- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

Falling Consumer, Commodity Prices are Creating a Buying Opportunity for Gold

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

Last Updated on: 26th January 2015, 04:50 pm

With November just around the corner, and 2015 on the horizon, now feels like an appropriate time to reflect on just how bizarre the markets have seemed to investors during 2014.

Entering Q1, nearly every analyst, expert and prognosticator was predicting troubling spikes in consumer prices, a swift end for the Federal Reserve’s bond purchase program, interest rates heading north, rising commodity prices and, perhaps, a “double-dip” recession. For many in the gold markets, especially those who understand that gold is a defensive position, precious metals seemed like a clear buy after a disappointing 2013.

What happened? The Fed has been unwinding bond purchases, though at a much slower rate than anticipated. The still-green Fed Chairwoman Janet Yellen has been taking a wait-and-see approach with volatile and uncertain markets, though most expect the purchase program to officially end before the new year.

Commodity prices have been falling for months, especially non-meat foods and petroleum-based products. The ensuing drop in prices has been a welcome sign for lower and middle classes across the world, but not necessarily for investors. Throw in trouble with the Eurozone and highly expansionary policies in China, and the dollar has experienced a mild resurgence.

With no pressure on the Consumer Price Index (at least in the way the Bureau of Labor Statistics manipulates it), the Fed has not had to raise interest rates. In fact, real interest rates on large installment loans (mortgages, auto loans) have declined in 2014. Some didn’t believe that was possible.

Bonds were (and probably still are) incredibly overvalued by Q4 2013 — and they’ve risen in price consistently this year. Money keeps on pouring into the bond market, and yields are shrinking.

What does that mean for 2015? We can’t really be certain. This, as T-Rowe Price puts it, is a complex global economy. It does mean that many of the pundits were incorrect.

Why Gold was a Good Buy in 2014, and Might be a Better Buy into 2015

Gold advocates didn’t see the price appreciation they expected, but that doesn’t mean they were wrong for advocating gold. Gold isn’t a speculative asset. Nobody, or at least nobody with any commodity understanding, buys physical gold hoping for a six-fold return on their investment over 12-24 months. If you bought gold, then good for you. Hold on to it. Too many in the markets are constantly playing the Hare. You’re the Tortoise.

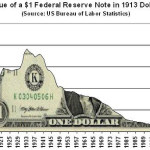

2014 hasn’t been kind to metals, but history has been. The trend of the U.S. dollar has been unmistakable over the century-long stewardship of the Federal Reserve, even if the dollar looks stronger today than it looked in 2013. Even without a massive round of hyperinflation, the dollar will be weaker in 2019 than it is today, and will be much weaker in 2029.

The dollar is worth less than 3% of what it was worth in 1914. Gold? Even using inflation-adjusted numbers, gold is nearly 300% more valuable today than in 1914. The dollar will always be used as a reckless political weapon by the economically illiterate. This is exactly why 68% of consumers age 55+ have lost faith in their currency.

Your retirement is not a one-year game. Your investment portfolio should be built with a multi-decade strategy, and it should incorporate the most consistently powerful investment and recession hedge available to you — precious metals.

Consumer prices have fallen temporarily, and consumable commodities have dropped by as much as 20-25%. Speculators are leaving commodity markets as a result, and both physical gold and gold stocks have felt that decline in demand. The answer many will draw is that gold was an empty promise. And they’re going to miss out on the buying opportunity.

We’ve discussed how completely undervalued gold is right now. You don’t have to be Warren Buffet to understand “buy low/sell high” strategies — and today, gold is low. Might even get lower. Want to own more gold? Buy it when it’s cheap. Because it’s not going to stay cheap.

As recently as the late 1990s, gold was at $250 an ounce. That might be hard for younger investors to fathom, but it’s true. Gold was far too undervalued then, and was still for the next half-decade. Those who knew it were able to survive the turmoil of the Great Recession far more effectively than those who didn’t.

When you’re retired, you’ll be glad that you had the foresight to buy gold when it was relatively cheap. Chances are, it will prevent your portfolio from collapsing at the wrong time.

Protecting Your Retirement Portfolio with Gold

Purchasing physical gold with your investment funds provides you the opportunity to profit even when equities and bonds are in decline. Precious metals retain value no matter what our government does to the dollar, no matter what economic climate is persisting and they have a track record of value dating back thousands of years.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum