- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

As Anti-EU Wilders Threatens to Upset Dutch Elections, Fed Threatens Rate Hikes and PM May Threatens Brexit Trigger

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

Last Updated on: 13th March 2017, 12:51 pm

This past week saw the continuing geopolitical chaos in Europe and the world move to a new level. On the continent, a war of bitter words and Turkish street protests erupted between the Netherlands and Turkey just before the most important election in recent Dutch history happens this Wednesday, March 15th. Pollsters and analysts are already admitting this will likely help populist anti-Islamic and anti-EU candidate Geert Wilders with strong last- minute, day of election voter turnout.

In the United States, the Federal Reserve continued to threaten the stability of global currency exchange markets by suggesting strongly they will proceed to hike the all-important U.S. benchmark interest rates three separate times this year, starting this week at the Fed's March meeting. U.S. stock markets are so far taking it in stride, though it could create significant headwinds for the relentless march of the stock indices later this year.

Across the pond in the United Kingdom, Prime Minister Theresa May continued to fight for the right to push forward unfettered with her Brexit negotiations which she intends to trigger by invoking Article 50 this very month. Her government quietly admitted on several occasions that they are increasingly preparing for a no-deal divorce where they may simply walk away from the European Union. Everywhere you look, you see the reasons why gold still glitters for many world leaders. It also reminds you that gold makes sense in an IRA.

With Dutch Elections In Focus, Turkish Diplomatic War and Protests Break Out

Last week saw an unforeseen quarrel erupt between first the Netherlands and Turkey before it expanded to involve the European Union and Turkey. The conflict started with the Dutch Prime Minister refusing two Turkish ministers admittance to Rotterdam to promote the Turkish referendum giving President Erdogan of Turkey dictatorial powers if it passes. When one of the Turkish ministers attempted to sneak back into Rotterdam to hold the rally even after they were barred from it, events quickly spiralled out of control.

By the weekend, Turkish citizens living in Rotterdam were protesting violently in the streets and Dutch riot police were using water cannons and smoke grenades against Turkish citizens. In what looked eerily like a reprise of the historically sour relations and frequent armed clashes of the Turkish Ottoman Empire against Christian Europe, Turkey's Erdogan called the Dutch government Nazis and and the German government fascists. The chaos spiralled further out of control when Denmark unexpectedly entered the fray. They threw their weight behind the Netherlands and Germany by announcing they would bar Turkish ministers from holding pro-Erdogan rallies in Denmark.

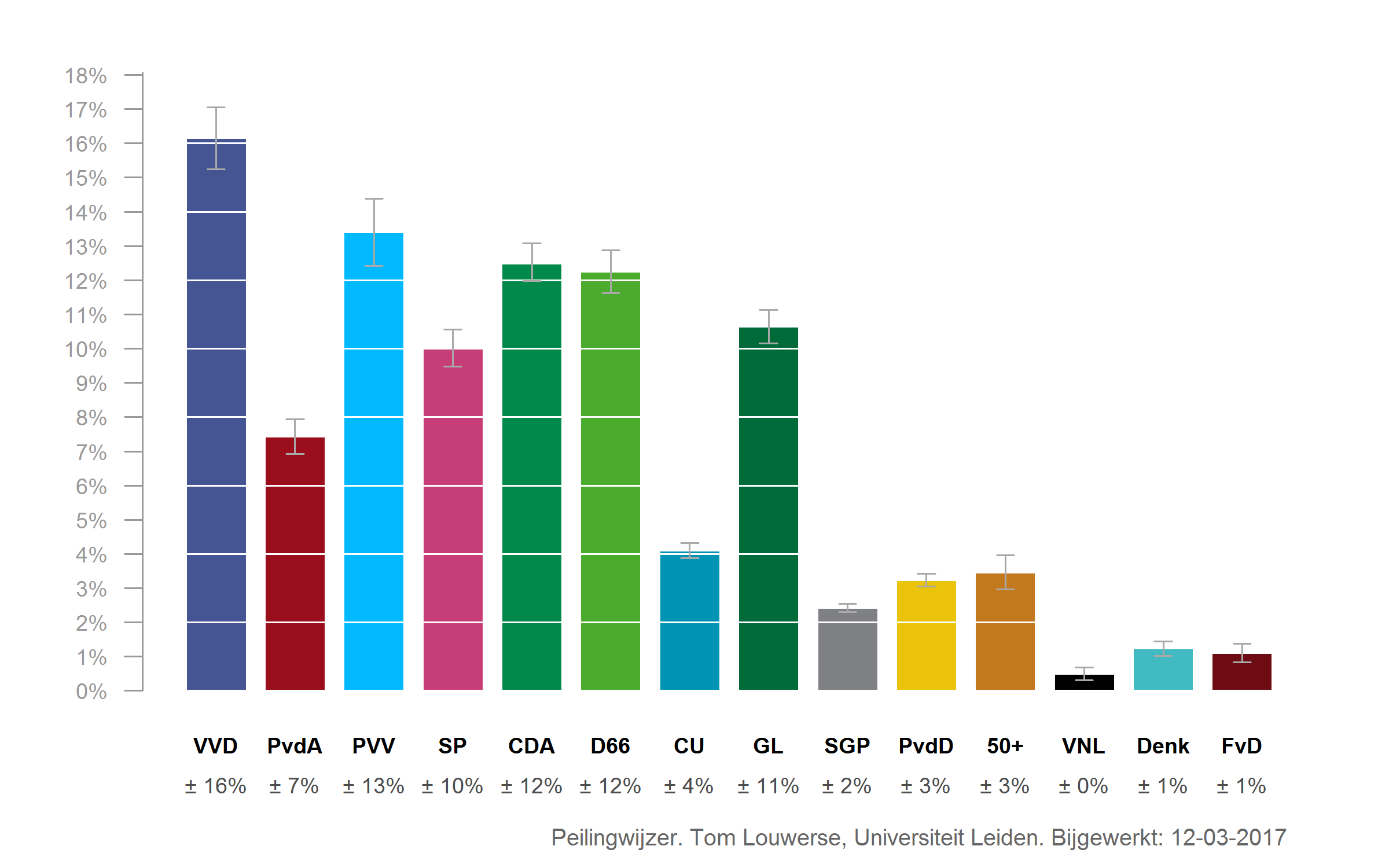

All these troubling events would be significant and bad enough if there were not crucial Dutch national elections this Wednesday. Polls show that the right wing populist/nationalist leader Geert Wilders, long a favorite to win the election out of the 28 parties vying for leadership of the new government, will likely get the boost he needs to come out on top after having recently slipped in the Dutch polls. Look at these graphics below to see how close a call it is already. The light blue PVV is the party of Wilders:

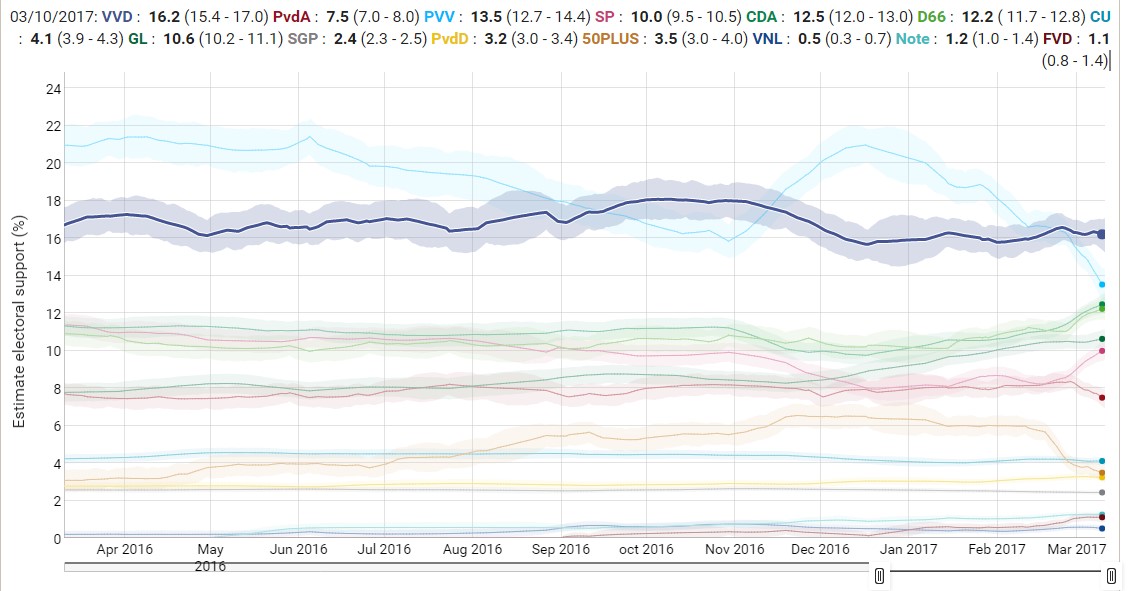

Recent trends had shown Wilders losing momentum, as this polls trending graphic demonstrates in light blue:

Analysts are saying that both current Prime Minister Mark Rutte and ultra-nationalist Geert Wilders will benefit from these events as the increasingly hateful rhetoric from both sides has overshadowed the last days of campaigning. The conflict is energizing the Wilders' campaign exactly as it appeared to be losing momentum, as Political Science Professor Sarah de Lange of the University of Amsterdam ominously warned:

Rutte could benefit “because he acted firmly to defend the Netherlands in an international conflict. Wilders could benefit because this incident strengthens the image that Turks are not integrated and show more loyalty towards Turkey than to the Netherlands. This could give him more support for his claims about Islam and sending people back to their own country.”

In fact this swing to Wilders is already materializing. Late weekend polls show that voters who were previously only somewhat likely to vote for Wilders now say emphatically that they will definitely vote for the anti-EU and -Islamic nationalist party candidate.

It bears close watching, as the critically important European bond markets will not only feel the effects of a strong showing by Wilders in the Netherlands, but more strongly and importantly in other countries with strong nationalist parties likely to win elections later this year such as France (May 7th) and Italy (probably by the end of the year). Now it is no longer just a potential Marine Le Pen French presidential victory threatening to blow up the EU.

U.S. Economic Indicators Push Fed Towards Three Interest Rate Hikes for 2017

Friday gave yet another assurance to Federal Reserve Chair Janet Yellen and company that they can go ahead with not only their anticipated March rate hike, but another two hikes for the remainder of 2017. The impressive job report was the latest in a series of stronger economic indicators for the U.S. It revealed growth in jobs averaging around 235,000 for January and February, which was above the trend. Hourly wages also rose 2.8 percent.

Thanks in no small part to this report, the Fed is anticipated to raise its benchmark fed funds rate by a quarter point to between .75 percent and one percent in March. This coming Wednesday, the Fed will unveil its latest economic forecasts. Analysts are looking to see if there will be any change in the market consensus estimate of three single quarter point interest rate hikes for 2017. The long-term credibility of the Fed is at stake now since last year Yellen's Fed forecasted four rate hikes but only delivered a pitiful single one last December.

Expectations are currently for the March rate hike, a June increase, and then another one later in the year. This all depends of course on the results of the Dutch, French, and Italian elections later this year. Events outside the United States were responsible for tripping up the Fed and their promised rate cuts last year (ala Brexit and China). Judging by the polls in Europe, several highly possible nationalist candidate upsets could trigger financial market instability and tie Janet Yellen's hands yet again this year.

Brexit Battle Rages As PM May Pushes Towards Article 50 Exit Trigger

This past week saw British Prime Minister Theresa May dealing with rebellions within her own ruling Conservative Party over gaining unstoppable powers to both trigger and unilaterally negotiate (from the British side) the Brexit divorce from the other 27 countries in the European Union. The House of Lords sent back her recently passed bill with two rounds of amendments proposed. One was to protect EU citizens already living in Britain, and the other was to insist that she can not simply walk away from the negotiating table with no deal unless Parliament approves.

This week the House of Commons will debate over-ruling the Lords in an effort for her to regain the momentum to move forward with her March triggering of Article 50 of the Lisbon Treaty. There is rampant speculation she may invoke the divorce protocol as early as this Tuesday, Wednesday, or Thursday. She has promised to do so before the end of March.

Meanwhile, the topic of a possible withdrawal from the European Union without a deal has begun and stubbornly persisted this past week. Key player in the British referendum vote to Brexit Foreign Secretary Boris Johnson told ITV Sunday:

It would be “perfectly OK, not apocalyptic” for Britain to walk away from the EU without an agreement.

Open Britain released research on Sunday that showed Britain would then enjoy the worst trading arrangements with the EU out of all the important G20 countries of the world. More critically for the bigger picture in Europe as a whole, these troubling discussions come at exactly the wrong time for stability in both Great Britain and the European continent.

April 6 is the summit date at which the EU is expected to approve their own negotiating rules for the European Commission. Between now and then, the Netherlands will hold their critical elections March 15th, the eager to breakaway from the U.K. Scottish National Party will hold their emergency “Scoxit” threat conference from March 17th to 18th, and the E.U. will hold its March 25th 60 year anniversary celebration of the EU- founding Treaty of Rome.

Gold is the insurance your portfolio desperately needs to survive the continuing and escalating turmoil. This study shows you how gold outperforms traditional asset classes during market crisis periods like the one which world events seem to be bringing together now.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum