- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

Sigfig Investment Optimizer

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

Last Updated on: 25th March 2023, 12:27 am

SigFig Investment Optimizer

- Phone : 855-875-1580

- URL :

- Global Rating

- Very Good

User Rating

- 0 No reviews yet!

Review Summary :

SigFig claims that it can uncover wasteful fees and help you to see which money managers and investments are performing poorly within your personal investment portfolio. With $30 billion under management now, this rising personal financial and investment app is now playing in the same league as Wall Street's big boys. What's more, they actually deliver the goods on their promises to help you save and make more money and keep Wall Street honest.

Pros:

- Monitor your bank accounts, watch your investments, and more

- Platform updates quickly and gives a good perspective of your account

- Signing up and getting your accounts set up is very straightforward

- User interface is flawless enough to be great for even the beginner investor

- The level of customer service is world class and the team at SigFig are top notch people

Cons:

- Some trouble with linking accounts and not updating automatically or regularly

- App does not work right or display properly on iPad

- Users complain that the updated version of SigFig no longer links to Vanguard

- Must manually enter cash positions because they do not update automatically

Quick Facts about SigFig Investment Optimizer

Reviewed By:David Crowder

Have you purchased products from SigFig Investment Optimizer? Leave a review!

SigFig is the personal finance service with a funny name that is serious about helping you to get your head wrapped around all of your finances and investment accounts. The site and service tracks and helps you to manage all of your mutual funds, stocks, IRA's and 401k's, and all in a single secure app for personal finances and in actual real time. Read on to see if the software app lives up to its own claims.

SigFig Intro and Background

SigFig boldly declares that it is the most sophisticated, technologically advanced online portfolio manager. It is hard to measure an intangible claim like this objectively, but they are right about one thing. The fact that they boast fully $30 billion in investments under management can not be wrong.This is the one and only service that respected financial publication Barron’s called, “The data-driven financial planner of your dreams,” and that TechCrunch calls, “A new threat to the financial industry's status quo.”

We were understandably intrigued by such matchless claims, facts and impressive quotes, so we had to delve further into the mystery that is SigFig Investment Optimizer. How is it that a site which allows you to keep track of every one of your investment accounts and positions at no charge is able to provide such a popular and respected service to so many people? This is one of the burning questions to which we just had to know the answer.

SigFig Supported Platforms & Countries

SigFig supports the operating systems of Android and iOS devices as well as standard Internet browsers on desktop and laptop computers. Their synchronizing software works with over 80 major American brokerages. Among these are such heavyweights as Zecco, Wachovia, Vanguard, USAA, T. Rowe Price, Thinkorswim, TD Ameritrade, Sharebuilder, Scottrade, OptionsXpress, Merrill Lynch, Janus, Fidelity, ETrade, Edward Jones, Charles Schwab, and Ameriprise Financial. One weakness in their synchronizing setup is their inability to support any brokerage account or bank account that is based outside of the U.S. at this point. International customers are simply out of luck for now.

SigFig Tools and Features

While SigFig offers a number of tools and features, some of them are more standout than others in this world of personal financial apps. Among the better features and tools SigFig provides are:

Automation – The power of SigFig lies in its near-miraculous ability to gather up all of your investment and bank accounts information from over 80 American brokers and plug them into your very own single dashboard setup. This provides you with a current moment snapshot for every mutual fund, stock, ETF, and option you hold at any given moment, as well as your IRA and 401(k) investment retirement accounts.

Weekly Email Summaries – Are sent out showing your account performances and gains or losses in your individual holdings.

Relevant News – That affects your portfolio is also displayed when you log on to the site.

Account Holdings Based Alerts – Your dashboard shows alerts which focus on your portfolio's top gainers and losers. This helps you to know if it is time to sell a screaming winner or a sinking loser.

Automatic Analysis of Your Retirement Portfolio – This tool is a helpful app for uncovering hidden fees, overexposure to one stock or individual industry, and higher than personal tolerance risk levels.

Investment Advice Engine – One of their greatest tools is this engine that literally diagnoses your investment portfolio to analyze it and then to deliver you practical, statistically based advice that you can put to work right away in tweaking your portfolio.

Portfolio Optimization – Another free service SigFig offers is the ability to analyze and optimize your investments. They then will follow your instructions to reinvest dividends, rebalance your portfolio as desired, and strategize for tax efficiency.

Automated Investing – For a fee, account holders can improve their investment returns using SigFig's automated investment management service.

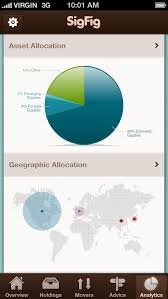

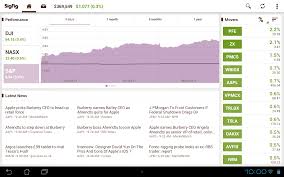

SigFig Interface Screenshots:

SigFig Fees

The Portfolio Tracker is completely free to use. This is another service that features the Fremium model with no hidden “gotcha” fees. The way that SigFig makes its money providing this substantial level of service for free is through the upgraded model of the service, the SigFig Managed Account service.

The way it works is straightforward and very affordable. Your first $10,000 under management they will manage at no charge. We feel that this is an astonishingly good offer for professional management that you can hardly afford to pass up if you do not want to do the heavy lifting yourself. For amounts greater than $10,000 under management, SigFig charges you a reasonable .25% per annum as management fees. This means that for $100,000 under management, you would pay $250 in annual fees.

SigFig Safety and Security

SigFig utilizes a series of good safety and security measures to protect all of your information and your money under management as well. Their app security is standard 256 bit SSL encryption, the same level utilized by brokerage firms and commercial banks alike. Your portfolio information is protected under a one of a kind PIN that is four digits. Account numbers and other sensitive data are encrypted so as to be impossible to identify. Not even the employees of SigFig are able to see your accounts. Perhaps most tellingly, neither yourself, nor anyone else for that matter, is able to utilize the mobile app to transfer or withdraw funds, or to trade shares.

Final Words on SigFig

SigFig has managed to gain substantial brand recognition and major market share in an astonishingly short period of time. With their more than $30 billion dollars under management, they are approaching the big boy leagues of investing. Edward Jones, a well-respected investment firm with decades of time and experience under its belt, has just over $65 billion under management by way of comparison.

Listen to the positive comments from The Street and you will get an idea of how popular and successful this free investment optimizing platform has become. They say that thanks to SigFig, you are able to view all of your accounts and investments in a single place. The platform provides beautiful charts to check up on your portfolio's individual allocation, performance, risk, and other factors. You are able to optimize your investment holdings in a matter of seconds.

SigFig lets you manage all of your various investment holdings and empire from any of your Internet browsers and from many tablet and mobile devices too, though not all of them. For some unknown reason, the iPad is not supported. On the plus side, no manual data entry is necessary. Besides this, SigFig delivers to you real time stock market news and charts in order to assist you in making informed and intelligent decisions about your investment portfolio.

Now you can get rid of your expensive fees, redeploy money from poorly performing investments, and learn if your money managers are under-performing or gouging you for their services. SigFig brags that it has so far uncovered more than $200 million in savings on fees and optimizing users accounts. In their own words, now is the time for you to “save more, make more, and keep Wall Street honest.”

SigFig Investment Optimizer

- Phone : 855-875-1580

- URL :

- Global Rating

- Very Good

User Rating

- 0 No reviews yet!

Review Summary :

SigFig claims that it can uncover wasteful fees and help you to see which money managers and investments are performing poorly within your personal investment portfolio. With $30 billion under management now, this rising personal financial and investment app is now playing in the same league as Wall Street's big boys. What's more, they actually deliver the goods on their promises to help you save and make more money and keep Wall Street honest.

Have you purchased products from SigFig Investment Optimizer? Leave a review!

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum