- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

Analysts Warning Stock and Bond Selloff May Not Be Over

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

Last Updated on: 26th February 2018, 03:32 pm

This past week, several prominent market analysts warned that the selloff in equities and bonds may not be over yet. In fact, Morgan Stanley argued that for stocks it is just beginning. The last week of January and first week of February saw U.S. equity markets sharply decline by more than 10 percent.

Since then a partial market recovery has pulled back in many investors, but it could very easily be a sucker's rally. This is why you simply can not put all of your investment and retirement account assets into only equities and bonds. The likelihood of more market turbulence to come reminds that you need to consider IRA-approved metals.

Gold is the asset class that has consistently protected investors from market volatility and financial instability for thousands of years. This is why gold makes sense in an IRA. Now is a good time to consider adding some of the top five gold coins for investors to your retirement portfolio.

Morgan Stanley Warning Cautions that the Plunge May Not At All Be Over

Markets have been fretting for years that the central banks of the world would start to increase global interest rates from the all time lows. Between the near zero interest rates and asset purchase regimes (such as quantitative easing), these governments were able to increase the growth in economies stricken by the Global Financial Crisis of a decade ago. Yet now that the full withdrawal of this support is nearing, liquidity is already fast drying up in both equity and bond markets.

This contributed to the severe equities' pullbacks of late January and early February as bond yields rose steadily. Part of the reason for Treasury yields increasing stemmed from a diminishing foreign demand for U.S. debt. This coincided with a larger supply of it offered on markets at the same time. With not enough buyers at the low rates offered, the yields were bound to rise. Treasury rates influence values on investments around the world on everything from stocks to debt from emerging markets.

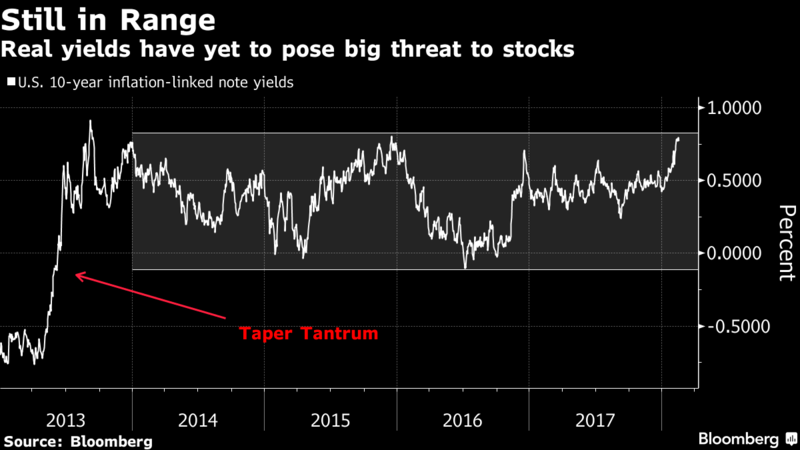

Yet despite the pullback that has already taken place, investment banking giant Morgan Stanley warns that the most significant test has still not arrived. They base this worrisome argument on inflation adjusted bond yields. Morgan pointed out last week that these adjusted yields are still within their last five year long range as the chart below demonstrates:

It means that the yields have not really threatened stocks so far. This has led Morgan Stanley's team headed by Strategist Andrew Sheets to call the correction of the past month merely the “appetizer, not the main course.” It was these low real bond yields that helped to drive equities higher over the last decade. This means that in order for stocks to resume a higher move, there would have to be significant growing earnings to account for it, according to Sheets.

Yet this boost to earnings is not necessarily in the near term cards. Sheets' team instead believes that a slowdown in corporate earnings is likely beginning in 2018‘s second quarter. Meanwhile, the greater real bond yields signal a larger discount rate to earnings in the future. If these real rates do manage to escape from the last five year range with investors expecting more normal central bank policy, it could really pressure stocks lower next time. Andrew Sheets and his team explained this with:

“It's when growth softens while inflation is still rising that returns suffer most. Strong global growth and a good first quarter reporting season provided an important offset. We remain on watch for tricky hand off in the second quarter, as core inflation rises and activity indicators moderate.”

In laymen's terms, they are referring to a combination of economic and policy factors ganging up on stocks and taking them potentially significantly lower than what you have seen so far.

JP Morgan Also Warning About Rising Bond Rates

It is not only Morgan Stanley that is sounding the warning alarm about markets being in danger of greater future declines. Strategists at rival mega bank JPMorgan Chase and Company are also claiming that the real bond rates are a possible turning point for the equities markets. For JP Morgan, the inflation adjusted cash rate is the one that is most critical to watch.

Analyst Warns of A Third Wave in the Market Selloff

Still a third analyst points out historical reasons to believe that the recent volatility and severe pullback has not ended. Longview Economics Chief Executive Chris Watling has been out warning about a third wave in market models. He claims that this is coming because market history and analysis consistently reveal that these types of corrections occur in “three waves.” Watling explained how this works in more detail with:

“You get your vicious first wave sell off that we had with the high on January 26 in the U.S. Then you get your typical wave two relief rally which we had last week when the S&P 500 was up six percent, the best weekly performance since 2011. Then you tend to get a third wave to either new lows or testing the lows from the first wave sell off. There's huge complacency. Everyone's talking about a healthy market correction but generally when you have proper pullbacks people are slightly fearful of the bottom — they're not regarding it as wonderful. So typically, that third wave is key, and I think there's probably some more downside risk over the next few weeks.”

Watling has astutely pointed out that U.S. and global investors enjoyed an unusual two full years when markets were mostly rising upward in a straight line. This is not normal for markets and investors to demonstrate such complacency. Phrases like “melt up” became all too common among analysts and investors alike. Now there is a drying up of liquidity. This is a real danger to the bull market of the last near decade.

This relative disappearance of liquidity explains why Watling remains nervous about additional market sell offs happening. He reminded you that:

“This has been the most heavily, liquidity fueled bull market ever. So sniffing taking it away, which was perhaps what the correction was about in January, is quite a dangerous environment. I'd be very nervous, in the medium term, about what happens when liquidity is withdrawn.”

The anticipated four interest rate hikes from the Federal Reserve are yet another example of the cheap and easy money (that has propped up global stock markets since 2009) going away soon.

Gold Is The Natural Hedge Against Declining Markets

This potential for more equities market blood letting reminds of why you need gold to offset investments in declining stock and bond markets. Gold outperforms in times of market crisis. When stocks go down, the ultimate safe haven holds its store of value and often increases as well.

Gold's resilience and performance over the last centuries and millennia helps to explain why many world leaders still hold gold for their nations and themselves. Now is the time for you to look into getting some IRA-approved gold for your own portfolio while you still can. You can buy gold in monthly installments these days. Besides this, you are able to utilize top offshore locations for storing your gold IRA now.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum