- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

IRA-Approved Gold

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

In the following paragraphs, you'll learn how to find the right types of gold bullion products for your Gold IRA, become familiar with IRS requirements for IRA gold, and see a list of popular gold coins and bars that are NOT IRA-eligible:

Table of Contents

IRS Requirements for Gold

The IRS allows the holder of a self-directed precious metals IRA to hold eligible silver bullion products within a retirement account that offers numerous tax benefits. This allows the investor to protect their portfolio from inflation while also generating retirement wealth on a tax-deferred or tax-free basis, using gold as an alternative investment within an IRA. Here are the main bullion eligibility requirements set forth by the IRS in regard to gold stored in IRA:

-

To be eligible for IRA investing, a gold bullion product must meet the minimum purity requirement for IRA gold, which is set at 0.995-pure. In other words, a gold coin or bar must be at least 0.995% pure to be deposited into an IRA.

-

The gold being deposited into the IRA must be stored in an approved depository. A depository is a highly secure precious metals storage facility. Only certain depositories have been approved by the IRS to hold IRA gold. Most bullion dealers and brokers will have one or more preferred depositories.

-

A custodian must be appointed as the trustee of the IRA. In a typical scenario the investor would find a bullion dealer from whom they're going to purchase the gold for their IRA, and then that dealer would then assist them in the process of setting up the account with their partnered custodian and depository. As such, the investor usually only needs to deal with one company (a dealer/broker) to begin investing in a Gold IRA

IRA-approved Gold Coins

Here's a list of some of the most popular gold coins that are eligible to be deposited into an IRA:

| American Gold Eagle Coin - The American Gold Eagle is 91.67 pure, but the coin itself weighs 1.0909 troy ounce, so the coin still contains 1 troy ounce in gold. |

| American Gold Buffalo Coin - These coins were the first 1 oz .9999-gold coin released by the United States Mint in 2006. The Gold Buffaloes quickly proved to be considerable competition for their Canadian Maple Leaf counterpart. |

| Australian Gold Kangaroo Coin - These coins were introduced in 1987 by Gold Corp, a company that is entirely owned by the Western Australian Government. Gold Kangaroo coins are considered legal tender in Australia and have remained a popular investment and collector's item during the past two and a half decades. |

| Austrian Gold Philharmonic Coin - This coin is known for its classic Musikverein design, which includes a symphony of common instruments like the cello, harp, violin, bassoon and french horn. |

| Canadian Gold Maple Leaf Coin - The purity and weight of Canadian Gold Maple Leafs are guaranteed by the Royal Canadian Mint. These coins are typically sold in packs of 10 in mint tubes. |

| Canadian War of 1812 Gold Coin - The Royal Canadian Mint guarantees both the weight and purity of these extremely limited editions commemorative coins issued on the bicentennial of the War of 1812. These coins come in sheets of 20 directly from the Royal Canadian Mint or in singles. |

Popular IRA-approved Gold Bars

| Credit Suisse Gold Bar – These bars are minted by the prestigious Credit Suisse mint headquartered in Zurich, Switzerland. All Credit Suisse bars meet minimum purity levels of 99.99%. |

| Johnson Matthey Gold Bar – Although these bars are less frequently available for sale than some of the other popular gold bullion bars, Johnson Matthew bars come in a variety of denominations and are industry-renowned as some of the finest gold bars money can buy. Johnson Matthey gold bars are guaranteed to meet a.9999-fine gold purity level. |

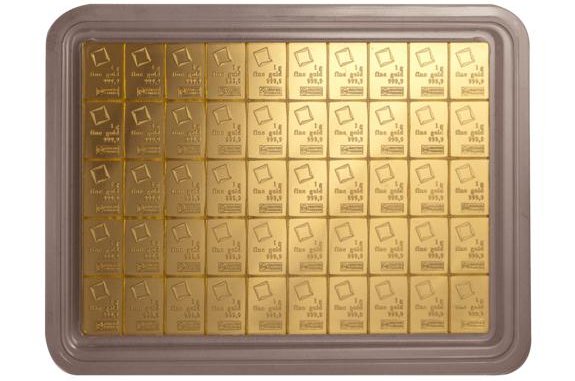

| Valcambi Gold CombiBar – These “divisible” bars consist of 0.999% pure gold and provide the distinct advantage of being split into 50 easily detachable 1 gram mini bars. |

Gold Bullion Coins NOT Allowed in an IRA

Although there are literally thousands of gold coins that cannot be used in IRA investing, the following list shows some of the more popular non-eligible coins. Steer clear of any bullion dealer that tries to sell you the following coins for your precious metals IRA:

Although there are literally thousands of gold coins that cannot be used in IRA investing, the following list shows some of the more popular non-eligible coins. Steer clear of any bullion dealer that tries to sell you the following coins for your precious metals IRA:

- Chilean 100 Peso Coins

- Chinese Panda Coins

- Dutch 10 Guilder Coins

- French Napoleon Coins

- Israel Tower of David Coins

- Mexican Peso Coins

- U.K. Britannia Coins

- South African Krugerrand coins

- Swiss 20 Franc Coins

- Switzerland Vreneli Coins

- Somalia Elephant Coins

- United Kingdom Sovereign Coins

- U.S. Double Eagle Gold Coins

- Soviet and Russian Chervonets Coins

- Italian 20 Lira Gold Coins

- French 20 Franc Gold Coins

- U.S. Liberty coins

- Tristan Da Cunha Gold Double Sovereign

- Sierra Leone Gold Lion Head Coins

- Turkey Gold 100 Kurush

- Saudi Arabia Gold One Guinea Coins

- Bhutan Gold 1 Sertum Jigme Dorji Wangchuck Coins

- Singapore Gold 100 Singold Coins

- Macau Gold Year of the Monkey Coins

- India Gold Sovereign George V Coins

- Uruguay Gold 5 Pesos

- Argentina Gold 5 Pesos

- Denmark Gold 20 Kroner Frederik VIII

- Colombia Gold 5 Pesos

- Brazil Gold 20,000 Reis

- Cayman Islands Gold $25

- Niue Gold Hawksbill Turtle Coins

- New Zealand Gold Kiwis

- Peru Gold 100,000 Soles Miguel Grau (1979) and Peru Gold 1 Libra

- Venezuela Gold 60 Bolivares (1955-1960)

- Dominican Republic Gold 30 Pesos (1955)

- Guatemala 1/2 oz Gold Tecun Uman (1965)

- Austria Gold 100 Coronas

- Germany Gold 20 Marks Prussia (1871-1913), Germany Gold 20 Mark Bavaria Otto (1895-1913)

- Netherlands Gold 10 Guilders

- Belgium Gold 20 Francs Leopold II (1867-1914)

- Denmark Gold 10 Kroner The Nightingale (2007), Denmark Gold 10 Kroner Snow Queen (2006)

- Hungary Gold 100 Korona (1908)

- Cook Islands $100 Gold Armillary Coin Valcambi (2015 1 oz)

- Cook Islands Year of the Monkey $200 Mother of Pearl Series Gold Coins (5 ounces)

- Sweden Gold 20 Kronor (Gustaf V 1920)

- Isle of Man 1 oz Gold Noble (2016)

- 2001 Isle of Man 1/5 oz Gold Somali Kittens, 1994 Isle of Man 1/5 oz Gold Japanese Bobtail Cat, 1991 Isle of Man 1/5 oz Gold Norwegian Cat, 1995 Isle of Man 1/10 oz Gold Turkish Van Cat, 1992 Isle of Man 1/5 oz Gold Siamese Cat, 1994 Isle of Man 1/5 oz Gold Japanese Bobtail Cat, 1990 Isle of Man 1 oz Gold New York Alley Cat, 1993 Isle of Man 1/10 oz Gold Maine Coon Cat, 1989 Isle of Man 1 oz Gold Persian Cat, 2001 Isle of Man 1 oz Gold Somali Kittens

- Greece Gold 20 Drachmai George I (1884-A)

- Germany 1/2 oz Gold 100 Euro Introduction of the Euro (2002) and 2007 Germany 1/2 oz Gold 100 Euro Lübeck, 2005 Germany 1/2 oz Gold 100 Euro Soccer World Cup Germany

- Yugoslavia Gold Dukat Alexander I (1931-1933)

- Serbia Gold 10 Dinara (1882)

- Sardinia Gold 20 Lire Carlo Felice (1821-1831)

- Russia Gold 15 Roubles Nicholas II (189), Russia Gold 10 Roubles Chervonets (1975-1982)

- Italy Gold 20 Lire Vittorio Emanuele II (1861-1878)

- Poland Gold 10 Zlotych Boleslaw (1925)

- Monaco Gold 100 Francs Albert I (1882-1904), Monaco Gold 20 Francs Charles III (1878-1879)

- Gibraltar Gold 1/10 oz Royal Cherubs

- Ukraine 1/4 oz Gold Archangel Michael (2014)

- Venice Gold Zecchino Ducat Pietro Grimani (1741-1752), Venice Gold Zecchino Ducat Ludovico Manin (1789-1797)

- Portugal Gold 10,000 Reis King Luiz I (1878-1889), Portugal Gold 5000 Reis King Luiz I (

- Romania Gold 20 Lei 3 Kings (1944)

- Vatican City Gold 100 Lire Pope Pius XI (1929)

- M PJ Spain Gold Escudo (1781)

- Bermuda 1 oz Proof Gold $60 Triangle (1997)

- Niue 1 oz Gold $200 Hawksbill Turtle (2016)

- Fiji 1 oz Gold $200 Taku (2012)

In addition to the above coins, avoid all commemoratives, numismatics, and collector's coins. These coins are sold at unnecessarily high premiums and are not intended to be used as investments. Be aware that some sales reps will try to persuade you into buying these “rare,” “special,” and “limited edition” coins. In reality they are overpriced and very few of them will ever be worth more than the price they were bought for.

Benefits of Investing in IRA-approved Gold

Investing in gold within a precious metals IRA can be advantageous for the retirement investor in multiple ways. First, the account is not dollar-backed like a 401k or other type of retirement account, so the ongoing depreciation of the dollar will not detrimentally affect the value of the gold held in your IRA. In fact, when the dollar loses value this causes many investors to turn to gold and other precious metals as a means to store their wealth in a medium that will not depreciate. When this happens the demand for gold increases, thereby causing the price to rise as well. Gold IRA investors intrinsically benefits from this clear and consistent correlation – as the value of the dollar decreases, the value of gold increases.

In addition to protecting a portion of your retirement wealth from the devaluing effects of inflation on paper currencies, investing in gold within an IRA also gives you the opportunity to earn a substantial return on your investment in the long-term. With some analysts speculating that gold could reach $5000 per ounce within the next decade, and mining companies estimating that all of the discovered gold deposits on Earth will be mined within the next 20 years, now could be one of the best times in history to hold gold as an asset and retirement investment.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum