- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

Canada Sold All Its Gold Reserves: That Could Prove to Be a Mistake

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

Canada has been selling its Gold reserves for decades so that fact alone does not surprise. What does surprise, however, is that it has sold almost all the remaining Gold coins in its coffers. In February Canada sold 28,851 ounces of Gold. It currently only holds 77 ounces of the precious metal, which being below the $1 million rounding figure used in official international reserve data means Canada has zero Gold.

In 1965, Canada held $1.15 trillion in Gold bullion and coins, in 1980 the Canadian government decided to start gradually selling its Gold reserves. By December 2003, the last of bullion holdings was sold and by January 2014, the last high-quality coins were also sold. What was left after that was lower quality coins that were melted down and sold off as bullion.

Their objective according to a government spokesman was to enhance portfolio diversification by selling commodities like Gold and improve returns. Don Drummond, a former Finance Department bureaucrat, thinks Gold has not delivered a good performance over time, and it costs money to store.

How right is the Canadian government about Gold performance in the long run?

Well, it certainly does cost money to store Gold but its diversification value is well known, and it is also a store of wealth, especially in times of market stress. Gold has a low correlation with other assets and is positively correlated to inflation. It also helps protect tail-risk, which is the risk of extreme adverse events that occur from time to time. We have seen the effect on Gold price over the past months as stock market volatility has increased. Gold has been one of the best-performing assets since the start of this year, with an increase of 19%.

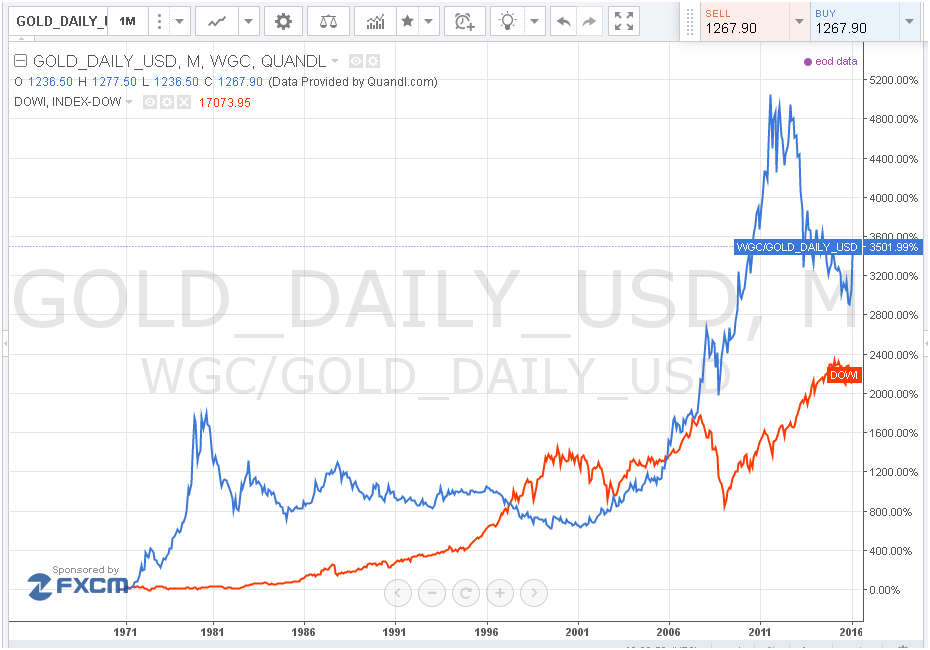

A quick look at the long-term performance compared to the stock market would prove them wrong on that statement also. The price of Gold in 1965 was $35.12 per ounce. It is currently trading around $1277.00 per ounce. The $1.15 trillion would now be worth around $35.24 trillion. The Dow Jones Industrial average in 1965 was 902.86, which compares to the current levels of around 16,960. That is still a steep increase in stocks; however, it only equals a multiple of 17.8, so the same $1.15 trillion invested in stocks in 1965 would now only be worth $20.45 trillion.

The chart below shows the performance of Gold and the Dow Jones Industrial average from the early 1960s. It is clearly visible how Gold has outperformed the stock market, not only in the long run but also on a consistent basis. Apart from the period that goes from April 1997 to December 2005, Gold has always beaten stock performance. The perception of Gold’s performance and characteristics, from the Canadian government, in the light of these facts does leave me very perplexed.

What are other countries doing with Gold?

Most developed economies hold large amounts of Gold reserves. The US is the largest owner of Gold with 8,133 tons, which makes up 72.6% of its total reserves. Germany holds 3,384 tons which accounts for 67.8%. Italy and France own approximately 2,440 tons which equal roughly 66% of reserves for both countries.

Developing countries have a typically lower ratio of Gold to total reserves, even though they may hold considerable quantities. Russia holds 1,352 tons of the shiny metal or 12% of its total reserves. China currently holds 1,762 tons or approximately just 1% of reserves. It may not seem surprising that both these countries wish to correct that ratio; Since January 2013, Russia has bought 394 tons of Gold increasing its Gold reserves by 41.2%. China also recently started increasing its hoard of Gold and at a faster rate; since March last year the Chinese Republic has bought 708 tons of the precious metal. That buying spree equals an increase in Gold reserves of 67.2%

source: tradingeconomics.com

Gold is a finite commodity making it rare and has been a store of value for centuries. When developing countries begin to increase their holding in Gold, as it would seem Russia and China have already started doing, Gold’s scarcity will only increase. So its scarcity and its other properties mentioned above together with its spectacular performance to date would seem to indicate more of the same, especially in the long term.

So why would Canada sell all its Gold? The need to balance its national debt and the fact it has plenty of Gold sitting underground are the only two things that come to mind. Basically, the nation is naturally long of Gold, even if it has not been extracted. Therefore, its value is not yet counted. However, it still has that potential source of wealth ready to be reaped when the time is right.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum