said this global currency disruptor has only begun its meteoric rise over the coming six months as it gains newfound acceptance and legitimacy throughout the world.

And over in France, the spotlight shifted from Emmanuel Macron's hopeful inauguration as president of the Fifth Republic over to the coming parliamentary elections of the General Assembly on June 11th and 18th. Macron's party leads a field of five different competing sides. It looks as if he will need a miracle to win a governing majority next month.

In Asia, North Korea test fired another missile in defiance of the international community and especially Presidents Trump of the U.S. and Xi of China.

Everywhere you turn, you are reminded more than ever why gold makes sense in an IRA. The best way to protect your investment and retirement assets is with physically stored IRA approved gold that no one can take away from you. World headlines are warning you to look into the Top 5 Gold Coins for Investors.

Cyber Attack on over 150 Countries Throughout the Globe Holds the World For Ransom

An unprecedented in scale, scope, and effectiveness cyber attack on computers throughout the globe shook the world on Friday afternoon. As of Sunday night, the damaged computers already tallied over 200,000 with many more infected ones expected today as people returned to their work and started up their computers and laptops.

Hospitals and the first hit facilities had managed to recover from the initial lockout of all their files as the hackers struck in what was only the first wave in an effort to collect bitcoin-based ransom in exchange for releasing the infected computers. In a strange twist of irony, Bitcoin just reached an all-time high the same week as the cyber attack took place.

The virus has been named the WannaCry – “ransomware.” It initially tied up computers from hospitals, to car manufacturing facilities, to schools, to shops in a number of nations. Russia's Ministry of the Interior, the British National Health Service, carmakers Nissan Motor Company of Japan and Renault SA of France, American logistics and shipping giant FedEx Corporation, PetroChina, and countless other hospital and corporate computer systems ranging across the United States, to Western and Eastern Europe, to Asia were all impacted. This devastatingly effective malware has supposedly been stolen off of the U.S. National Security Agency.

As cyber security and international and national police forces tried to figure out who was behind the attack and how to stop it, the hackers themselves were busy encrypting important files on all impacted computers so they could not be accessed. They demanded ransom usually in the amount of $300 in Bitcoin to release the machines. Any finger pointing at Russia was immediately ruled out by Dutch security firm Avast Software that revealed both Russia and its hostile neighbor the Ukraine were heavily infected. The map below shows the initial reports of RansomWare infection incidents:

Rob Wainwright the Director of Europol warned on Sunday that this attack was completely unique in its deadly combination of both ransomware and the functionality of a worm which enabled the computer infection to spread from computer to computer automatically:

“We've seen the rise of ransomware becoming the principal threat, I think, but this is something we haven't seen before — the global reach is unprecedented. The latest count is over 200,000 victims in at least 150 countries, and those victims, many of those will be businesses, including large corporations. At the moment, we are in the face of an escalating threat. The numbers are going up; I am worried about how the numbers will continue to grow when people go to work and turn (on) their machines on Monday morning. Of course there are amounts that are being demanded, in this case relatively small amounts – $300 rising to $600 if you don't pay within three days.”

Wainwright and Europol are not alone in their concern about the weakness of cyber security, particularly in the healthcare universe where so much personal and financial patient data is stored. British Defense Minister Michael Fallon shared with the BBC that:

“The NHS was not particularly targeted. There were the same attacks applied to Nissan on Friday and in other areas of the economy and indeed around the world. But let me just assure you, we are spending money on strengthening the cyber defense of our hospital system.”

Fortunately for hundreds of thousands of business and organizations, a security researcher discovered a means of disabling the worm's ability to spread. Yet computer experts warned that the clever hackers would probably launch a second assault because of the gaping security weakness in Microsoft's Windows operating systems. The March-released security patches were not downloaded by legions of personal computers which remain completely vulnerable to any additional assaults.

Microsoft's President Brad Smith chastised governments of the United States and the world on Sunday with an ominous warning about governments needing to take this lapse as a “wake up call” with:

“They need to take a different approach and adhere in cyberspace to the same rules applied to weapons in the physical world.”

While it remains to be seen how much the cyber criminals will realize in paid ransoms, as of Sunday night the total stood at $30,000 so far. COO and co-founder of Elliptic Enterprises Limited Tom Robinson believes that the ransom total will rise “substantially” in the coming week.

Bitcoin Reaches New All Time Highs

Coincidentally the same week that the cyber hackers held up the world for ransom in their computer attack, Bitcoin notched substantially new all-time highs in its prices. On Thursday, the world's leading crypto-currency soared higher to smash through $1,800. When the currency pulled back at the end of the week, it had still realized over $200 in gains in the one week alone. The price increases started in response to an enormous boost in demand from across the globe.

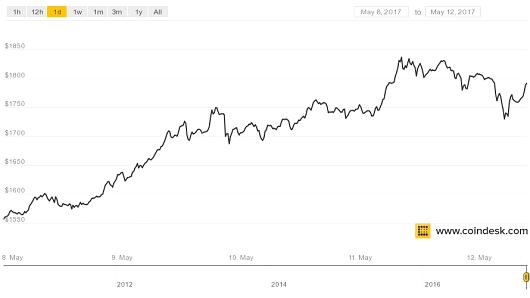

Bitcoin began this past week at approximately $1,555 per BTC. By Tuesday it had broken through $1,700 apiece for the first time ever. This chart from Coindesk shows how dramatic the surge in just the last week was:

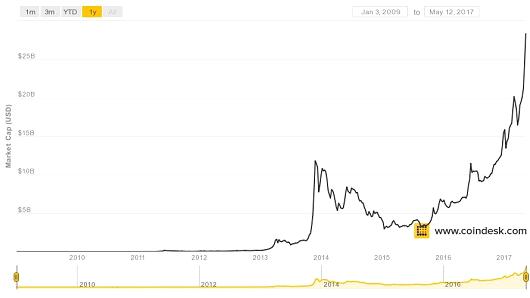

Even though the foremost crypto-currency touched $1,830 before retreating to $1,772, it still closed out the week with an approximately 13 percent gain. This jump has increased the BTC market cap by an impressive $2 billion to reach $28.86 billion. It has grown from only $16 billion based on its price on January 1st. Look at this chart which demonstrates the meteoric rise in Bitcoin prices from its humble launch in January of 2009:

A few reasons explain the dramatic price increases since only the beginning of 2017. The SEC Securities and Exchange Commission is considering allowing an ETF exchange traded fund based on bitcoin. More importantly still is the Japanese decision in the month of April to accept Bitcoin's legitimacy as a currency. Naturally this caused an enormous jump in demand for the crypto-currency from Japanese investors of all types, but particularly from the growth asset-hungry institutional investors.

CEO and cofounder Gran Strajnar of Brave New Coin the digital currency data provider stated:

“The world is full of cheap or free credit. There are asset bubbles everywhere from property to retail to bonds. Lots of cheap credit is looking for new safe havens to move into and digital assets are an attractive new asset class. The volatility (of digital currencies) really doesn't matter as demand greatly outstrips supply. We expect some corrections but have adjusted our outlook and are now feeling that the $1,200 to $1,800 per bitcoin price band is a temporary consolidation period before undoubtedly climbing up to $3,800 to $8,000 over the next six months.”

Newly Sworn In French President Macron Faces Immediate Challenges of Parliamentary Elections

Amid much fanfare and optimism, the French centrist who won the presidential election became sworn in yesterday as the latest head of state for France. While jubilance from his supporters and sombre resignation from his opponents in the French electorate were in evidence, the world received a stark reminder from outgoing French Finance Minister Michel Sapin regarding the prospects of Macron actually winning a working parliamentary majority in the upcoming June 11 and 18th General Assembly elections with:

“The elections will be held and it's possible that the right will have a majority. The majority takes action and I don't think there's any contradiction between what a right-wing party working with a left-wing president. But in any case, we've already experienced cohabitation twice. It didn't stop things from working.”

Sapin who opined from the sidelines of the G7 finance ministers' meeting this past week in Bari, Italy was speaking optimistically. Now-opposition leader Marine Le Pen does not want Macron to succeed at all, for the very simple realpolitik reason that she already has her eye on running for French President again in 2022. She represents the total opposite of his policies in every category. The French parliamentary elections next month will be the key ones to watch. Gridlock and deadlock in France over the next few years will likely spell the ultimate victory for the anti-EU, far right, ultra nationalists in the Fifth Republic.

France is only the latest reminder of why you need to hold onto your gold. Between the massive global cyber hacking attack and continuing geopolitical instability around Europe, Asia, and the whole world, you need the precious metals allowed in an IRA to protect your retirement assets now more than ever. It is time to learn the gold IRA allocation strategies fast.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum