- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

Empower Review (formerly Personal Capital)

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

Last Updated on: 25th March 2023, 12:11 am

Empower (Personal Capital)

- Phone : 855-756-4738

- URL :

- Global Rating

- Spectacular

User Rating

- 0 No reviews yet!

Review Summary :

Empower is basically a beefed up version of Mint. Formerly known as "Personal Capital", it's a great app with all the features a serious investor would need. Think of the investment management division as an added, but completely optional service should you need to use it. Frankly, it is hard to argue with a great service that is totally free on top of it. For monitoring personal finance on a phone or device based app, Empower is the ideal service at keeping an eye on your investment and retirement portfolios.

Pros:

- 360 Degree View of Your Financial Life – Your entire financial picture is right on their site at the tips of your fingers.

- Complete Investment Portfolio – Empower ingeniously incorporates all of your investment and retirement accounts, along with bank accounts and credit cards, into one central platform.

- You Index – Empower's measurement of the results of your stock and investment portfolio and how it is doing comparatively over time.

- Fantastic Reporting Functions – Allowing you to hone in on your assets’ performances and proper allocation.

- Simple to Set Up – Because the reporting and interfaces are so well-designed and displayed, a child could practically set up, personalize, and run this platform.

- Support for Apples iPhone, Android, Apple Watch, and iPad – fortunately the features on the apps are much like the desktop or laptop editions and even more convenient for your busy lifestyle.

- Ability to Allocate Irregular Assets – This new feature permits you to categorize assets that are irregular and do not fall into an easy, prefabricated category

Cons:

- Inflexibility of Asset Allocation – Empower sticks with its pre-set models for asset allocation, which will work for most users. If you want to do your own type of asset allocation, you are out of luck.

- Categories Are Static – They have pre-set categories for most elements in their financial model universe, and you can not just create new or additional ones.

Quick Facts about Empower (Personal Capital)

Year Founded:2014

Company Headquarters:Denver, CO

Reviewed By:David Crowder

Have you purchased products from Empower (Personal Capital)? Leave a review!

(Note: Personal Capital is now known as “Empower”. You can read more about the company's rebrand here.)

There are many different services available today that help you to manage your personal financial empire, but few of them do this as well as Empower does. The proof is in the proverbial pudding – more than 87,000 individuals utilize Empower to keep track of in excess of $187 billion worth of assets. Their asset management division service separately handles over $1.3 billion worth of investor money.

While the financial advisory and asset management division is a for pay service, the mainstay of the site that tracks and helps you to manage your finances, investments, income, spending, and net worth all in a single location is free and simple to use. Empower has been awarded with the Disruptor 50 by CNBC for two consecutive years. For anyone looking seriously for a website that focuses much more intensely on the investment part of personal finance, including but not limited to taxes, asset allocation, and retirement planning, read on to discover the tools, services, pros, and cons to this extremely popular and growing company and website.

Empower Origins and Background

The founder and CEO of Empower is legendary personal financial app master Bill Harris. As CEO in the past of both PayPal and Intuit, Harris found it easy to staff this brainchild project with former employees of Intuit. His company has achieved success in an under-targeted niche of Wall Street, those whose net worth comes in between $100,000 and $2 million in liquid, available assets.

This is a smart target audience to go after, and Empower has been wise to build market share with this financial demographic that is well off enough to possess complex finances, yet has managed to go under the radar of Wall Street as they simply could not make the major Street firms enough money to bother with them. It works for Empower thanks to rapidly advancing computer power and Internet technology that allows them to provide effective and personal service for significantly lower costs than ever imagined to be possible in the past. This strategy looks like it could be financial management’s future.

Empower Tools and Features

The characteristic that makes Empower so effective to so many different people is their focus on retirement planning and investing. This is something that a large percentage of Americans can relate to in their daily lives. Some of their best features and tools are:

The characteristic that makes Empower so effective to so many different people is their focus on retirement planning and investing. This is something that a large percentage of Americans can relate to in their daily lives. Some of their best features and tools are:

- All New Budgeting Tool – Allows you to track your annual, monthly, and weekly income, as well as spending patterns using the spending tool.

- All New Retirement Planner – Helps you to know if you are where you need to be with planning for retirement.

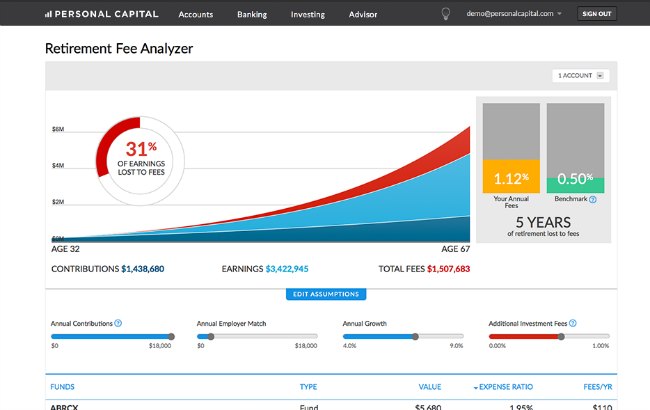

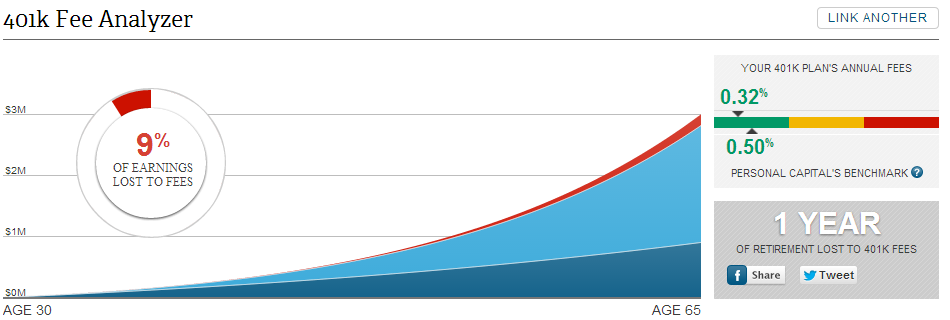

- Fee Analyzer for your 401k – Alerts you to the amount of money you are spending on your retirement plan. In general, these fees will take your breath away.

- Asset Allocation Target – Tells you if you are unintentionally underweight or overweight the critical equity sectors of the market.

- Investment Checkup – Provides intelligent and researched advice for your allocation of investments and assets. First Empower will question you to ascertain your appropriate risk profile, then they will come up with corresponding asset allocation tailored specifically to you.

- Notifications by Email – Receive weekly or daily emails that summarize both your spending patterns and the progress of your investments during that time frame.

- Bills Due – Delivers a handy report of bills that are about to be due and when you must pay them.

- Apple Watch App – Offering Apple Watch app functionality, Empower is proud of being among the first such services to make this possible with their service.

- Mobile and Website App – Makes it possible for you to access the site not simply from a computer-based web browser, but also via your Android or iOS phones and devices.

- Cash Flow Tracker – Tracks both your expenses and income simply and effectually. This has been enhanced to now help watch your money coming in and going out.

- Universal Checkbook – Allows you to simply and quickly send money from any one of your accounts logged with Empower to any person, any place, any time with only a couple of quick buttons pressed, or screens swiped, from either your laptop, tablet, or smart phone. The company will do this for you without charging once you input instructions from your online command center or mobile app, something that is hard to find in the world today. It also permits you to deposit checks directly by simply taking a picture of the check. This might be the most powerful financial tool invented anywhere in decades at least

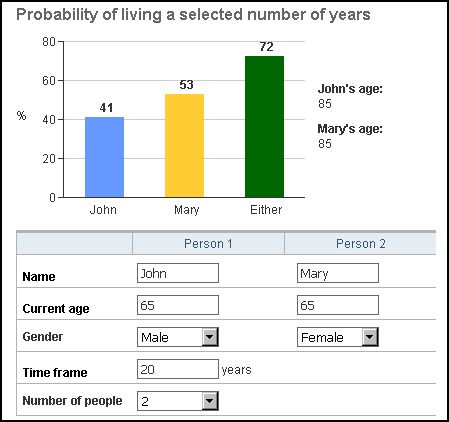

The retirement planner is fairly unique simply because there are so few good retirement planning tools available today, whether free or paid. The retirement tool in Empower proves to be among the most thorough around. The program starts by taking your information on income, spending goals, and projected portfolio value in the future to put all this together and compute numbers on where you are for retirement. It also allows you to put in dummy scenarios to see alternative outcomes based on these varying scenarios. While other rivals also provide fairly good retirement tools, as with Betterment, Empower does not make you input your various pieces of financial information manually. They have synced up all of your accounts, so they simply pull your assets and financial information from other sections of the site.

Empower Interface Screenshots

Empower Financial Advisor Service Fees

The best thing about Empower of course is that it is 100% free to users, something they call the Freemium model. For those high rollers who are interested, the company also offers its advisory service at an additional fee. The advisors at Empower are qualified to assist you in managing your investments. They actually do provide a dedicated financial advisor whether or not you choose to utilize their wealth management services. These advisors reportedly handle customer account loads of around two hundred different clients, so be sure to set up a consultation with him or her from within the service if you need them.

The costs for these services are basically .89% annual fee if you have under one million dollars. For higher investable amounts, they charge:

- $1 million to $3 million account – annual fee of .79% of assets managed

- Additional $2 million – annual fee of .69%

- Additional $5 million – annual fee of .59%

- Additional $10 million and up – annual fee of .49%

These management fees are far less than the old school financial advisors charge. These rates includes costs of commissions and trading, management, and any custody as well.

Empower Safety and Security

Empower boasts a security that is something like the one that Mint.com maintains but is even more safe. Each computer that you utilize on the site must be fully registered. The same is true with devices that are used on the site. You will then be made either to verify by a phone call they make or an email they sent out. This is the low sophistication level of two form identification, which you would be hard pressed to find with a traditional bank of investment brokerage even.

They also feature several other security protocols. The iOS devices that have the finger print scanner makes you log on to the app with a swipe of the finger. It is a nice extra security feature. Information about your account in Empower is kept encrypted. You have to employ a special encryption token so that you can log into your account. Transfers and withdrawals may not be done via the mobile phones and devices as these apps only allow read level views to protect your interests.

Empower Ratings & Complaints

Complaints are quite telling where any service or product is concerned. Empower has the top rating offered by the Better Business Bureau, at A+. There are no complaints registered with them, either closed or outstanding. Ratings do not get much better than this.

- Empower BBB Rating: A

- Empower BBB Complaints: 2

How Empower Saves You On Taxes

Empower features a process known as TLH, or Tax Loss Harvesting. They do this in recommending baskets of funds or stocks in lieu of index funds. This will save you significantly in taxes and fees paid for buying, selling, and owning index funds.

In Conclusion

It is hard to argue with a great service that is totally free. Think of the investment management division as an added, but completely optional, upgraded service. For monitoring personal finance on a phone or device based app, Empower is the most ideal service at keeping an eye on your investment and retirement portfolios.

Their really strong suite is in their retirement planner that is both world class and unbeaten in the industry. Its role playing scenario ability allows you to experiment with the various “what if’s.” Also very highly recommended is the investment checkup tool that provides quality, well-researched, and intelligently recommended picks. Some would say their investment management services are highly priced, but that is when measured against robotic advisors and not flesh and blood staffed desks. For individuals who are clueless as to properly allocating their investments and retirement accounts, their financial advisor service is a fine place to start.

Empower (Personal Capital)

- Phone : 855-756-4738

- URL :

- Global Rating

- Spectacular

User Rating

- 0 No reviews yet!

Review Summary :

Empower is basically a beefed up version of Mint. Formerly known as "Personal Capital", it's a great app with all the features a serious investor would need. Think of the investment management division as an added, but completely optional service should you need to use it. Frankly, it is hard to argue with a great service that is totally free on top of it. For monitoring personal finance on a phone or device based app, Empower is the ideal service at keeping an eye on your investment and retirement portfolios.

Have you purchased products from Empower (Personal Capital)? Leave a review!

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum