- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

Quicken Review

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

Last Updated on: 25th March 2023, 12:18 am

Quicken

- Phone : 650-250-1900

- URL :

- Global Rating

- Good

User Rating

- 0 No reviews yet!

Review Summary :

Although there is still star power in Quicken's name, the personal financial management software's rivals are rapidly gaining on it. The upgraded editions like deluxe and premier are more impressive than the basic, more simple starter edition. For investment monitoring and decision-making capabilities, Personal Capital is a superior platform and service.

Pros:

- Your information is easy to export from all Quicken editions over to TurboTax's personal income tax program.

- Sixty day no questions asked refund policy.

- Bragging rights for using the still name brand personal financial management software.

Cons:

- This personal financial management software is quite expensive relative to rivals.

- There is no free trial for current Quicken editions.

- Quicken's sunset policy forces you to upgrade to a newer edition every three years or lose services and features functionality.

Quick Facts about Quicken

Year Founded:1983

Company Headquarters:Menlo Park, CA

Reviewed By:David Crowder

Have you purchased products from Quicken? Leave a review!

Quicken Intro and Background

Quicken has always been the legendary gold standard of personal financial management apps. They maintain this status in part because every year the software developer (formerly Intuit) releases an updated version with at least a few new improvements to keep users coming back for more. While you could keep on using an older version of Quicken for a time, the firm's clever sunset policy of only allowing older versions' features and tools to work for three years after the version is released ensures that you as an existing customer will purchase a newer version of Quicken at least every three years, if not more frequently.

As a case in point, when you open up your new Quicken interface to set it up, you will be required to create a new login ID or log in with a previously existing one. With this ID, you will be able to connect with all of the services that now come with Quicken standard, plus you will be required to utilize this ID in order to register your licensed copy of the software. Such services include the ability to download your bank and financial company transactions, text and email alerts, utilizing Quicken's online bill pay from the software, and accessing the Quicken support and help sections.

New in this Edition of Quicken

The current version of Quicken includes a credit score every quarter as well as new and improved simple to comprehend investment reporting. For the second year in a row, mobile apps are available for iPhone, iPad, and Android mobile devices. You can take pictures of critical receipts then attach these to your online transactions as back up measures. Where before such image attachments became saved to your device, they are now cloud based. Both Alerts and Mobile portions of the software are simpler to utilize this year.

Quicken Tools and Features

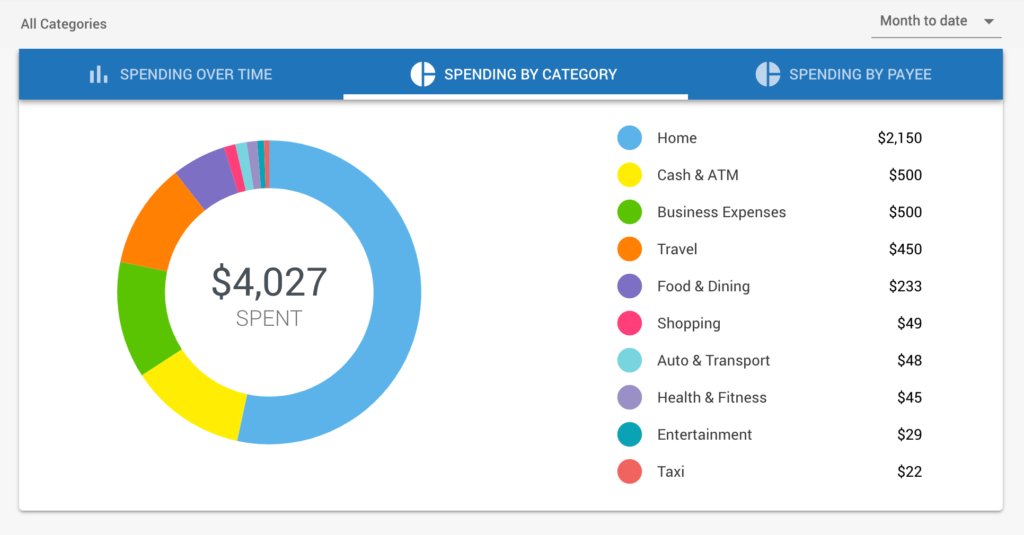

- Budgeting – Allows you to create and oversee your budget through the year. You are able to set sending categories using a dollar amount per time frame, or you can choose to budget for a whole batch of related categories. In this edition, you can also exclude your transfers to savings account from your budget, as well as review the total of monthly rollover categories underneath the totals column.

- Personal Credit Score – We love that the developers include this new quarterly-updating feature, which is probably worth the extra cost of the new edition by itself.

- Cash Flow Reports – These are monthly reports that now detail how much money you have remaining after all expenses are covered.

- Downloadable Account Transactions – Help you to figure up and to reconcile your accounts.

- Data Synchronization – Now you can do direct synchronization between the desktop or laptop version of the platform and your no cost iOS and Android mobile apps.

- Email and Text Alerts – You can choose to receive such alerts as account activities and reminders of upcoming bills, among other types.

- Financial Reports – We think the rising competition must be getting to the dev team. A decent assortment of these reports are now available to you.

Quicken Deluxe Features

The deluxe edition of Quicken provides all of the starter Quicken edition offerings plus the following tools and features:

- Retirement and Debt Reduction Tools – These handy tools help with reducing debt, planning for retirement, and longer term budgeting to save up for purchasing a house or car, for affording college education, and for other big ticket items.

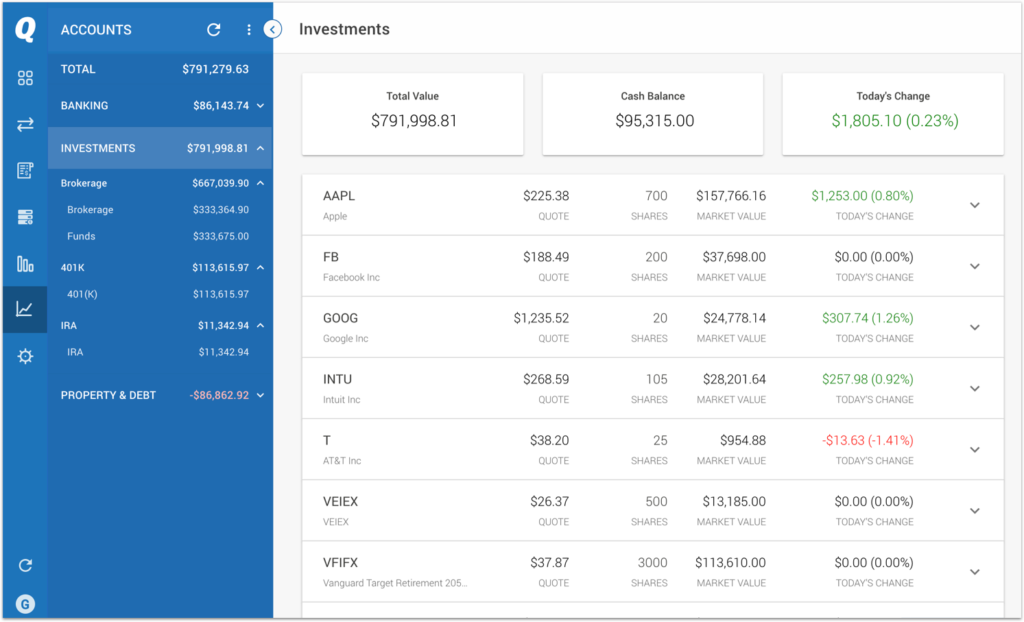

- Improved Tracking Utility – Allows you to better monitor loans and mortgages, as well as to keep an eye on your investment accounts, albeit with limited functionality.

- Quicken Attachment Support – Helps with taking and attaching pictures of warranties, receipts, and other items that you wish to include with your account statements and transaction records.

Quicken Premier Features

The Premier edition includes everything that Deluxe does, but also gives you analysis of your portfolio, better monitoring of your investments, and a feature called Portfolio X-Ray. This X-Ray displays your whole portfolio sector weighting and allocation of assets, individual stock holdings inside of your mutual funds, and your portfolio's performance comparison to the results obtained by the important indexes. Best of all, the results are put into layman's terms to help you know if you should change up your investments. Besides this functionality, it includes additional features such as:

- Tracking of capital gains and your basis of cost – also includes reporting for investment tax deductions and Schedule D for the Internal Revenue Service.

- Comparing mutual funds.

- Comparing your portfolio – versus important market averages.

- Graphical reports – showing allocation of your assets.

- Alignment of your portfolio – with your own stated return versus risk goals.

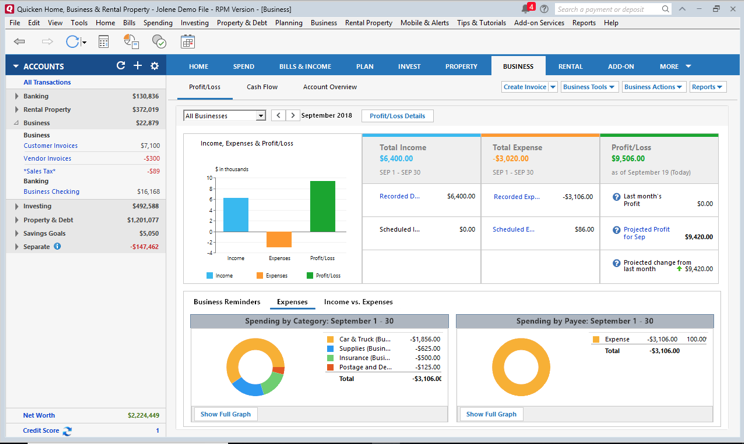

Quicken Home & Business Edition

This edition includes additional features useful for monitoring your expenses and income in your small business. While it does not replace full blown accounting software, it is helpful for independent contractors who do not maintain any inventory or have employees and who are running a small home-based business.

Quicken Interface Screenshots

Quicken Fees

If only the fee structure were simple with Quicken. Instead, you have five different editions at five different prices. We feel this is far too complicated for most people who just want to use Quicken and to not be confused by which edition is right for them and at what price point they feel comfortable getting involved with the personal financial management application. Here are the prices for this year's dizzying array of editions:

- Quicken Premier sells for $4.19 USD per month billed annually

- Simplifi by Quicken sells for $2.39 USD per month billed annually

- Quicken Home & Business sells for $5.99 per month billed annually

In case you accidentally buy a version that is too rich for your blood or that is overly complicated for your personal needs, they've has got you covered with their no questions asked, guaranteed 60 day refund on any version that you purchase.

Quicken Safety and Security

The developers assure us they are serious about stringent security. This starts with a promise that they never utilize your downloaded information in any capacity except for maintaining the One Step Update protocol. Besides this promise, they employ safeguards and securities lik SSL technology in the transmitting of any financial data between Quicken and your bank or financial company. They also encrypt it to be impossible to read when it moves through the Internet. As part of this, they run integrity checks that make certain no messages have been changed once you or they send it. All of Quicken's servers are firewalled within their data center.

They also give you a password vault in which to store your bank access passwords, as these passwords that your bank or financial company issues must be inputted every time that you sync up with them via the Internet. You choose the password that will protect this critical database of bank passwords which Quicken will then use each time it connects to your banks to sync up data. Each of your data files with Quicken may be similarly password protected if you wish them to be.

Quicken Ratings & Complaints

Quicken enjoys an A+ rating from the Better Business Bureau. Although they have closed out 1,303 complaints over the last three years and 551 during the course of the last 12 months, this is considered to be a reasonable number of complaints for a company of Quicken's vast size. Not all of these complaints would have involved this current Quicken edition, in any case.

Final Words on Quicken

Quicken remains the personal financial management platform to beat in the space. This does not mean it no longer has any effective challengers though. Thanks to the rise of several major rivals who are making waves in personal financial management with creative and fresh new ideas, like PocketSmith, Mint, MoneyDance, and iBank 5, the Quicken people have to be constantly on their toes and looking over their shoulders.

One thing we distinctly do not like about Quicken is the confusing and complicated array of editions and their dizzying variances in pricing. Which Quicken edition is right for you has become a complex, almost philosophical question in recent years. If you can get past these issues, and in particular if you have always been with Quicken since they first made waves in the industry back in the glory days of their infancy, then the platform will still be for you.

Quicken

- Phone : 650-250-1900

- URL :

- Global Rating

- Good

User Rating

- 0 No reviews yet!

Review Summary :

Although there is still star power in Quicken's name, the personal financial management software's rivals are rapidly gaining on it. The upgraded editions like deluxe and premier are more impressive than the basic, more simple starter edition. For investment monitoring and decision-making capabilities, Personal Capital is a superior platform and service.

Have you purchased products from Quicken? Leave a review!

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum