- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

A Once in a Decade Opportunity in Gold

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

Last Updated on: 1st October 2013, 01:11 pm

There’s a rare opportunity in gold right now that doesn’t come around too often…

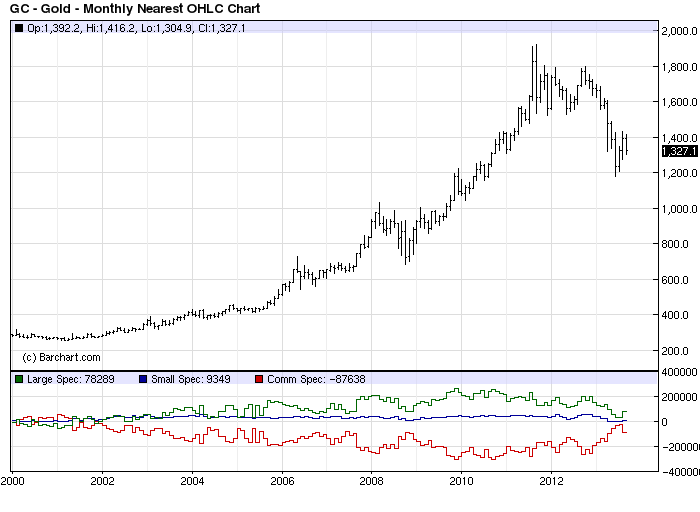

Below is a chart of gold since 2000. Notice at the bottom of the chart there are three colored lines, which represent the following:

Green Line = Large Speculators

Blue Line = Small Speculators

Red Line = Large Producers of Gold

A positive reading means that collectively this group is a net buyer of gold, while a negative reading means that the group is a net seller of gold.

Historically, speculators both Large and Small are always wrong at market bottoms and tops. The old saying about speculators is “They’re always long and always wrong.”

You’ll notice on this chart that the speculators (Green and Blue Lines) are buying large amounts of gold at the tops in 2006, early 2008, and 2011.

Speculators Have Stopped Buying – That’s Your Cue

But look at how the speculators buying activity comes to a halt when prices are getting ready to blast off in 2004, late 2006, and at the bottom in 2008.

Here’s what’s exciting…

In the last month, the speculative buying activity has completely died. The speculators haven’t been this afraid to buy in years!

On the other hand, the Large Producers of gold (Red Line) are typically sellers of gold since that’s the business they’re in. Therefore, the Red Line on this chart is most often going to be below the zero line. They like to sell a lot of gold when the prices are high, and when prices are lower they don’t offer out as much.

In the last month look at how they have really pulled back from selling gold to the market. It’s the closest the producers have come to being net buyers in 12 years!

Think about it this way…

If you were in the business of manufacturing cars (a car producer), you wouldn’t want to be buying finished cars because you're trying to get rid of the inventory you already have. But, if finished cars were coming back on the market at prices that were ridiculously low, and you knew demand was strong enough to take your extra inventory, then you’d be OK with buying cars.

Producers of gold have almost gotten to that point, and at the very least they don’t want to sell too much gold at these low prices.

That’s very bullish.

Here’s how to take advantage of this situation…

The easiest thing to do is to buy gold bullion. Demand for physical gold is very high due to all the risks of “paper gold”, which includes ETF’s and other types of gold certificates. So the premium to spot price will be a bit high, but try to get your bullion below $1,400 an ounce.

A Rare Opportunity in Gold Stocks

There’s also a rare situation that’s occurring in gold stocks you should know about.

Relative to the price of gold, gold stocks are at historically cheap. In other words, gold stocks are way too low compared to the current price of gold at $1,320.

Gold stocks should be much higher because their earning potential with gold at these prices is incredible.

In fact, the last time gold stocks were this cheap was during the financial crisis of 2008, and after that gold stocks were up 200% in just six months!

Before that was 2001, which marked the beginning of the massive 12 year bull market in gold.

This is your cue to step up to the table and buy.

What to Buy

Buy Barrick Gold (ABX) below $18/share and Iam Gold (IAG) below $5.25/share. These are two of the lowest cost gold producers in the world, both of which can pull gold out of the ground for around $750/oz or less.

In other words, these two companies can make money even if gold were to fall all the way down to $800/oz.

That’s a nice safety net, since other companies like Newmont and Kinross are at around $1,200 in costs just to pull an ounce of gold out of the ground.

Barrick has a dividend yield of 1.13% and Iam has an even nicer dividend paying 4.66%.

Buy them both and hold for at least a double, and if they go down further sell calls against your position to reduce your cost.

If you are interested in opening a Gold IRA, you can receive more information about the process by requesting the free gold investment kit below.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum