- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

Despite Recent Strength, Bonds Remain Vulnerable

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

Last Updated on: 8th February 2016, 07:20 pm

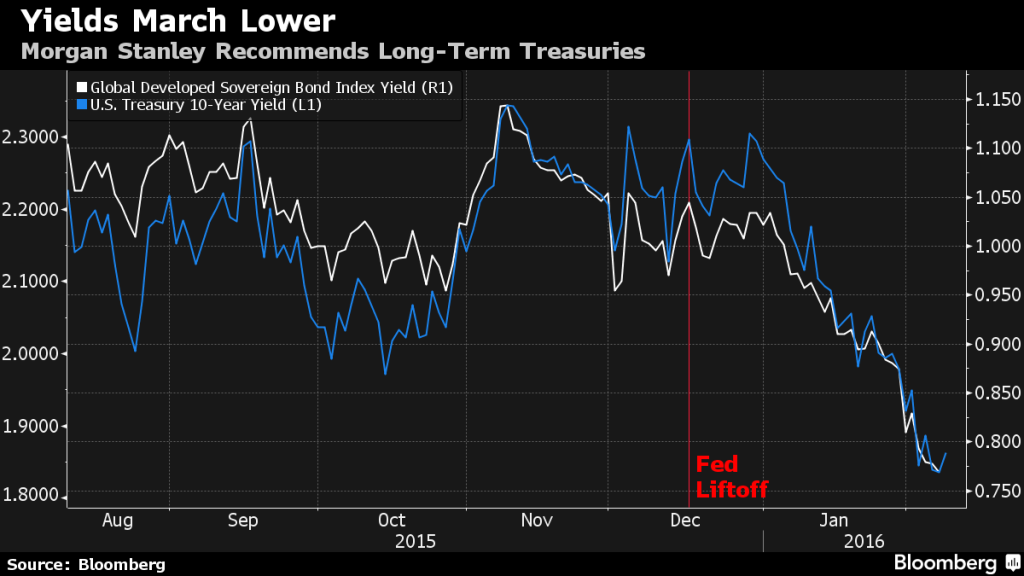

A number of fixed-income markets have been on a tear in recent weeks. Treasurys, for example, have rallied sharply, pushing yields lower across the board. So, too, have some municipal and higher-rated corporate bonds. Does that mean what I argued previously is wrong? Perhaps, but what is happening elsewhere in the space suggest that it is more than the traditional economic drivers that are influencing rates.

In fact, some sectors are performing far more poorly than the higher-quality markets. According to Bloomberg, the risk premium on the Markit CDX North American High Yield Index–a credit-default swaps benchmark tied to the debt of 100 speculative-grade companies–recently hit a two-week high, while a Bank of America Merrill Lynch gauge of high yield spreads widened to 7.9%, a stone's throw from the previous week's five-year extremes.

Securities at the lowest end of the credit spectrum have really taken it on the chin. Reuters reports that yields on U.S. corporate bonds rated triple-C or below rose above 20% last week, offering holders the juiciest prospective returns in six-and-a-half years. The newswire noted that there are up to $30 billion of high-yield deals in the pipeline.

Concerns about the economy

Two factors, in particular, are powering the divergence: concerns about the the economy and the fallout from weak commodity prices. To be sure, opinions vary about where growth is headed, as I've noted elsewhere. Among other things, many view relative strength in the U.S. jobs market and the Federal Reserve's decision to initiate a tightening cycle as clear evidence that the path of least resistance is up.

In fact, investment bank UBS recently argued that, based on a proprietary credit-based risk gauge, “the odds of odds of a U.S. recession by the third quarter of 2016 remained low–at about 16.5%.” In their view, reports Digital Outlook, measures other than high-yield spreads–which many forecasters believe are the canary-in-the-coal mine for an economic downturn–including year-on-year changes in corporate leverage and bank non-performing loans, are the “best leading indicators of a recession.”

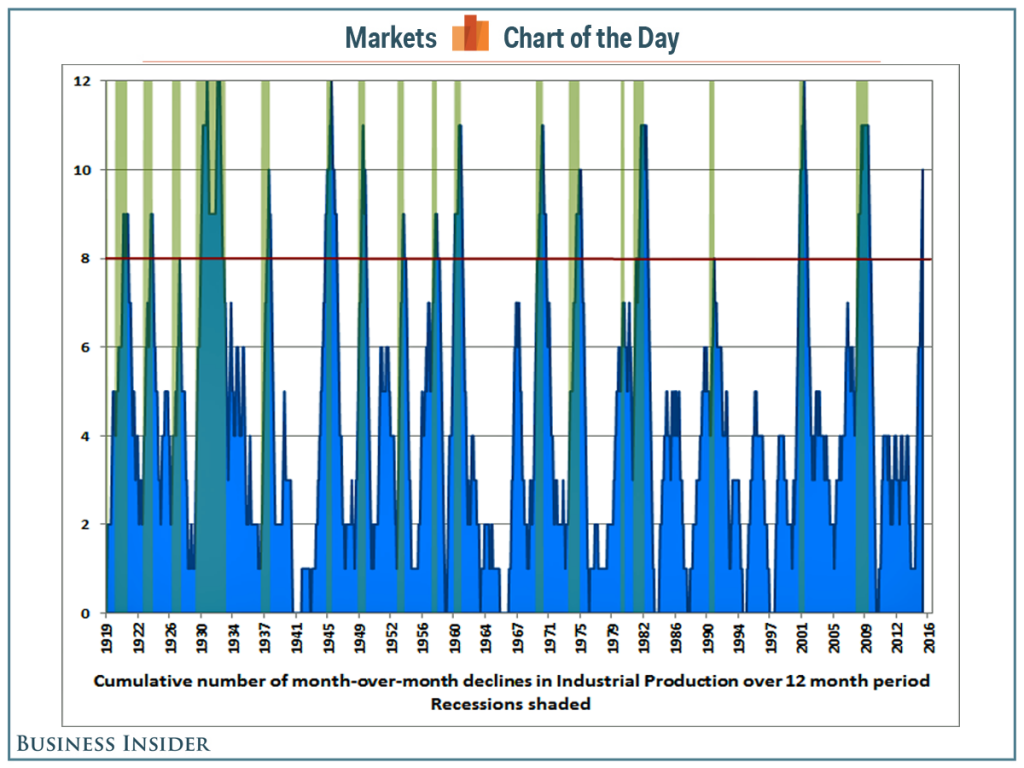

Nonetheless, the evidence for an imminent reversal of fortunes seems compelling. According to John Hussman of Hussman Funds, a recession is “not just probable; it's nearly guaranteed,” reports Business Insider, based in part on the recent trend of U.S. industrial production.

“Industrial production has now…declined on a year-over-year basis. The weakness we presently observe is strongly associated with recession. The chart below (h/t Jeff Wilson) plots the cumulative number of month-over-month declines in Industrial Production during the preceding 12-month period, in data since 1919. Recessions are shaded. The current total of 10 (of a possible 12) month-over-month declines in Industrial Production has never been observed except in the context of a U.S. recession. Historically, as Dick Van Patten would say, eight is enough.”

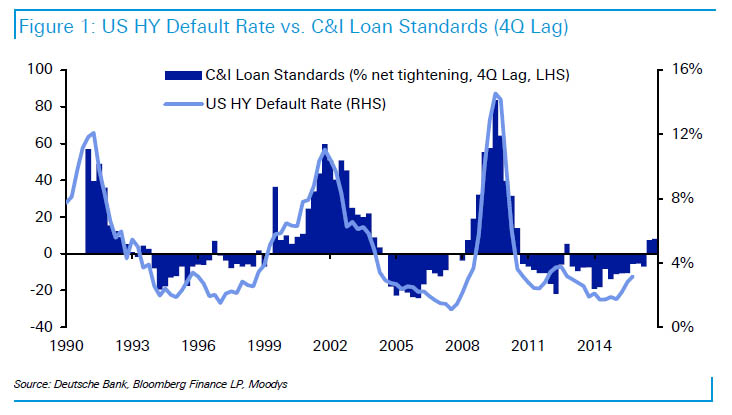

Reports that lenders are becoming more conservative are also a concern. Zero Hedge writes that lending standards tightened for the second consecutive quarter in the October-December period.

This is problematic because, as DB's Jim Reid writes, two consecutive quarters of tightening standards “has never happened before without it signalling an eventual move into recession and a notable default cycle. Once we have 2 such quarters lending standards don't net loosen again until the start of the next cycle.”

Other signs of trouble

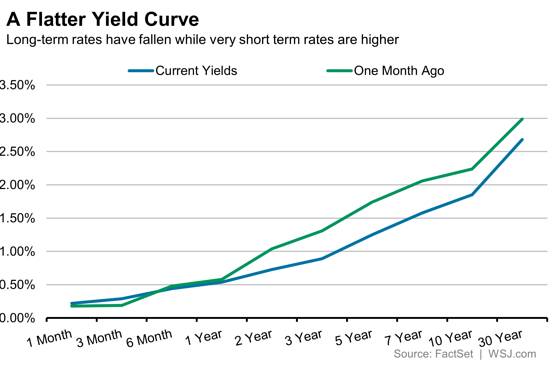

Another indicator, the slope of the yield curve–which many analysts (including at the Fed) regard as a key gauge of future prospects–may be saying something different than in the past. Historically, long-term rates tend to be higher than short-term counterparts, reflecting the additional return that investors demand as compensation for uncertainty about the future. However, the gap between the two often disappears or turns negative before a recession, as markets begin to anticipate that authorities will be forced to step in and loosen policy to help economic activity recover.

Up until now, that spread has remained positive, suggesting that the outlook is more sanguine than pessimists maintain. But as a recent Wall Street Journal article notes, the fact that short-term rates are already so low may mean that a flat or inverted yield curve is unlikely to come about. For some analysts, in fact, it is the relative change, rather than nominal values, that matter. If so, the recent flattening trend appears to be sending a clear negative message.

In sum, highly-rated securities are benefiting from perceptions that deteriorating conditions will lead to a reversal of the tightening cycle that began in December. Lower-rated counterparts, meanwhile, are being hurt by fears that a downturn will undermine creditworthiness and make it more difficult for some borrowers–including a broad array of energy-sector players who have been hurt by the collapse in oil prices–to repay their debts.

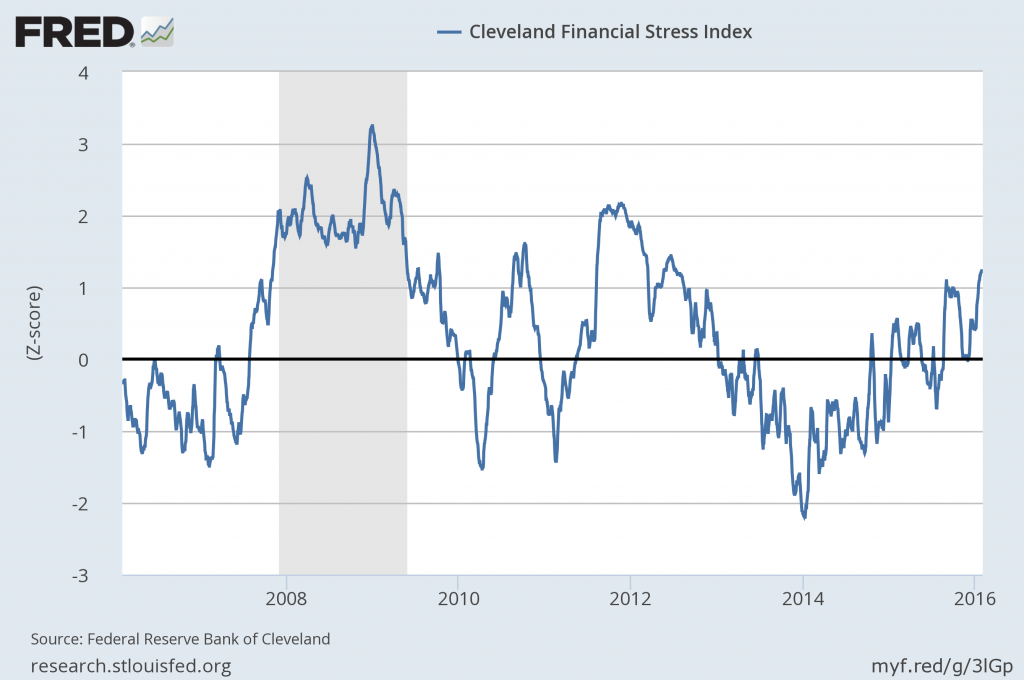

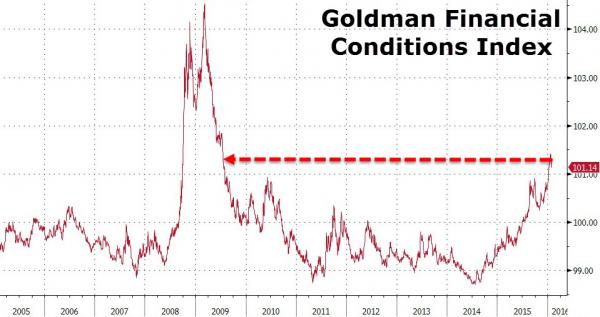

Demand for Treasurys is also being bolstered by their traditional role as safe havens. Aside from the weakness in high-yield markets, the recent swoon in share prices has spurred some investors to favor capital preservation over future returns. The fact that a number of indicators, including the Cleveland Fed U.S. Financial index, St. Louis Fed U.S. Financial Stress Index, Goldman Sachs Financial Conditions index and Moody's Liquidity-Stress Index, are also signaling trouble ahead only adds to concerns.

Changes ahead

While the disparity between high- and low-end markets might make sense now, there are reasons to believe that fixed-income securities more broadly are headed for trouble. As I noted previously, there has been sizable issuance of dollar-denominated debt since the era of easy money began, and it's a good bet that a great many issuers will be hard-pressed to pay it off. Among other things, the collapse in commodity prices has slashed the cash available to meet some of these obligations, many of which are coming due in the immediate years ahead.

In addition, weaker commodity prices and a less-than-robust global economy suggest that some countries with significant dollar reserves, which have largely been invested in Treasurys and other highly-rated securities, will need to raise cash. Aside from covering the cost of energy and other imports, some will need extrra resources to offset pressures being created by increasing cross-border outflows. Indeed, just-published data reveals that China's foreign exchange reserves have fallen to $3.23 trillion, a three-year low, amid widespread capital flight.

There is also the prospect that disillusionment with policymakers will lead investors to reconsider just how safe Treasurys and other “high quality” securities are. With many commentators suggesting that recent moves by Japanese and other authorities reflect “a measure of desperation,” others speculating about “a loss of faith” in central bankers, and even some insiders questioning the efficacy of strategies such as quantitative easing, the stage seems set for an inevitable change of heart. That might not prove helpful in an environment where total U.S. debt just hit a record $19 trillion.

Under the circumstances, investors may find that their views about what is sensible or what makes sense are called into question, and that the only investments that really fit the bill are those that have proved their worth over the broader course of time.

Got gold?

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum